So far, Mario Draghi has been the central banker Mr. Trump would love to have on his team – coming from a big Wall Street investment bank, he managed to push rates deeply into negative, weaken the EUR versus most other currencies (excellent news for exporters), and voice support for more stimulus. However, opposition to unconventional monetary measures has been growing in Frankfurt. Will the ECB’s Governing Council allow Mr. Draghi to say his farewells with a proper monetary bazooka? Find out in this short article.

The big day has finally arrived… at least the first of the big days when central banks start to deliver on accommodative monetary policy. A lot is expected from today’s ECB’s Governing Council monetary policy meeting (rates decision @ 13.45 CET, speech @ 14.30 CET), although expectations have been trimmed in recent weeks on the back of some national central banks switching from dovish camp into neutral, as well as Christine Lagarde’s ambiguous comments about unconventional monetary policy instruments.

So what is expected of today’s meeting? The latest Bloomberg survey states that the market expects a 10bps deposit facility rate cut with no tiering, strengthening of forward guidance and a rekindled QE of about 30b EUR per month for a total of twelve months. It’s worth mentioning that since the survey was conducted, the market did trim its expectations – this morning expectations were closer to about 30b EUR for nine months. These expectations were framed by Draghi’s speech in Sintra, augmented by structurally weak economic data coming from Europe, and then blurred a bit by hawkish comments coming from heads of central banks in core euro area countries. Nevertheless, the hawkish members of the GC seem to be in minority – there are only four heads of national central banks (Weidmann, Knot, Holzmann and Müller) that voiced their opposition to new asset purchase, although they are also supported by two executive board members (Lautenschläger and Mersch). It’s worth mentioning that recent headlines mentioned ideas about the introduction of deficit spending in the core countries (namely Germany), but most of these speculations were subsequently dropped due to hard spending limits. In other words, in the absence of fiscal stimulus, the head of the ECB would have a powerful argument to deliver a somewhat stronger version of accommodative monetary policy.

What would that mean, exactly? One of the areas where ECB can act in order to create environment for a sustained support for inflation is forward guidance. Quite recently the ECB applied calendar guidance for possible lifting rates, stating that the rates wouldn’t be lifted before at least middle of 2020. Mr. Draghi could change that and say, for instance, that rates would rise if inflation expectations come closer to ECB’s long-term inflation rate. Since 5Y inflation break-even currently stands at 1.21%, we’re quite far from that fateful day when rates actually do start to rise. Additionally, dovish forward guidance would be acceptable for Ms. Lagarde (who takes office on November 1st) since she didn’t express any reservations regarding conventional monetary measures, deposit facility being one of them. Also, the ECB could lower the deposit facility by 20bps or more, include tiering, or simply expand the asset purchase package above what the markets are betting on.

One thing the bond traders are wrapping their heads around is – are we looking at the end of a short, but sweet bull market on bonds? Historically, yields have started to rise about at the same time when QE was initiated. As a matter of fact, back in March 2015 when ECB’s QE1 started, a bear market followed suit and Bund yields increased from 0.05% to about 1.00% in a matter of weeks. Could this happen again? The most notorious words on the debt market are “this time is different”, nevertheless this QE looks different from the last one. Back then, the markets were thinking that asset purchase is only temporary and once the inflation expectations recuperate, it’s all going to come back to normal. Well, four years later we all understand this is not going to happen any time soon and that ECB is stuck with that 2.6 trillion EUR of assets it purchased, with little intention/opportunity to start unwinding the book. In this sense of the word, this time really is different. Nevertheless, some bond selling will certainly come from short term speculators once the blueprint of accommodative monetary policy becomes clear, but it would probably not resemble the bond sell off in spring of 2015.

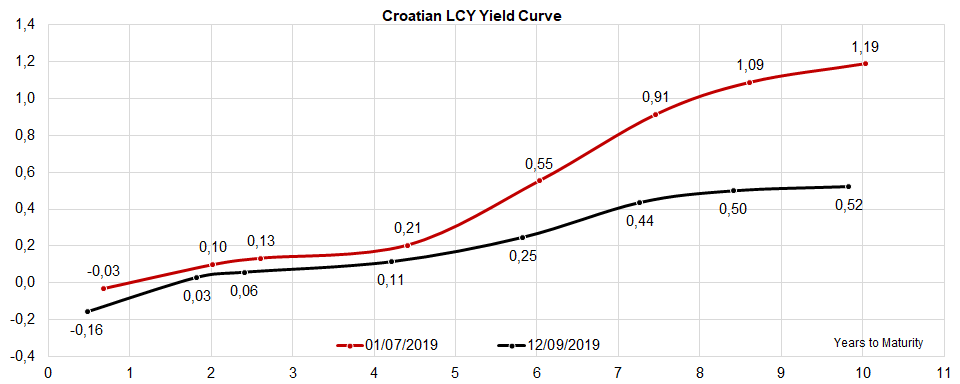

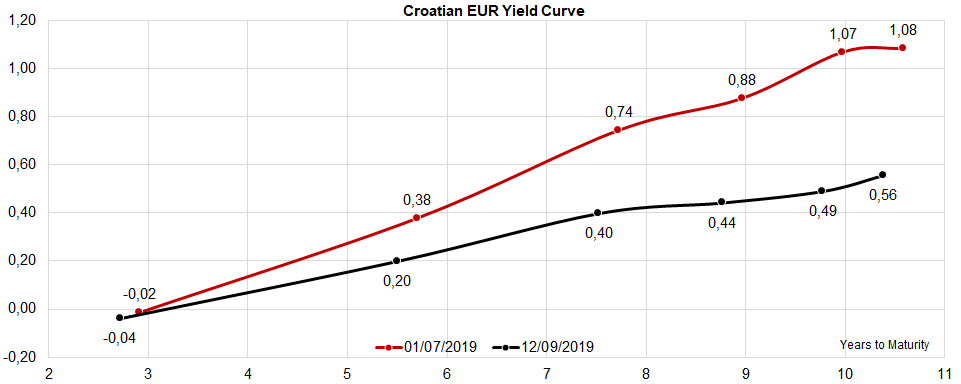

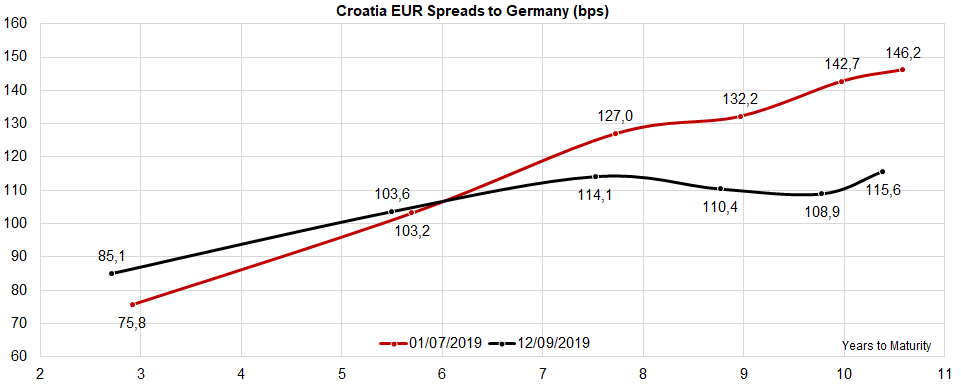

What’s going on with Croatian bonds? The risk premiums on longer part of the EUR-denominated Eurobond curve have tightened compared to beginning of July as scarcity dominated the market. Prospective buyers are becoming skeptical about spreads in size of 108.9bps for CROATIA 2029 EUR, so the market is currently threading water. The local bonds appear to have reached their lows in terms of yields and as the end of the quarter nears, some sellers might come to the market in order to realize the gains penciled in since the bond auction in February (we’re talking about CROATE 2.375 07/09/2029). Looking at the yield curve and seeing that it could be traded at a YTM of 0.52%, these market participants are right to ask themselves how low can it go in terms of yield in the short run. However, with high liquidity surplus in the financial system, even the slightest yield rise would be merely temporary. With fiscal blueprint becoming better and better, ERM II accession, CA surplus recycling and inflation under control, it’s reasonable to assume that in the long run the longer part of the curve might have some more room for risk premium to tighten even further. Ceteris paribus, of course.