In October 2021, US CPI stood at 6.2% YoY while in monthly terms it was at 0.9%, surprising markets on the upside and showing that prices in US rise at the fastest pace since 1990. Although inflation was way above expectations, longer yields went up moderately but accelerated after terrible 30Y auction.

Yesterday’s data published by Bureau of Labor Statistics showed that US CPI increased by 0.9% MoM and 6.2% YoY in October 2021, compared to BBG forecasts of 0.6% and 5.9% respectively. Furthermore, both MoM and YoY pace increased compared to September when CPI increased by 0.4% and 5.4%. Core inflation also increased more than expected as it stood at 0.6% MoM and 4.6% YoY terms. Looking at the details from the press release, it could be seen that increase was broad based, with energy and new and used cars being the largest driver while prices of food do not show any signs of deceleration, growing by 0.9% MoM for the second consecutive month. Going on, rent prices also posted significant gains of 0.4% MoM meaning that cyclical inflation pressures are starting to incorporate in all parts of the economy. This also means that inflation is most likely to be more persistent than was expected by all central bankers in the developed world. Before US CPI data was released, Chinese CPI also surprised investors on the upside as it stood at 1.5% YoY compared to 0.7% last month while PPI was at 13.5%, highest level in the last 26 years.

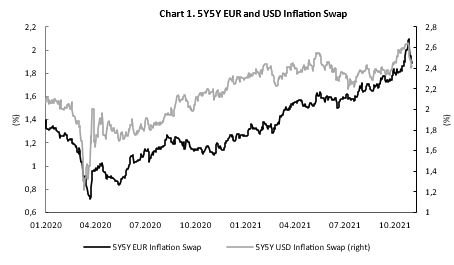

On its latest monetary policy meeting, Mr Jerome Powell still insisted that inflationary pressures are expected to be mostly transitory with drivers of the pressure being mostly connected to dislocations caused by the pandemic. Although one could agree that inflation pressures are driven by pandemic, it is becoming more and more questionable whether strong inflation forces could decrease significantly in the next several quarters. Nevertheless, inflation expectations in US did not move much yesterday, with 5y5y inflation swap being at 2.55%, more than 3 percentage points below compared to October’s CPI.

Talking about expectations, markets did react on the inflation surprise but moves were not dramatical as one would expect showing how investors got used on deeply negative real rates and expect inflation to settle down rather sooner than later. Namely, US 2Y yield went up by 5bps, from 45 to 50bps, while Libor futures dropped by some 10bps. Longer part of the curve increased more modestly, with US 10Y increasing by few basis points, barely surpassing 1.50% level, resulting in further flattening of the yield curve. Equity markets were little changed but equity markets stopped reacting on inflation surprises many months ago. However, that all changed after US 30y auction with more than 5bps NIP, highest since 2011. US 10y yield accelerated North and ended the day more than 10bps above, at 1.56%, while equity markets sold off.

So, what to take from yesterday’s move on markets? We think that investors expect a mix of the following: (1) inflation will fall quickly next year and Fed will lift rates slowly starting September; (2) Fed will decide to lift rates at much faster pace meaning that it will decelerate economic growth in such a manner that it will have to choose between higher inflation and growth and will choose growth and cut rates; (3) central banks will not be able to decrease their balances in the distant future and QEs will only increase; (4) there are too many financial subjects with mandate to buy bonds. However, one must wonder what would happen in case oil price continues increasing or wages start increasing faster and inflation rates stay above 5.0% for few quarters more. However, not many portfolios would want to see that scenario.

Source: Bloomberg, InterCapital