If you are trading EURHRK, then August 2020 reminds you of the final season of Game of Thrones – it kicked off with big expectations that were not matched in reality. The tourist season is better then expected, yet EURHRK doesn’t manage to hold a print below 7.5000 for longer. What can we expect before the turn of the month? Find out in this brief article.

A series of quite volatile sessions on EURHRK is behind us and several investors have highlighted the need for a more thorough, flow-based analysis. On the back of stronger tourism revenues, a rebound of exports and speculative flow, the EURHRK managed to dip below 7.5500 at the beginning of July. High frequency data about tourism arrivals and overnight stays suggested that Croatia might experience a softer correction compared to the rest of the Mediterranean. Better than expected macro data propelled the confidence in the local currency coming from domestic UCITS funds, causing them to start increasing their short EURHRK exposure and pushing the exchange rate even lower in the process. Additionally, the most recent data from Croatian tax administration shows that in the first week of August the value of invoices was only 14.5% lower than in the same period last year. This trend ended abruptly in the second week of August.

What exactly happened in the week starting from August 10th (last Monday)? On Monday morning the exchange rate was hovering around 7.4600 and anecdotal evidence from banks supported the claim that inflow of euros over the w/e was as strong as it could get, suggesting that another dip of EURHRK might be just around the corner. This expectation proved to be false as the trading day went by since EURHRK staged a rebound to 7.4900 levels on the back of strong corporate demand. Most of the analysts argued that higher EURHRK on Monday was a corollary of dividend payment made by the largest Croatian telecom company, which might have resulted in approximately 44mm EUR being purchased by the company’s owner in order to convert the proceeds into euros. Many did not see that coming, although it was announced at least a week earlier. This was compounded with a couple of stronger corporate tickets, all of them EURHRK buy orders, contributing to the stronger euro. Still, a majority of institutional investors didn’t make much of this, expecting net retail selling to bring the exchange rate back to 7.4600 by the end of the week. Once that didn’t happen, around the hump day of the week institutional investors carefully started to trim their short EURHRK exposure, basically in a standard profit taking fashion.

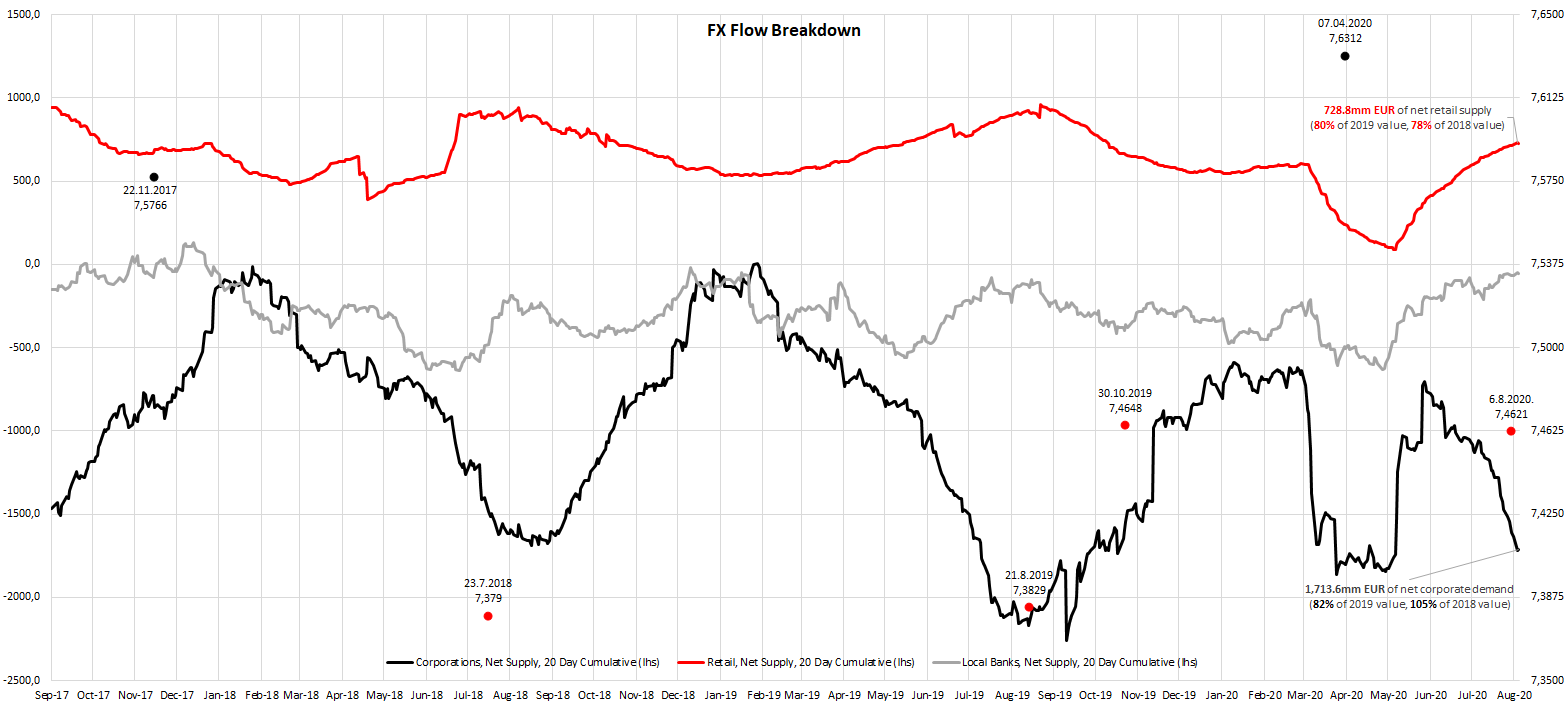

Speaking about the UCITS bond funds, it’s worth mentioning that dash for cash that took place in March and April reduced their NAV from 3.1bn EUR to about 2.2bn EUR. Most of them are EUR-denominated and saw their opportunity to make an extra gain on long HRK (short EURHRK) position in the dawn of a better than expected tourist season. So in mid-June and July they gradually started adding up to their short EURHRK exposure and by the end of July the five largest UCITS funds ended up with a total net short position in size of 214mm EUR (32% average NAV). This is quite a cozy position and may appear a bit outsized if the funds were forced to close it upfront in a case of a risk off event. Still, nobody really made a big deal out of this since UCITS funds entered this roller coaster with a significantly reduced balance sheets (implying they can not build FX positions as large as before) and besides, high frequency central bank data suggested that FX flow was better than expected (N4 table). Regarding the FX flows, cumulative 20-day data (to curb short term volatility and make trends more visible) shows that net retail selling was on 80% of 2019 values, while net corporate buying was at 82% of last year’s values, as char submitted below might suggest.

Focusing more on the chart, it’s worth mentioning that the data depicted consist merely of spot transactions, meaning that it really misses a lot – namely, there’s no optics on the forward transactions. The data was supplemented by local minimums (red dots, date and value) and maximums (black dots) in the EURHRK exchange rate (right hand axis) to make the orientation in time more efficient. The red line on the chart depicts net retail selling, accumulated over a 20-day period which roughly corresponds to a 1M period once you add weekends and holidays. You can see that on August 13th net retail selling reached 728.8mm EUR over one-month period, which corresponds to 80% of 2019 value registered in the same time frame, or 78% of 2018 value. By taking a look at the black line, we could see that corporate net buying also increased to 1,713.6mm EUR (82% of 2019 value and 105% of 2018 value). Don’t make too much of the fact that there’s a 985mm EUR hole (985mm = 1,713.6mm – 728mm) because as we stated before, the data is incomplete since it only includes spot transactions. This nugget of information can nevertheless be useful if understood as a proxy of wider market conditions and compared historically – this analysis yields that the situation might be much better than expected at the onset of tourist season.

OK, so if the tourist revenues look good, what then went wrong and brought about an evident short squeeze on EURHRK? Well on Wednesday (August 12th) Italy announced safety measures that would immediately be placed on tourists returning to Italy from four countries: Croatia, Malta, Greece and Spain. A cynical observer might conclude that all four countries have on thing in common: they are all major Italian tourist rivals. The mentioned measures essentially meant that everybody returning from the four countries would have to hand over a Covid-19 test no older than 72 hours or go through a 48 hour self-isolation before being administered one. At the same time Slovenian government spokesman Jelko Kacin mentioned the possibility of Slovenia enacting similar measures, albeit after a broadly based consultations (the decision should be made by the end of this week). Finally, Austrian government announced that they would also enact safety measures starting from August 17th against tourists returning from their vacations in Croatia. At the time of announcements of safeguards there were estimated 45k Italian tourists and 115k Slovenian tourists in Croatia (the total number of tourists regardless of country of origin was 820k, 68% of last year’s 1.2m). Slovenians and Italians make up some 20% of overall foreign tourists resting in Croatia and hence these safeguard measures were the red alarm that UCITS funds were looking for. On Friday morning EURHRK briefly visited 7.5400 level and some seasoned dealers hade a feeling that the central bank might intervene in order to curb excess FX volatility (to our understanding, that hasn’t happened yet). Anecdotal data suggest that not all of the outstanding short positions were closed last week – don’t forget that most of these positions were added back in June/July, when EURHRK was hovering in the 7.5500-7.6000 band, meaning that they’re still making money. The trouble with UCITS funds is that they have daily P&L reporting, meaning that when the exchange rate dropped to 7.4600 they already reported paper gains, after which the appreciation of euro against kuna started hurting on a daily basis. Also, with a 32% average net short positions, every 1 percentage point appreciation of euro brings about 0.32% of overall loss – basically these funds had to curb their exposure as soon as possible. This is how a mini EURHRK short squeeze came about, although a couple of short sellers managed to bring the EURHRK down to 7.5200 levels.

What happens next? Looking at the high frequency data, we have seen some 760k foreign tourists resting in Croatia over the course of this week and by looking at highway and traffic data we can conclude one simple thing: we have seen the peak of tourist season, but not it’s very end. UCITS funds may have reacted too carefully to Slovenian, Italian and Austrian safeguards (if one can ever be too careful), however this means that a considerable amount of dry powder (short EURHRK) has been neutralized. On the other hand the recent EURHRK spike has been so abrupt that not many investors managed to build up an opposite, long EURHRK position. This claim could be supported by almost non-existent rise in EURHRK forward points (for instance, take a look at “EURHRK3M ZABA Currncy” on BBG; a small, but unimportant forward point rise was nevertheless recorded), a common companion of EURHRK appreciation and a signpost of long EURHRK buildup. This observation can mean only one thing: there will be a lot of hunters waiting for EURHRK to drop because with dwindling exports the only way for EURHRK into autumn and winter could be up. Besides, many investors argued that in circumstances like these it’s safer to play EURHRK from the long side than the short one. This means that even when the EURHRK slides down, it would be a very limited slide because short sellers are after closing their initial positions while long speculators are also looking to build their three- or four-month positions.

Putting it all together, it’s likely that EURHRK would revisit 7.50 before the turn of the month, but we don’t put a high probability of another deep dip below 7.49. With the current setup most of the investors are looking to close the month of August with a long EURHRK position.