Canadian ice skater Wayne Gretzky is often credited for the saying: “I skate to where the puck is going to be, not where it has been.” This is exactly how we felt when FED’s Jerome Powell said yesterday that they’re getting closer to Taylor rule implied FED fund rate. Are they really? What does Powell think where the puck will be in December? Find out in this brief research piece.

Yesterday’s Humphrey Hawkins testimony delivered by FED Chairman Jerome Powell in front of the Senate banking committee was inconspicuous in content but eventful in effect. The latter we attribute to positioning before the event since it’s clear a lot of market participants had a bit larger fixed income short positions than they could have handled.

The wording of the statement and subsequent Q&A session was largely in line with what we have heard before. Massachusetts senator Elizabeth Warren questioned Powell on the effects high inflation and possible recession are going to have on the worst well off, but Powell stated that „We know from history that that will hurt the people we’d like to help, the people in the lower income spectrum who suffer now from high inflation.“ This is exactly what a central bank governor with a dual mandate would need to say in an environment of inflation hovering close to 10.0% YoY (8.6% YoY was the last print) and subdued unemployment. Powell also argued that although soft landing prospects look slightly dim, the economy is resilient enough to weather higher interest rates. So let’s have one thing completely clear: there was really nothing dovish in the wording of the testimony. The FED is still determined to hike rates as high as it takes to bring soaring prices under control.

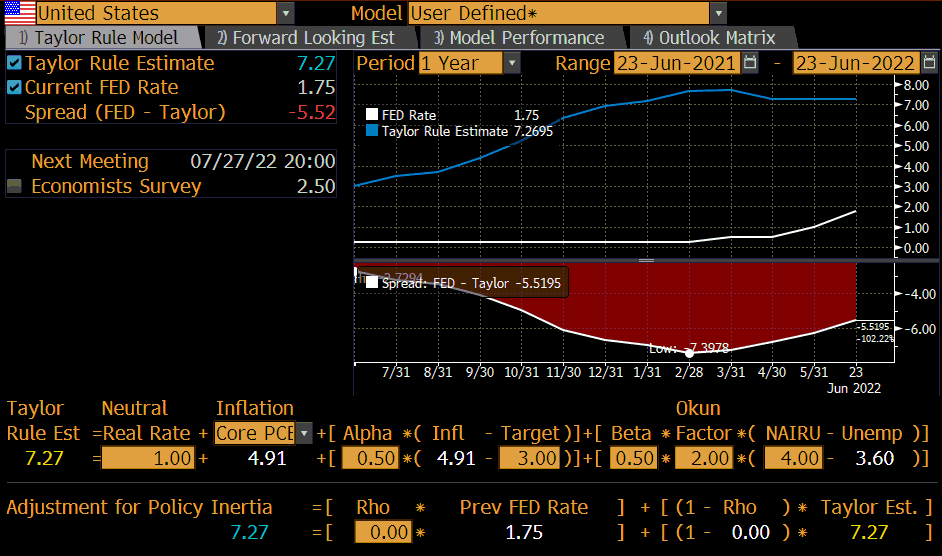

Regarding rule-based guidance, Powel stated that „by the end of the year we will be pretty close to where some of the Taylor Rule iterations are“. This sentence has a particular ring because of the BBG TAYL function:

Taylor rule implied rate is currently 7.27% (with core PCE @ 4.91% and unemployment @ 3.60%), meaning that after the implied July 27th hike in size of 75bps (FED fund range @ 2.25%-2.50%) the central bank will still be some 477bps below the target. Currently, FFZ2 (FED fund futures maturing in December 2022) prices a 3.55% FED fund rate, still some 370bps below the Taylor rule. What we’re trying to tell is that getting pretty close to the target would require unemployment getting at least 2 percentage points up and core PCE dropping to about 2.0%. This is where the puck might be in six months’ time – well at least Powell is skating towards it.

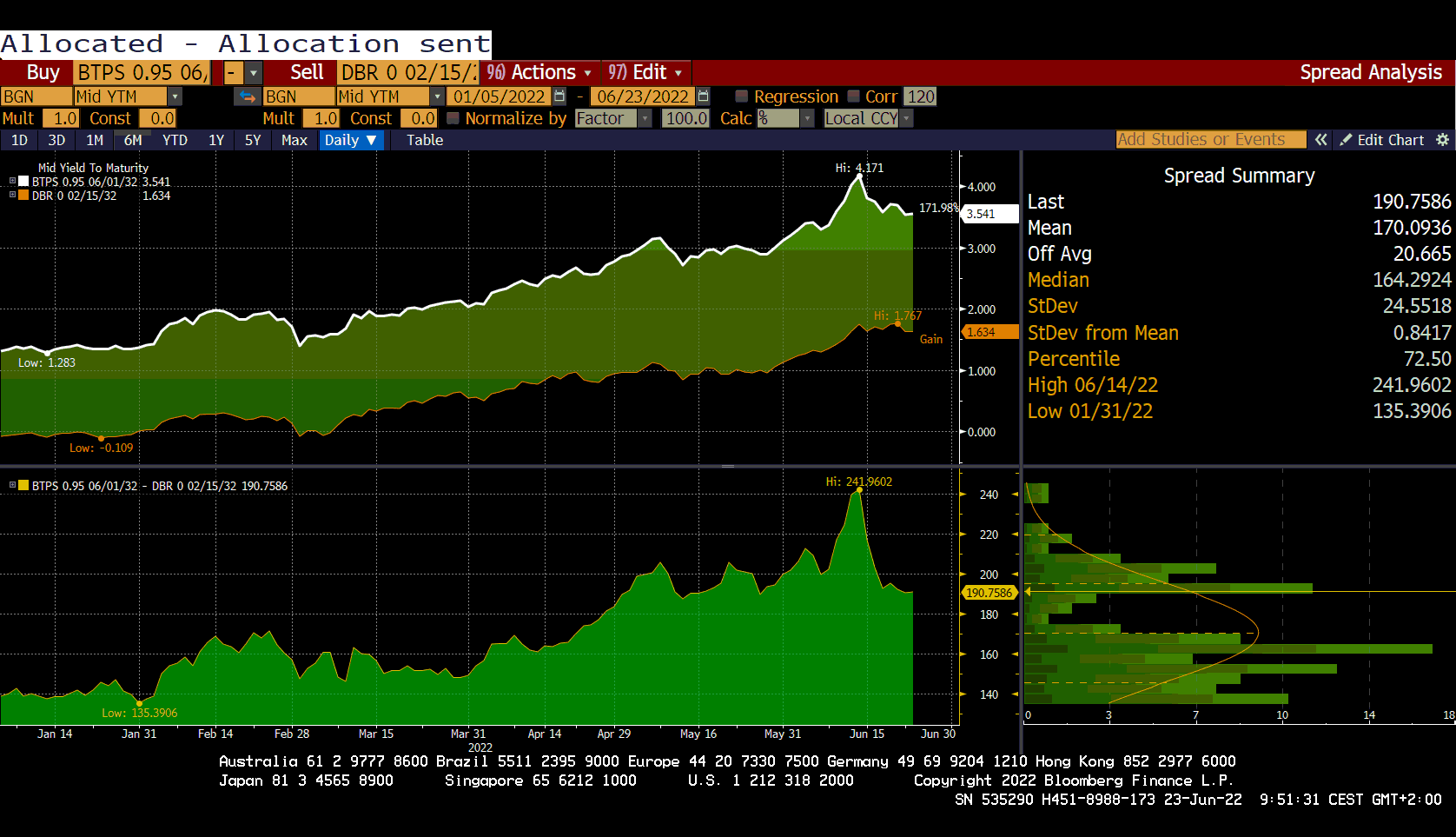

Global rates rallied based on short positioning and perceived dovishness in Powell’s testimony so currently, German 10Y just broke below 1.50% YTM. Ahead of a large BTP auction lo spread (BTPS-DBR) is once again traded below 190bps (188bps spotted this morning) and all of this comes against the backdrop of falling equities and widening iTraxx (take a look at the ITRX XOVER CDSI GEN 5Y Corp on BBG). This effectively means that ECB’s antifragmentation tool is working, at least from the rhetorical point of view. That’s all the Frankfurt officials were looking for in the first place – for the market to take them seriously. However, eventually, they will have to deliver on that rhetoric, so keep on monitoring closely.

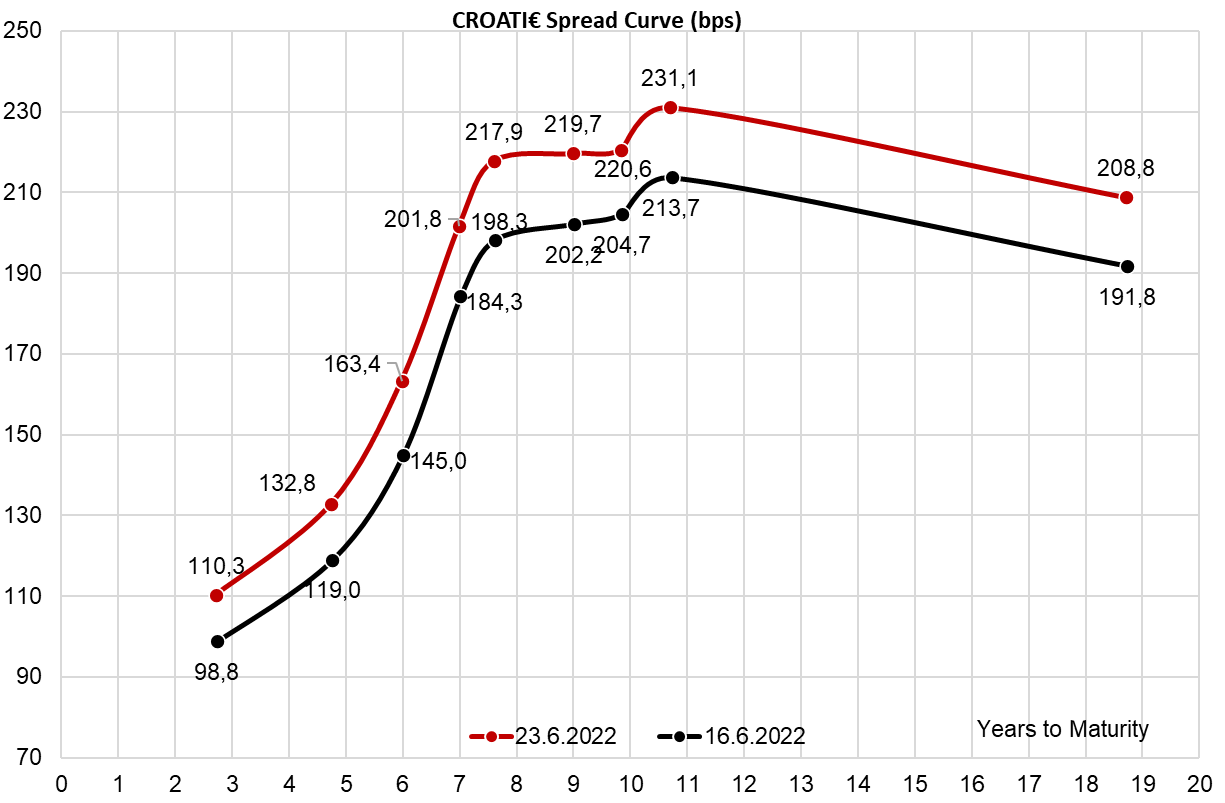

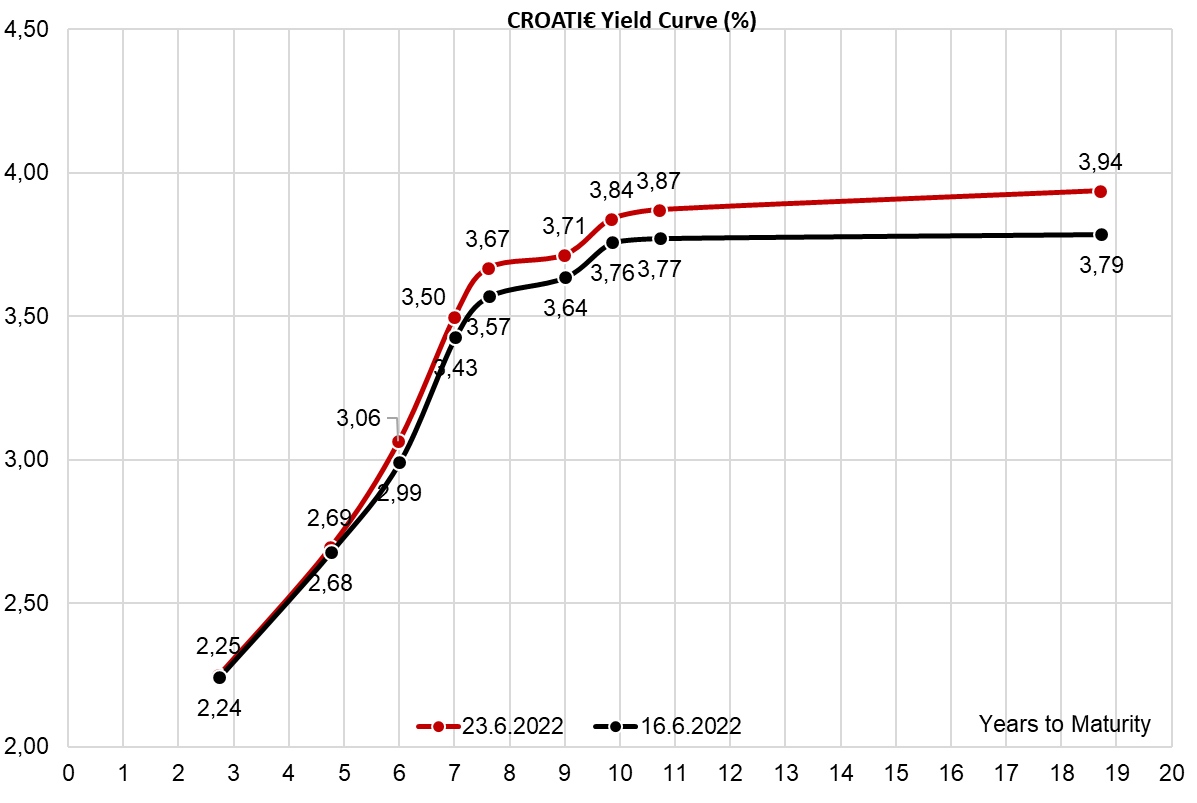

Bear in mind that this morning we have still seen CROATI€ trading around 200bps above the German benchmark. For instance, CROATI 2.875 04/22/2032€ was offered at 92.625 (3.787% YTM, B+229bps), albeit not in decent size.