With presidential elections behind us and millions of votes still not counted, we cannot be 100% sure who the 46th US president is, but there are high chances that former Vice president Biden won. In this brief article we are looking at US vote in more details and how market feels about the outcome.

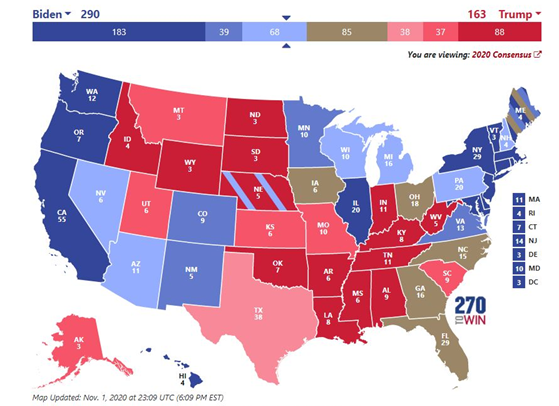

This week headline news was not about real economy, coronavirus cases or new lockdowns but clash between two candidates in US presidential elections. At the moment, it seems that democrat candidate Joe Biden will be the next US president while there are smaller chances of blue wave. Now, let us look what happened in the last three days. It is estimated that more than 100m people voted by mail before the election date, meaning that more than 60% of the Americans that voted did their ‘duty’ before the November 3rd. According to NBS news projections, around 160m Americans voted in total which marks a record high number and turnout rate in presidential election. Looking at the past presidential races, high turnout did not favor Republican candidates while before the election it was also stated that voters leaning to the left candidate preferred mail-in voting resulting in pre-election polls highly favoring Mr Biden. On Nov1st, Fivethirtyeight.com predicted Mr Biden will win 290 electors, Mr Trump 163 (with 85 electors undecided), which was way higher margin compared to 2016. Translated into odds, former vice president led by 52% versus 44% while in 2016 Clinton had margin of only 2% with 48% versus 46%.

Source: Fivethirtyeight.com, Nov 1st, two days before US presidential elections

After the polling locations were closed on Tuesday, Florida was the first swing states that Trump won. Furthermore, Obama’s swing states Michigan and Wisconsin also favored Trump in the first hours while North Carolina and Georgia were too close to call. All in all, on Wednesday morning (GMT time), it looked like Mr Donald Trump could stay another 4 years in White House, while blue wave was completely out of the picture. As expected, Mr Trump declared his victory saying that they will go to US supreme court and that he wants all voting and counting to stop as he assumed (correctly) that additional counting of mail-in votes will decrease his margins in swing states. Nevertheless, most of the swing states did continue to count mail-in votes through the day, resulting in Mr Biden flipping Wisconsin and Michigan states meaning that he only needs Nevada and Arizona (in which he is tightly winning) to count their votes in full. That would make swing states Pennsylvania, Georgia, and North Carolina unnecessary for Mr Biden to secure presidency. We are still waiting for the confirmation that votes are counted in full, but this morning it looks like Mr Biden will become the oldest president in the history of US. Blue wave could still be possible although margins will be significantly smaller than pre-election polls “predicted”. Trump reacted as expected, saying that votes in Wisconsin should be counted again while filling a lawsuit over the counting of absentee ballots in Georgia, Pennsylvania, and Michigan. If you have read just one article regarding US election, you would have known that this was predicted as the worst possible scenario for financial markets.

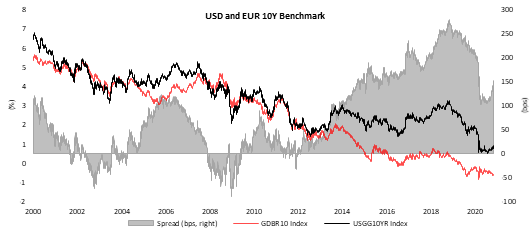

This morning, the most likely scenario is that Mr Biden won the White House while Democrats did not manage to take control over Senate. What the market has to say about this most feared outcome? It looks like investors just waited elections to pass and to buy whatever there is to buy not even bothering about who actually won the elections. US and EM equity, Treasury and EM bonds, EM currencies, you name it. USD yield curve bull flattened due to mixed Congress that will not easily approve new fiscal package worth USD trillions, as announced by some analysts. Since fiscal push is maybe even more distant than before, there were some speculations that FED could be the only safe net in case coronavirus keeps denting the economy. Just to put things into perspective, from its highs of 95bps on November 3rd, US 10Y yesterday fell close to 70bps. If Republican’s control of Senate gets confirmed (hence tougher negotiations on fiscal package), yields could fall further and US10Y-Bund spread could reach levels last seen this summer; especially if coronavirus cases continue rising, resulting in risk-off sentiment on equity markets. All in all, from financial markets’ perspective it seems we got the best from both candidates.

Source: Bloomberg, InterCapital