As World Cup in Qatar is drawing to a close, the match between central banks and inflation is going into overtime. After hawkish FED, ECB states that higher for longer is the game they’re playing because the EZ economy is resilient and core CPI remains flat. What are the implications of yesterday’s ECB decisions on CROATI€ (and CEE in general)? Read in this brief research piece.

Although ECB’s Governing Council slowed the pace of rate hikes to 50bps at the December meeting, the Q&A session dropped the bomb with a statement that rates are expected to rise by 50bps for a “period of time”. This statement was further reinforced by this morning’s comment from François Villeroy de Galhau (Banque de France) on BFM Business Forum that market rate expectations fell too far in November and that he was also in the 50bps camp for the December move. To picture the change that has happened in the financial markets, one ought to look at the BBG WIRP function with implied forward interest rates. Here is the chart from December 13th (before FED & ECB speak):

Notice that the implied O/N rate on the 27th July meeting stood at 2.812% and now take a look at where it stands now:

It’s at 3.159%, meaning that markets are now expecting a +35bps higher terminal rate in the summer of next year. This is essentially the only change coming directly from Lagarde’s Q&A session on rate hikes because if you look more closely at the two screens, you can spot that markets were already pricing in another +50bps move in February and additional +25bps in March before pivoting. Now they are seeing +50bps in March on top of February’s +50bps, as well as another +25bps hike in May. With these statements, we see ECB’s terminal rate at 3.25%. However, Villeroy de Galhau reiterated this morning that GC still doesn’t see the terminal rate as a static number (i.e. it’s data-dependent).

Speaking about data dependency – why did the ECB GC do such a thing, this hawkish pivot? EURUSD has been steadily appreciating and energy prices have been gradually declining since peaking in early summer. The main reason in our view is the fact that although US Core CPI has been steadily declining in the past few months, EZ Core CPI remains stubbornly flat at about 5.0% YoY. We can say that after ECB trailed FED on the path to higher rates claiming that US and EZ inflation are two different stories (in the US it’s driven by a tight labour market, in EZ by higher energy costs), it becomes clear that ECB will have “more ground to cover” even after the FED is done with raising rates to make up for the lost time.

Speaking about ground to cover, what about the longer EGB bonds? ECB also announced APP shrinkage of 15bn EUR per month in period March-June, with possible revisiting the QT pace at the June meeting. With Muller’s and de Galhau’s comments from this morning, it’s quite likely that APP reinvestments might completely end after June, which was kind of priced in before the meeting. What is really new here is this three-month period of 15bn EUR/month slower reinvestments, reducing the aggregate demand for EGB’s by 60bn EUR in the aggregate (4 x 15bn = 60bn EUR). One PM correctly said – it comes at the worst possible time since that is when the CEE governments come to the market to borrow. With the current setup of restrictive monetary policy and loose fiscal policy in 2023 across the “old continent” to buffer higher energy costs, we can only support the claim that the only way for the European yields/spreads is up. With this in mind, we would be looking at the first SLOREP€ syndicate early next year (possibly in the first few days of January) to see how deep the markets really are.

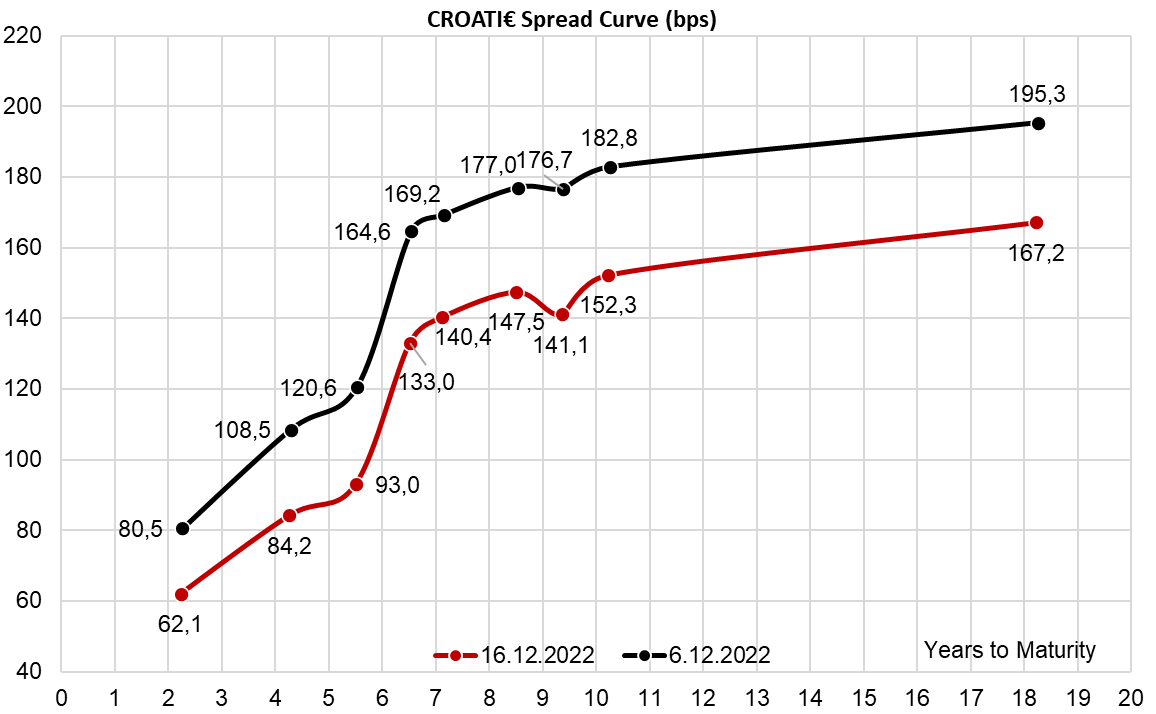

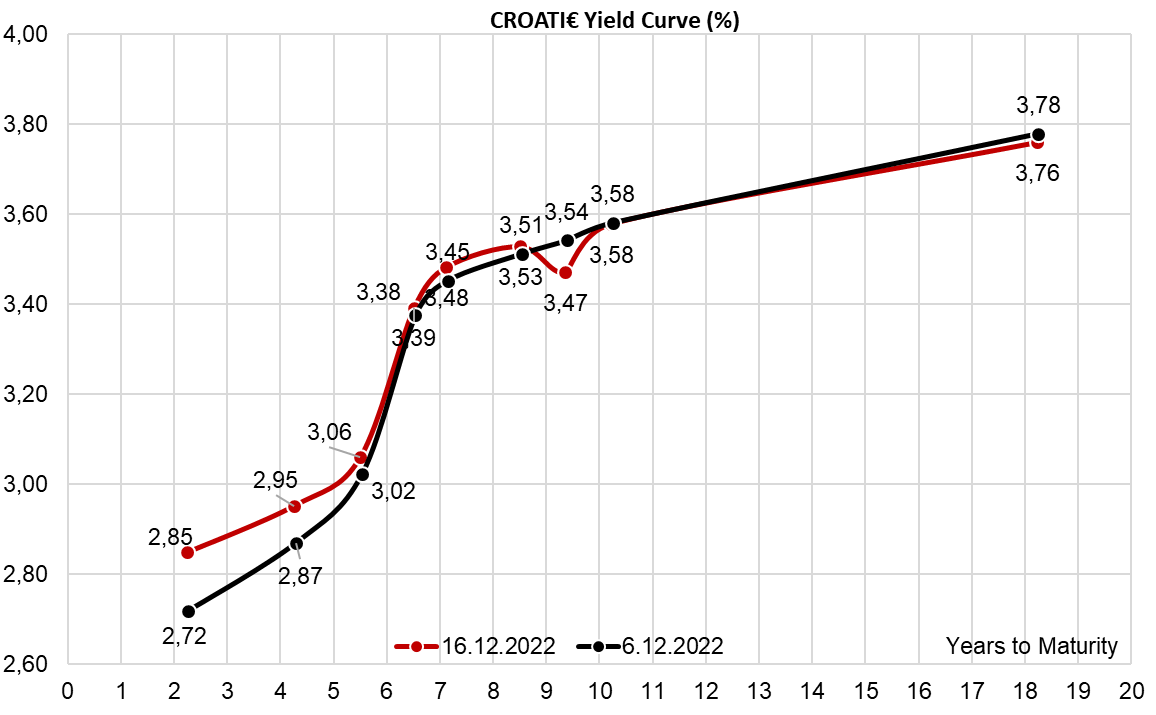

Speaking about Croatian international bonds, when you came to the office this morning your screen probably showed you that nothing has happened, but veteran bond dealers know that screens are mirrors into ancient history. Notice that the lo spread has widened from +183bps to +213bps in the last three trading sessions, so all that you see on CROATI€ on the screens this morning should be taken with a grain of salt.