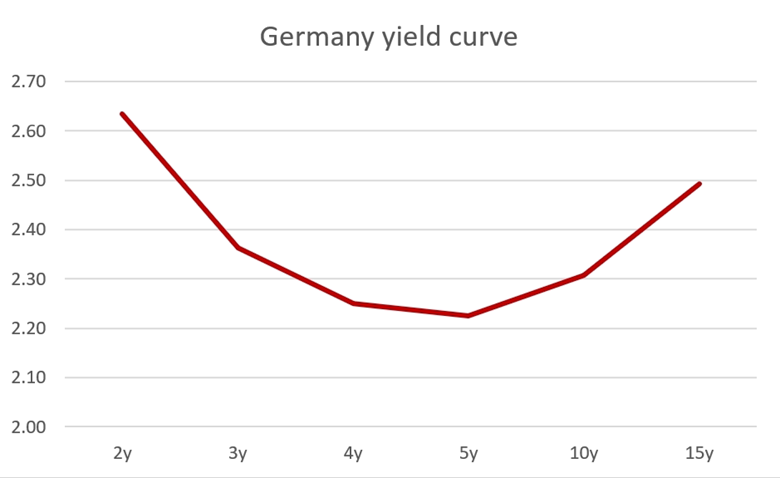

Central banks raised interest rates during the last two years which mainly affected the short end of the yield curve. Schatz (German 2-year bond) entered 2022 with a yield of -0.611% and closed 2022 at 2.764%. Schatz peaked on March 9th last year when it was at 3.382% and today Schatz is at 2.665% with yields falling mainly in the last two months. In the meantime, Bund entered 2022 at -0.570% and closed the same year at 2.571%. Bund peaked on October 4th, 2023, at 3.026% and today is at 2.312%. In this part, we will consider trading a steepening of the yield curve through the 2-10y.

As stated above, today we mainly have inverted yield curves in the EU and in the States. Last month central bankers started to talk about cutting interest rates during 2024 what already reflected in yield curves, so this should be a good moment for trading steepening of the yield curve (i.e. yields on the short end becoming lower than yields on the long end). Yield curve steepening can happen with three different events:

- Yields on the short end are falling faster than on the long end.

- Yields on the short end are falling, while on the long end, they are rising.

- Yields on the short end are rising, while on the long end, they are rising much faster.

Inflation came close to the 2% target, PPIs (i.e. inflation that producers of goods have on their entry of materials) are in Europe in negative territory at -8.8%, while in the US last PPI was 1.0%, the price of energy returned on levels before COVID and war in Ukraine. All those reasons are deflationary. To be fair, on the other hand, we have strong employment that is inflationary per se, but we still see inflation near the 2% target during 2024. Consequently, central banks should cut rates through 2024 when the short end must react and close on lower yields. So, it seems obvious to trade the steepening of the yield curve during 2024.

A simple way to trade the steepening of the yield curve is with futures. The crucial thing is to adjust the duration in total of the short end with the long end. If we think that the steepening of the curve will happen, then we expect one of the three cases that we stated above and to cover all those scenarios we go long the short end and short the long end. Because the short end has a much smaller duration, we must buy more futures on the short end so that the sum of all these durations is equal to the sum of the durations on the long end. We want to be duration-neutral so that the same move in yield on both ends (the whole curve goes up/down for the same amount of bps) doesn’t generate loss.

Example 1. With the <FIHR> function on BBG, we find that at this moment for long 100 futures of Schatz (DUA), we need to sell 18 futures of Bund (RXA) so that we are duration neutral. If we are constantly duration-neutral, on the constant spread of 2-10y, our P&L is also constant. (Here we don’t consider the impact of the cheapest-to-deliver bond on futures.)

With trading the steepening of the yield curve, we should always stay duration-neutral so that we are not exposed to other factors. The first problem is that a duration changes with movements in yields. Nominally, the same movement in yield on both ends will result in the spread staying on the same level, but the duration will change and then the long end will have bigger movements.

Example 2. Let’s look at DUA and RXA, currently cheapest-to-deliver bonds for those futures are BKO 3.1 12/12/25 (YTM 2.674%) and DBR 2.3 02/15/33 (YTM 2.262%), spread is 41.2 bps. The duration is 1.805 and 7.919, respectively. If we change YTM for 500 bps on both bonds (7.674% and 7.262%), the spread is still the same as before, but the new durations are 1.720 and 7.279. After this move, the proper duration-neutral position is long 100 futures on the Schatz and short 32 futures on the Bund.

The last example shows that it is not enough just to look for the spread 2-10y in a trading of a steepening of a yield curve, but the actual movement in yield matters also.

While trading a steepening of a yield curve with futures, a trader should make a position duration-neutral after every greater movement in a yield on any end.

Source: Bloomberg, InterCapital