US labor data surprised to the upside, but we have a long way to go before we’re back to full employment. Cleveland FED chief Loretta Mester called the current approach to monetary policy “deliberately patient“. What are the next big dates on our calendar and which CROATI€ bonds we find as “deliberately cheap“? Find out in this brief research piece.

In case you snoozed the last two trading sessions, here are the main takeaways. On Thursday the National Federation of Independent Business (NFIB) reported a record share of job openings, but what’s even more interesting is the fact that NFIB Small Business Compensation Index (SBOICOMP Index on BBG) rose to one-year high of 28.0. The indicator detects how many small businesses are raising wages in order to attract workers and it’s worth mentioning that it’s still well below the pre-pandemic level.

The most of the investors’ focus was instead on the US labor data published on Friday: US economy added 916k new jobs versus 660k expected by analysts surveyed by Bloomberg. Research portals interpreted this figure with a healthy dose of pessimism, reminding the readers that before the pandemic there were some 8.4 million people working that are currently out of work or are looking for jobs. In other words, the recovery is swift, but we have a long way to go before we reach full employment and FED starts to think about thinking about raising rates. Average hourly workers managed to decrease slightly (-0.1%) on a monthly level, while increasing by +4.2% YoY on annual basis (that was below BBG survey).

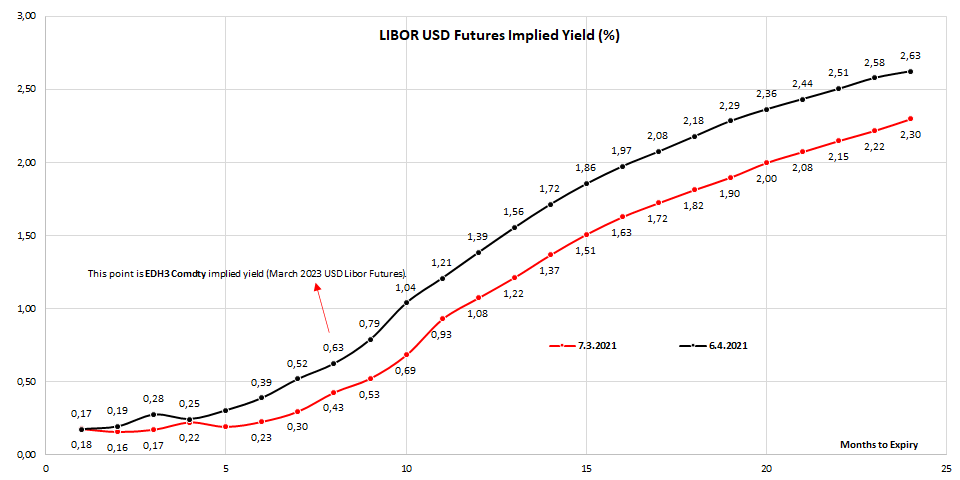

Loretta Mester (Federal Reserve Bank of Cleveland President, a non-voting dove) was the first one to comment on the optimistic labor data and her comments were in line with what Jerome Powell, Richard Clarida, Mary Daly, Patrick Harker, and Christopher Waller have been telling us all along: the outlook is brightening, but the policy stays the same. Mester even coined a new term to describe the approach to the monetary policy in times like these: “deliberately patient”. The payroll data managed to increase the USD LIBOR implied yields slightly (implied yield = 100 – futures price, so EDH3 Comdty @ 99.375 gives an implied yield of 0.625%), however Mester’s comment brought the implied yield right before it was before the labor data.

So what comes next? You won’t need to wait for too long before next US CPI data crosses the wires and April 13th is the next big date on your calendar (next Tuesday; al least it’s not Friday the 13th). Expectations are high: 2.5% YoY (versus 1.7% YoY last month) with 1.6% YoY for core inflation. The core data is the one that needs to be in your crosshairs and FOMC member comments following the data publication would be under the spotlight as well. Especially if the CPI data outperforms the consensus estimate (albeit it’s likely it won’t).

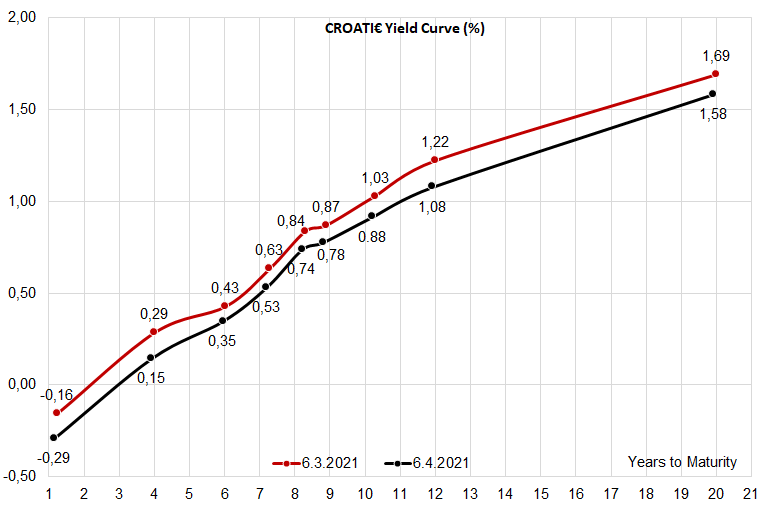

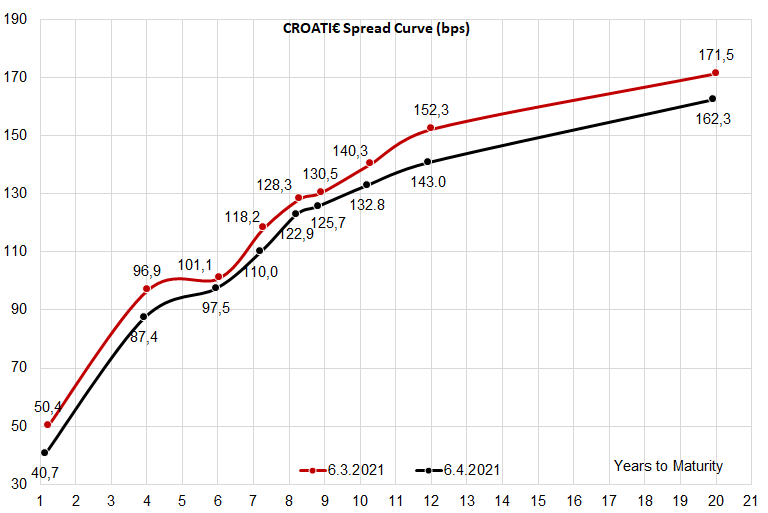

What happened with CROATI€ bonds throughout last few weeks? Looking at the charts submitted, both yields and spreads contracted and currently CROATI 1.125 03/04/2033 trades at 100.50 clean (1.08% YTM, B+143bps). Around the turn of the month we saw some selling pressure on this one due to some of the fast money liquidating their holdings after carrying them for one month straight (for fast money clients/flippers, this is very, very long). However, RM demand was happy to pick up the slack and this morning we see a bit more buyers than sellers. Interestingly enough, the strongest demand we have perceived on CROATI 3 03/11/2025, which is traded around 111.33 clean (0.10% YTM, B+70bps). Demand is coming from bank ALM departments and for a brief moment we had a feeling that every ALM in the region is looking for this particular paper. A part of the explanation might come from recent maturity of CROATI 6.375 03/24/2021 – although that was a USD-denominated international bond, at least part of the banks is buying EUR assets and placing dollars they received on the liability side in an EURUSD swap (simultaneously lending USD and borrowing EUR). It’s possible that the maturity of the swap corresponds to the maturity of the US dollar deposits these banks carry on the liability side.

Putting that aside, we believe CROATI 3 03/11/2025 looks a bit expensive, so we suggest that you rather focus on the next spot on the yield curve: namely CROATI 3 03/20/2027. According to the charts, the paper is traded at 0.35% YTM (B+97.5bps) and hasn’t experienced much of the spread tightening. It’s worth bearing in mind that two years from now, assuming the yield curve stays the same, in the coming two years we can expect to pocket some 0.71% annually in total return. Here’s the math:

- 115.55 (0.35% YTM) – 111.20 (0.15% two years from now) = 4.35 or 435 cents you lose on the price depreciation

- 600 cents is what you get from coupon payments in two year’s time

- 600 – 435 = 165 cents net for the two year holding period

- that’s 82.5 cents annually

- 82.5/115.55 (clean price today) gives you 0.71% annually.

A rough, but accurate calculation reveals the most interesting opportunity from risk/reward (maturity/total return) assumptions.