Inflation data in the United Kingdom surprised the market on Wednesday as the YoY inflation rate came worse than expected. In addition to that, on Tuesday the released PMI data indicates that the economic growth should remain solid. Consequently, the Gilt yield curve shifted north. Yields are now approaching levels seen after the announced tax reform of Kwazi Kwarteng which spurred volatility in the market as bond markets quickly penalized expansionary fiscal policy during times of high inflation. Pension funds lived through difficulties back then, but a similar problem in UK financial system may emerge again.

PMI data on Tuesday fueled the depreciation of Gilts as the market expects additional hawkishness of the monetary policy. Also, inflation data pushed yields further up as the expectations were heavily overshot (0.7% MoM expected vs 1.2% MoM actual. The most significant contributor to the headline rate is the food prices which continued their worldwide growth and amounted to 19.1% YoY in April 2023. Core CPI rose from 6.2% YoY in March to 6.8% YoY in April due to the growth in services CPI. The core inflation rate is still at very high levels and is struggling to drop down to sustainable levels. According to OIS, the market priced in more than one rate hike in two days as the data showed a highly resilient headline and core inflation rate in combination with higher expectations of growth. Higher MoM inflation rates last year in April are contributing to the softer YoY rate, but recent MoM inflation data are indicating that the higher inflation rates are going to persevere.

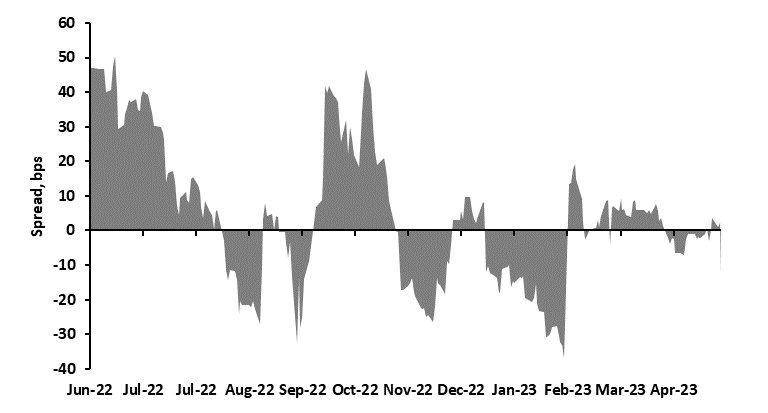

The market reacted swiftly pushing yields up by 30 – 50 bps across the yield curve over the course of just one week. 2-year yield went up from 3.86% to 4.35%, 10-year from 3.85% to 4.23% while the 20-year yield went up from 4.23% to 4.55%. In comparison with Eurozone and US yield curves, the market presumes that the inflation problem in the UK is the hardest to solve. German 10-year yield is currently 32 bps off its highs in this cycle and the US 10-year Treasury yield stands at 60 bps off highs. However, both US and Euro yield curves are heavily inverted, but in the UK the situation is different. Spread between 10-year Gilt and 2-year Gilt amounts to a small -12 bps while in the US and Eurozone is at -60bps and -37bps, respectively. Lighter inversion in the UK points out deeper economic problems that the country is facing such as persistent inflation which indicates that the tightening cycle is still far off its end. Also, this move inverted the 10-year – 2-year spread again as it was not inverted before the data release.

UK pension funds may be in focus again as they were rescued in October last year. Still, other significant financial market participants may emerge as a problem similar to regional banks in the US as the yields approach levels seen in September and October. Portfolios of such banks may be in danger as financial instabilities in US and Eurozone may fuel bank runs in the UK as a result of a chain reaction. Also, one should be aware that BoE will probably backstop any financial difficulties similar to the US (BOE has already done temporary QE to save pension funds) which could be a short-term bullish factor for Gilts. To conclude the analysis, I would argue for longer-term higher interest rates as inflation remains persistent and fiscal policy trying to boost economic growth in the longer term after subdued growth post-Brexit.

Gilt 10-year to 2-year spread

Source: Bloomberg