Croatia is close to placing the dual tranche of 12Y and 20Y € paper – where would we price such long maturities? Find out in this brief research piece.

Croatia is scheduled to place a dual tranche of € international bonds (12Y/20Y) any time soon, possibly even today. On the yesterday’s roadshow we found out that the Ministry of Finance has penciled in about 1.8bn EUR of eurobond placement in the days ahead, while about 1.09bn EUR would be required to settle the maturing CROATI 6.375 03/24/2021 at the end of March. Although the outstanding amount of the maturing paper is 1.5bn USD, it has been placed with underlying FX swap, turning this into about 1.09bn EUR. We are convinced that the Ministry of Finance would not issue less than 1.8bn EUR, but cannot exclude placement going as high as 2.25bn EUR if investor demand turns up higher than expected.

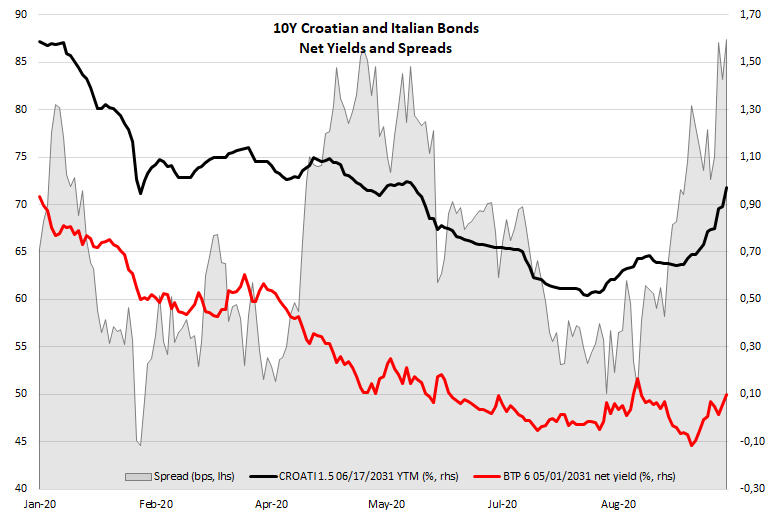

How are Croatian bonds faring this morning? First of all, the information about eurobond placement caused the existing Croatian bonds to sell off significantly and this morning CROATI 1.5 06/17/2031 could be bought very close to 1.0% YTM (we were receiving offers this morning a thad away from 105.00, which is 0.9867% YTM). The move was focused only on Croatian eurobonds and we can see that the spread between CROATI 1.5 06/17/2031 and BTPS 6 05/01/2031 widened to the highest level since June 2020 (CROATI placement). When calculating these spreads we use Italian net yield (interest rate tax subtracted) and currently the difference between YTM on CROATI 1.5 06/17/2031 and BTPS 6 05/01/2031 has widened to about +87.4bps (BTPS net YTM @ 0.10%, CROATI YTM @ 0.974%). The spread widening came at an unpleasant time when clearly some of the market participants want to cut their exposure to Croatian outstanding bonds, but dealers on the Street are unwilling to add their long exposure to 10Y+ periphery during the reflation bond sell off. The good thing about this is that Christine Lagarde gave verbal support to long term bond prices on Monday saying that the ECB is closely monitoring long nominal bond yields. On the other hand, back in 2012 when the situation was dire Lagarde’s predecessor Mario Draghi pledged to do whatever it takes, while Lagarde on Monday pledged to monitor whatever there is, which was sufficient to put some support under the bond prices, but not enough to reverse the trend. Jerome Powell during his two day Humprey-Hawkins testimony reiterated that economy is far from recovery, unemployment is still high, inflation pressures relatively subdued, while Powell’s vice chairman Clarida stated that the FED would probably not react in any way if there’s a short term inflation overshoot. Still not enough to reverse the trend masters of the universe (bond dealers) have charted, but at least it relieved some selling pressure from the long term bond space.

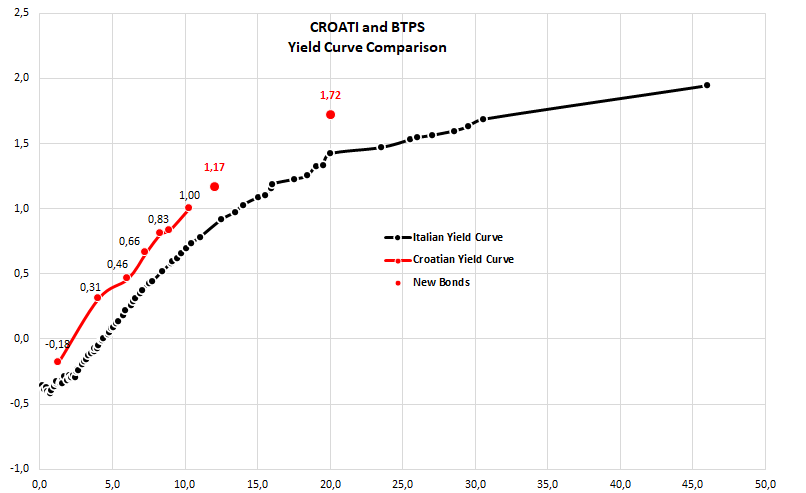

Where do we price the new dual tranche? From our experience, most of the bond dealers use Italy as a good proxy to price CROATIs, some of them even buy CROATIs and sell BTPS when the spread between the two gets too wide. When pricing CROATIs they refer to gross yields and we calculated that on the long part of the curve CROATIs are priced some 30bps-35bps above BTPS. With this in mind we calculated fair value of CROATI 2033 YTM @ 1.17% (MS+104bps) and fair value of CROATI 2041 YTM @ 1.72% (MS+135bps). This pricing should come with a handful of disclaimers and beware that IPTs are likely to come 30bps or even 50bps higher to facilitate book buildup. How much tightening investors would receive in the end would be subject to the movements of global rates, which is not at all easy to forecast or model. It’s also worth bearing in mind that REPHUN 1.75 06/05/2035 (proxy for CROATI 2033) is traded at 1.15% YTM, while regarding REPHUN 1.5 11/17/2050 (proxy for CROATI 2041) the most accurate pricing we received yesterday was about 1.70%. As we stated in our previous blogs, REPHUNs and CROATIs are generally closely traded and used as each other’s proxy on eurobond placements, albeit due to illiquidity sometimes it’s quite difficult to get fair pricing on both. This is the reason we used two methods of pricing – interpolating liquid Italian bond curve (plus some premium) and comparing the results to REPHUNs.

What has yesterday’s Serbian bond placement taught us? SERBIA 1.65 03/03/2033 was placed at MS+180bps (1.92% YTM) against an IPT of MS+210bps-215bps. This was the tighter end of the pricing range and basically right on ROMANI curve. Since Serbian eurobonds are generally traded at a spread to ROMANI, this could be interpreted as a major success, especially once you take into account that the book was 3.2x oversubscribed (1.0bn EUR was placed versus 3.2bn EUR orderbook size). From our understanding most of the auction participants received pro rata allocations (30%-40% of orders given) and early this morning we have seen it trading slightly below reoffer (97.00-97.50 market versus 97.13 reoffer). The moral of this story is that tight placements are still possible, however Serbian success might be interpreted by lower GDP drop last year, swift recovery penciled in this year and finally the notorious, but proverbial, interest of American investors after Serbian fixed income assets.