Trade war was one of the main economic themes in 2018 but market expected there could be the deal as Mr Trump eased his rhetoric on China. However, as impulsive as he is, Mr Trump decided trade war should mark 2019 as well as he increased tariffs on existing Chinese goods and introduced tariffs on new goods. Few days later, China retaliated with tariffs on USD 60bn goods and is expected to reduce purchases of US agricultural goods and other products while US treasuries could be bought at a slower pace. In this short article we are analyzing the consequences of the tariffs on financial markets and CEE region.

Just as markets started to forget about trade war and turned bullish again, when S&P500 and other equity indices were reaching their all-time highs, Mr Trump once again decided there will not be the deal with China and that tariffs are to be increased/introduced. As we wrote in the summary, China’s officials retaliated and are planning to reduce purchases of US goods despite Mr Trump saying that “…there will be nobody left in China to do business with. Very bad for China, very good for USA…” and “…Therefore, China should not retaliate – will only get worse!”. In the meantime, White House Economic Advisor Larry Kudlow said that Mr Trump and Mr Xi are most likely to meet at the G-20 summit in Japan in June 2019. However, he also said that there aren’t definite plans when US and Chinese negotiators will meet again, leaving market in wonder whether fully blown trade war will continue crippling the financial markets. Knowing current POTUS and his rhetoric and bearing in mind that US presidential elections are coming closer we do not expect this story to end in June. Besides tariffs on Chinese goods, tariffs could be introduced on EU motor vehicles and the due is Saturday, May 18th although according to the media Mr Trump is to postpone these for 6 months. However, that is another story that’s going to keep investors’ off their toes this week.

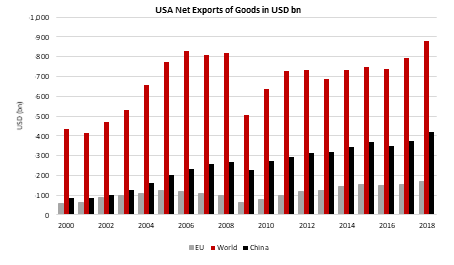

Source: US Census, InterCapital

As you may know, financial markets did not react on the news with much joy. Namely, equity prices all across the globe fell by several percentage points while volatility indices jumped close to their December highs. After the Chinese officials stated that they are introducing retaliatory measures S&P500 fell by 2.41% while US 10Y fell to 2.40%, few basis points above March’s lows. On the other side of the planet, EM assets were also hit as risk-off sentiment combined with big index ETFs do not spare one. However, Trump’s tweet “When the time is right, we will make a deal with China” was enough to drive modest recovery of risky assets as analysts expect Mr. Trump and his game theory politics could reverse once again for his great “victory”.

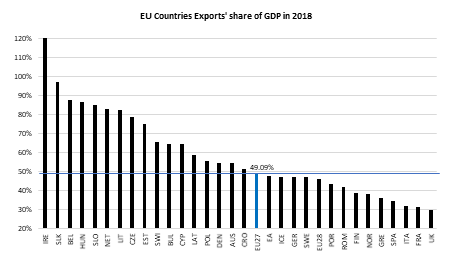

By Saturday, May 18th, Mr Trump has to decide on tariffs on EU motor vehicles and then the tariffs could be implemented in 15 days or in 180 days in case of further talks with EU officials so it is interesting to look at EU countries, especially CEE and which countries could suffer the most. On the chart submitted below you could see exports’ share of GDP among EU countries. First of all, one should bear in mind that EU as a whole runs CA surpluses and that exports made 49% of total GDP in 2018. Looking at the CEE one could see that Hungary, Slovenia and Czech Republic have their exports contributing by 80% to overall GDP. Furthermore, Bulgaria, Poland and Croatia are all above 50%. Although Czech Republic and Hungary are major exporters of parts for motor vehicles, all countries mentioned have their stake in the vehicle supply chain as well. Hence, without going into deeper analysis and breakdown of export countries, tariffs on EU goods and especially motor vehicles could weigh significantly on small and opened economies as CEE countries are. EM currencies such as PLN, CZK and HUF already depreciated versus euro in the last few weeks, but it seems there could be more in front of us in case USA decides to derail global trade further as it did last year.

Source: Eurostat, InterCapital