Down days have become more common for the FI crowd than up days, mostly because of the unwinding of Christmas rally-induced rate cut expectations. However, the situation is much different compared to five years ago because much of the CROATIs are now sitting in the diamond hands of long-term asset managers, instead of the shakey hands of UCITS funds. Benchmark prices are dropping, but funds are not popping – ergo the spread tightens even further. How do we trade this regime? Find out in this brief research piece.

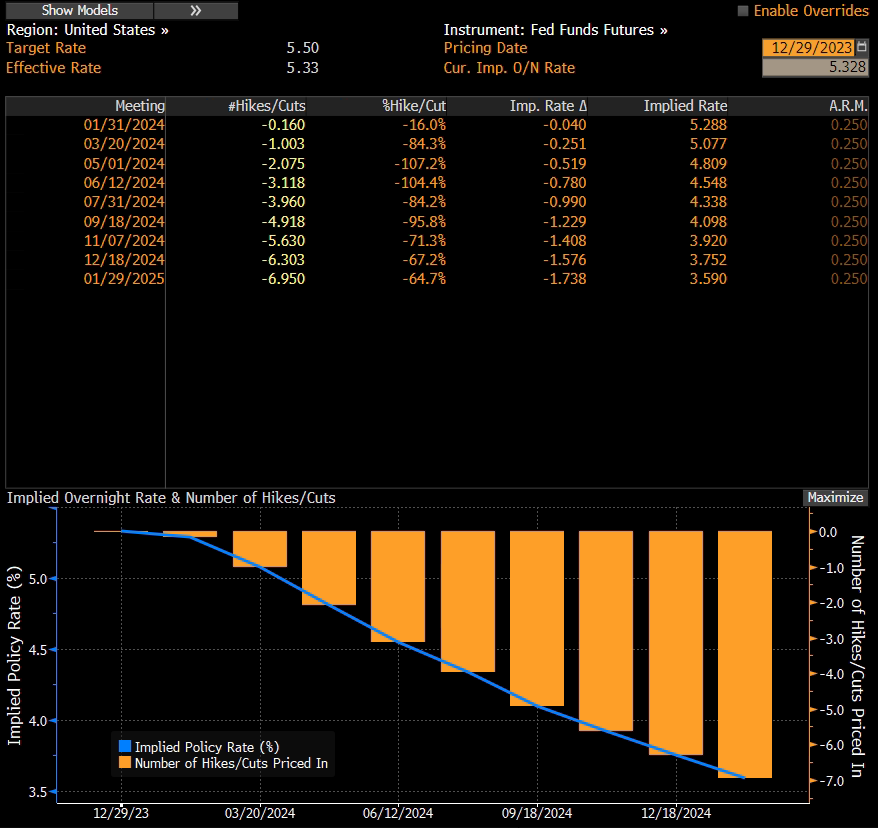

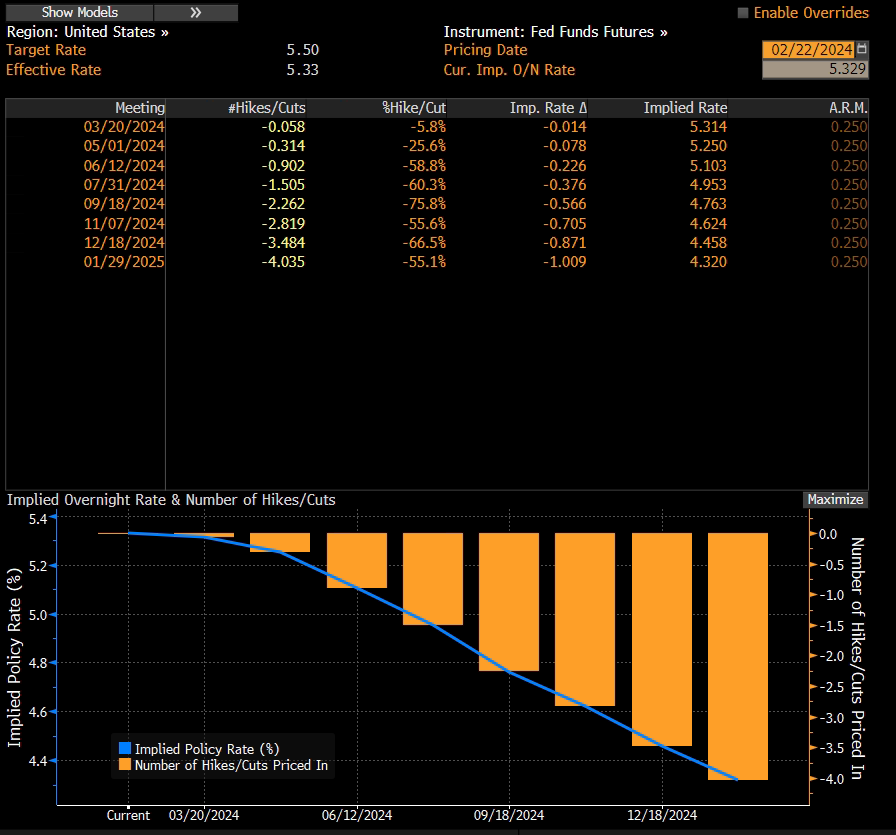

Last week was just another point in a string of hot inflation prints that might cause FOMC to postpone rate cuts. PPI figures were slightly hotter than anticipated, providing the empirical foundation for sticky inflation trades: PPI final demand made its way to 0.9% YoY (versus 0.6% YoY BBG consensus estimate); PPI excl. food and energy rose by 2.0% YoY (versus 1.6% YoY BBG consensus). US CPI figures were released just three days earlier, also beating analyst consensus (3.1% YoY versus 2.9% YoY BBG consensus), a signal that FED rate cuts might be subject to further revision and that the path to 2.0% inflation is all but clear. Actually, FOMC minutes from the January meeting released yesterday were interpreted in such a tone – no need to rush rate cuts. Asset managers reacted to the two prints in a familiar fashion: according to Bloomberg (actually CFTC data), AMs unwound a total of 260k 10Y futures (largest dump since March 2022) after the CPI print, just to start building up front-end short positions after hot PPI. JP Morgan’s client survey released yesterday stated that all-client net long positions dropped to the lowest figure since April last year. Speaking about market reaction, compare the change taking place on WIRP US from EOY 2023…

… compared to today’s:

Historically, January data is prone to seasonal adjustments and for the FED rate cut path to become clearer markets will have to wait and see for more data points in the coming months. At this moment, FED fund rate futures are pricing three full cuts in 2024 beginning in June/July. Markets were also slightly disturbed by former Treasury Secretary’s Larry Summers statement that there might be a small chance of raising interest rates even further should the goods deflation cease and headline figures start increasing all over again. Summers is a notorious hawk and a critic of monetary easing in all forms, possibly because of the effect it had on active portfolio management at the benefit of passive, low-to-no-fee strategies, so his statements might be taken with a grain of salt.

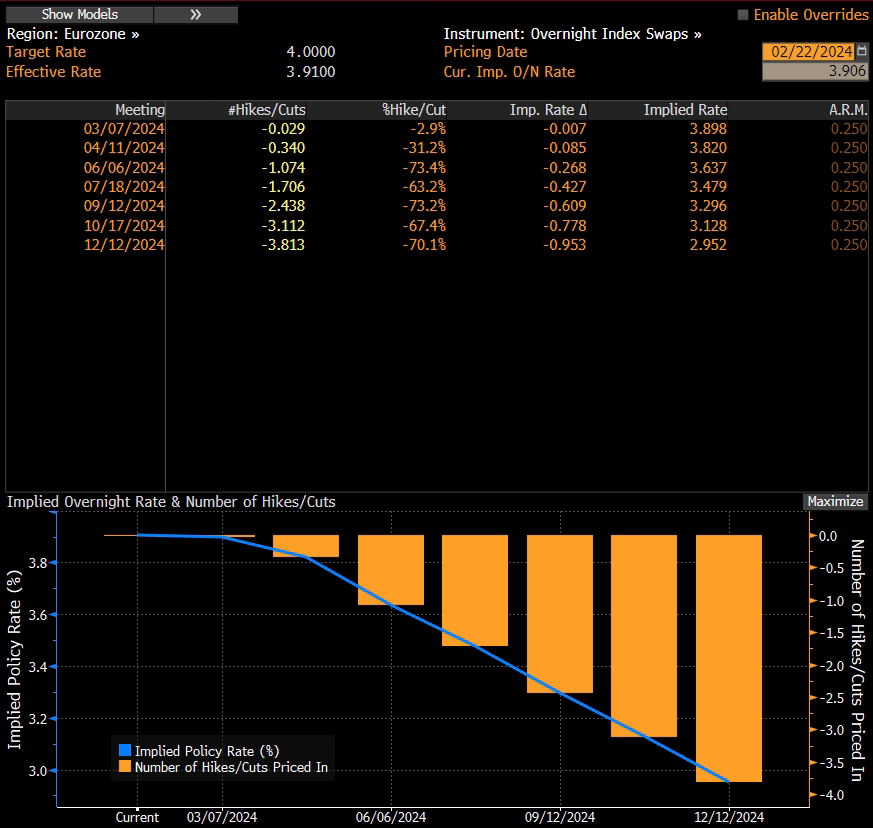

Meanwhile, in Europe, the situation is similar in terms of rate cut expectations. The ECB released yesterday wage growth figures that showed easing for the first time in 18 months, a favourable story for doves hiding in the GC. On the other hand, the inflation rate is still above 3% which is a long way from the 2% target, services CPI is quite sticky and the unemployment rate remains at a record low of 6.4%, all of which suggest solid economic indicators, so wise move would be to wait for April ECB meeting to see Q1 2024 numbers before making any judgments on rate cuts. Our stance is that the ECB will be likely to push rate cuts later in the year, much like the FED, and potentially wait for the FED to make a move in downgrading direction first.

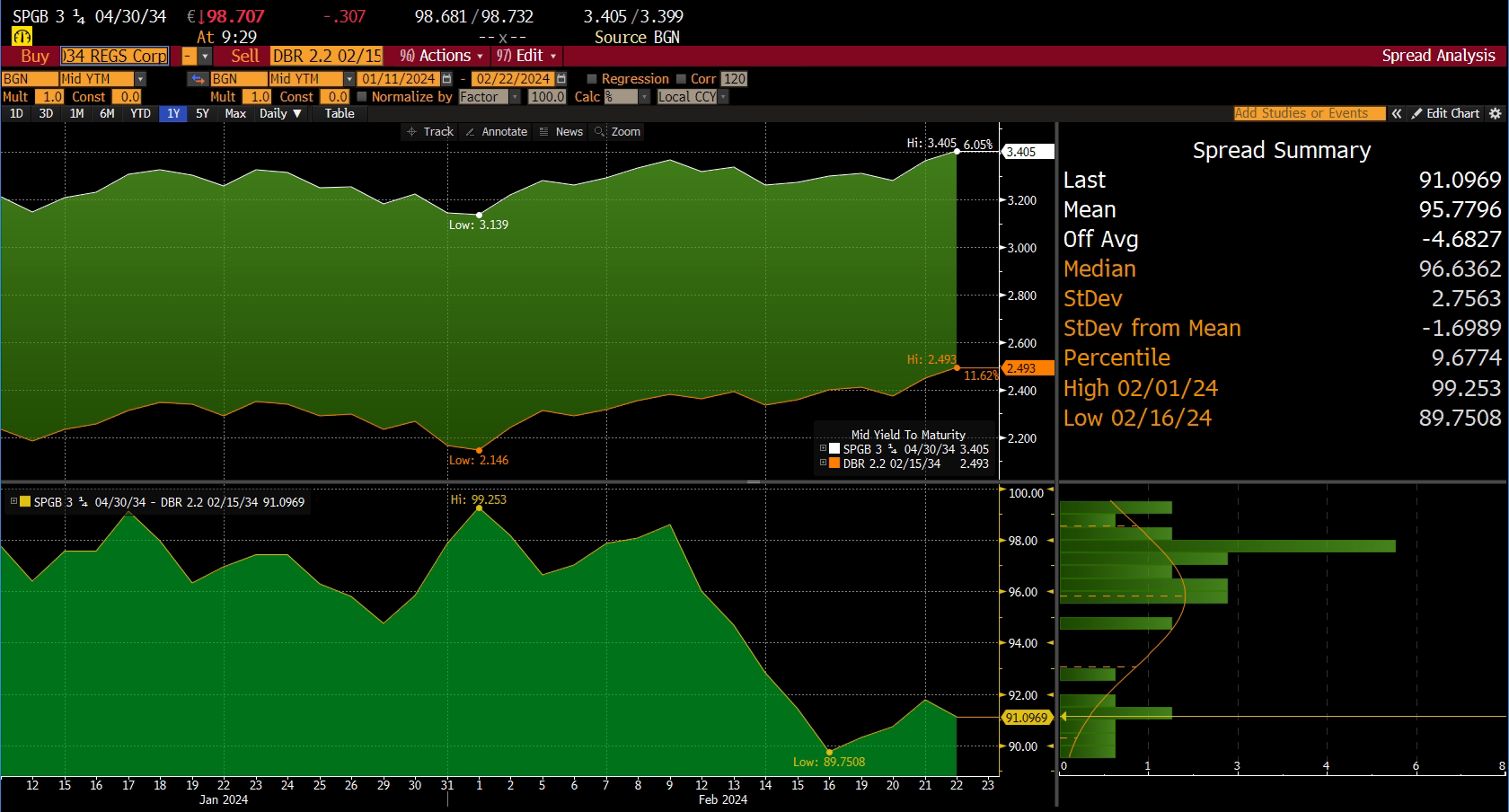

What’s going on with CEE bonds? Well, here’s the kicker – to answer that question, just take a look at what’s going on with SPGB 3.25 04/30/2034€ in terms of spread to German paper:

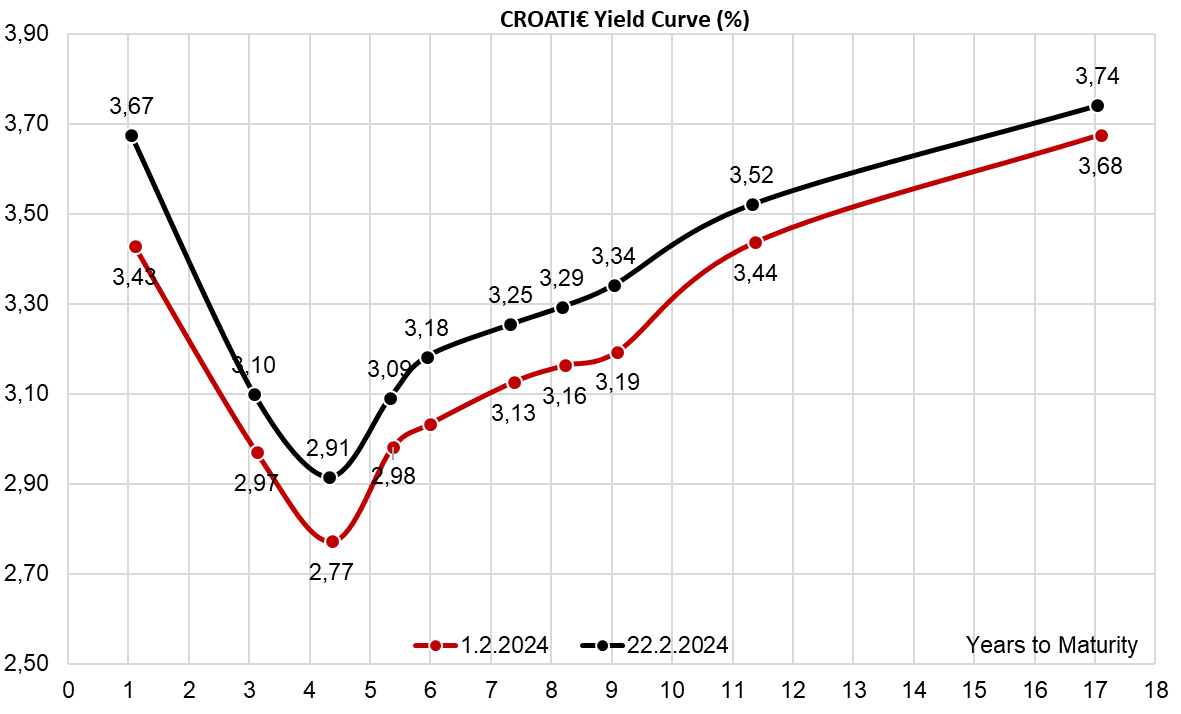

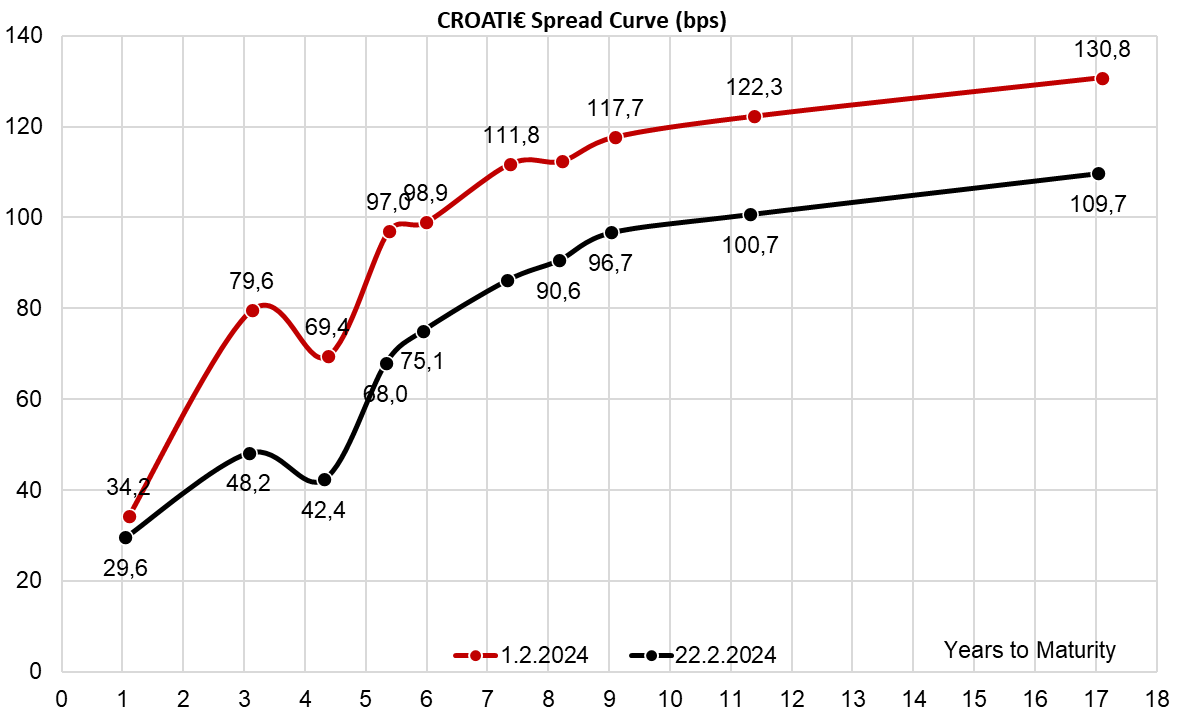

It’s getting tighter and tighter, now standing at B+91bps. The same is happening with CROATI€ curve as the two charts might suggest. This is not due to market illiquidity, but we see a couple of Street dealers that remained short CROATI 4 06/14/2035€ after the Ministry of Finance skipped international bond placement in January and domestic asset managers had to be invested. We are unsure of how that would hold, however, look for Spanish spread for clues on where CROATI€ is heading. Currently, the CROATI€ spread on the long end is around 100bps, meaning that the markets might have already given Croatian bonds the rating upgrade we have all been waiting for.

Source: Bloomberg, InterCapital