US midterm elections passed with a modest surprise as Democrats most likely managed to keep the majority in the Senate with a Democratic flip in Pennsylvania. However, it seems that midterm elections were not very important for the market at the moment although there could be some consequences for the fiscal policy that will have implications for the financial markets. In this article, we are looking into more details on the elections and what to expect from today’s all-important CPI release.

It is still too early to call who controls the Senate and House after the latest US midterm elections, but it seems that Democrats could keep the Senate majority while Republicans are expected to win the House of Representatives. As was the case in the elections in 2020, the winner of the Senate could be decided only on the 6th of December when the second round of voting should take place in Georgia. In any case, it already looks like the Democrats went much better than expected in the polls while many Republican candidates that were backed by the 45th president of the US Mr. Trump disappointed in the latest race. Negative surprises on several candidates backed by Trump prompted markets to price Ron DeSantis being the main candidate for the GOP in 2024. As stated above, the results are still not clear but most likely we will see a divided Congress resulting in difficulties with any major changes in domestic policies for Mr. Biden for the next two years while we could witness another debt ceiling crisis. Looking at the equity and bond markets one could not tell that midterm elections took part this week, with most equity indices kept rising stubbornly despite a big crash in crypto markets while bonds are still not out of the woods with US Treasury yields being close to their recent highs and trading sideways. Republicans now being able to stop most of the fiscal loosening in case of any economic downturn could be seen as a modest tailwind for bond bulls.

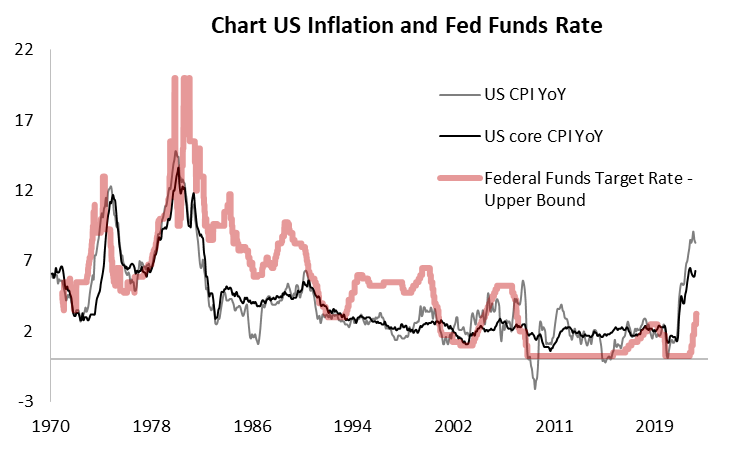

Talking about yield drivers, today we will see US CPI data for October. In YoY terms, inflation is expected to continue decelerating from 8.2% in September to 7.9% YoY while the core is expected to decrease to 6.5%, 10bps lower compared to September. As the commodity complex fell significantly from its high in June, goods inflation is expected to keep decelerating. Most of the focus will be on services inflation which seems to be driving inflation further. Last week we saw jobs report surprising markets on the upside with the economy adding more jobs and showing that average hourly earnings growth accelerated to 0.4% MoM.

September CPI release resulted in one of the weirdest intraday swings that I have seen in my short (7 years) career and in general CPI reports have been strong drivers for the market this year. With equity markets rising slowly without obvious drivers lately, we see another leg higher in case CPI comes under expectations. The picture is more blurred in case inflation overjumps expectations as the market tends to see what it wants, i.e. it could find a reason to keep rising even if CPI overjumps expectations slightly. However, I do not see this trend lasting as one has a hard time finding tailwinds for adding equity exposure besides low positioning, i.e. flow.

Source: InterCapital, Bloomberg