This week US Bureau of Statistics released the long-awaited US March CPI data. Compared to February, CPI prices posted growth of 0.6%, displaying the highest MoM jump since August 2012, while on yearly basis CPI inflation reached 2.6% (vs. 2.5% expected). However, investors were obviously well prepared for this and therefore were not impressed by data. 10Y Treasury yield actually fell towards 1.60% level. In this article we are looking at the main drivers of inflation and what to expect further, from both data and rates.

Since Georgia election in January 2021 in which Democrats won the Senate, markets have started to price larger than previously expected fiscal stimulus that passed through the complex US legislation system quite easily. Biden even announced USD 2 trillion infrastructure plan before USD 1.400 checks from the previous fiscal package were sent in full. Fiscal packages are the largest part of the reflation puzzle but not the only one. Very successful vaccination process in US, enormous savings that Americans are still hoarding, and pent-up demand need also to be taken into account. Unemployment is, however, still way above pre-crisis level but that is mostly due to lagging recovery in the service sector that should materialize in the following months. All the above have driven reflation talk resulting in inflation expectations reaching multi-year highs. This leads us to March’s data, the first month which reflects full effect from the corona crisis, hence its importance. The data was almost correctly forecasted by analysts’ consensus (missed by only 10bps). CPI stood at 2.6% in YoY terms, rising from 1.7% in February while MoM growth was the highest in the last 9 years. Looking into more details, gasoline index rose by 9.1% MoM and accounted for almost half of the CPI growth. However, core CPI index still rose by 0.3% MoM or 1.6% in YoY terms. Interestingly enough, 10Y Treasury yield actually fell towards 1.60% level as investors obviously positioned for an even higher inflation than consensus as market always goes a bit ahead of itself.

March’s data is quite important but says little without looking at the events that happened a year ago. Namely, in March 2020 corona crisis kicked in in US and in March 2020 WTI crude oil future fell from above USD 40 to below USD 20 (even went to negative territory at one point). Demand for most of the goods and services plunged strongly, pushing inflation in the negative territory. In April and May 2020 prices were still on the downward trajectory and started to recover only in June. Therefore, the base effect obviously plays large role in last month’s inflation data. Ceteris paribus, in April and May we could expect CPI to reach or even overjump 4.0% and then to slowly start fading in the second half of the year. However, if demand continues to grow, CPI could easily remain above 2.5% for the whole 2H2021. As Fed officials were so often pointing out recently, increased CPI level should only be transitory. We are, also, still not convinced whether giant fiscal easing undertaken by US government will have lasting effects on US economy that could keep inflation elevated after 2021.

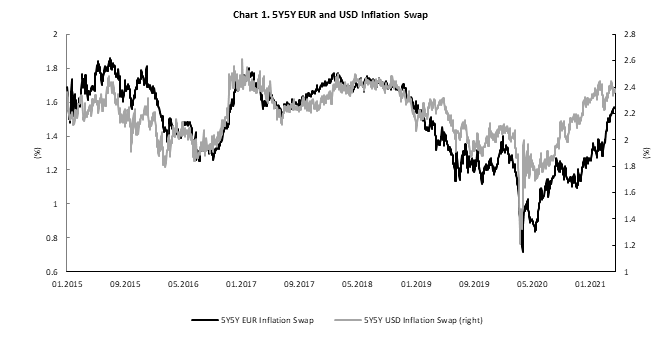

Talking about Fed, Powell is the most vocal defender of transitory effects and subdued inflation. Nevertheless, market has its own mind. In the last two months we have witnessed the large surge in inflation expectations and strong sell-off in rates which drove US 10Y to 1.75% while curve steepened significantly. When market started to price in higher taxes to fund infrastructure stimulus, some of the participants most likely started assessing whether US yield curve is quite rich and is inflation story calculated enough. For now, 1.75% level proves to be a strong support. Most of the analysts now expect US10Y to reach 2.0% in 2021 (there are few of them expecting it to reach 2.0% before summer).

Looking ahead, we expect inflation story to stay with us for at least 2 or 3 quarters, accompanied by increased volatility in rates. One of the most important things for the rates will be Fed communication in case inflation stays high for longer than central bank expects. In case inflation does not surprise on the upside, we could be far away from any monetary policy tightening, while yield hunt could once again become a dominant theme.

Source: Bloomberg, InterCapital