“The future’s in the air; I can feel it everywhere, blowing with the wind of change…” It seems that the same wind of change that steered the Fed into starting its cutting cycle with 50 bps has crossed the Atlantic and is now peddling front-loading cuts to the ECB. In this week’s research piece, we will review the data that has led the market to expect a cut from the ECB at their October meeting, along with some other global events that have shaped the week behind us. Let’s dive in!

Even though the median FOMC’s dot expects four cuts in total this year, meaning one more 50bps cut, or more realistic, two more 25bps cuts, the market is, at this point, pricing in 5 cuts in total till year-end. It has grasped the idea of front-loading cuts with glee, witnessed by the US stock market, which effortlessly cranked out a new all-time high last week. The pricing points to pure goldilocks, with the Fed pre-emptively cutting to preserve growth and stabilize the slackening labour market instead of having to dial back restriction frantically when genuine cracks emerge.

The wind of change has found its way into Europe, further bolstered by some downbeat data received in the previous week, and has piqued the market in front-loading, now pricing a cut from the ECB on October 17 with 87%, a near certainty. The anticipation has switched from cuts at so-called projection meetings that take place quarterly and when the ECB updates its economic projections to a cut at every meeting until the terminal rate is reached at 2% at the beginning of the summer, with a possibility of another corrective cut later in the year. The shift started Monday a week ago with HCOB PMIs. The eurozone Composite PM is now in contractionary territory, with an unexpected slowdown in the Services sector empowered by data from various sources signalling that wage growth is stabilizing. The growth scare hasn’t kicked in (yet), but the risk that inflation might not just reach the target but undershoot it is growing. Reporting of the September inflation numbers started on Friday and is set to continue today with Germany and Italy, finishing tomorrow with a mosaic eurozone CPI. The prints for Spain and France were preternaturally below expectations, with the French economy leaving the Olympics behind and now having an inflation rate of 1.2% YoY (HICP 1.5% YoY).

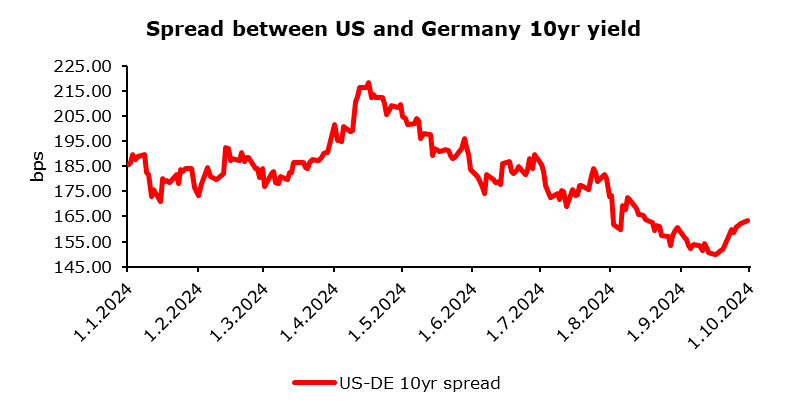

Also worth mentioning is China’s “whatever it takes” moment, with the People’s Bank of China cutting their medium-term lending rate by the single heftiest amount since they started prioritizing this monetary policy tool. Equities related to China have reaped the most significant share of the benefits, with commodity prices such as oil, copper, and iron ore also getting a boost. Yield curves were on the move, following the repricing of the speed with which the terminal rates will be reached, with 2-10s in the US and Germany back into a positive domain and at their steepest levels since June and November 2022, respectively. There was also an evident change in the trend in the US-DE 10-year spread. It is poised for further widening given the perfect pricing for US monetary policy changes, a beast called US public debt lurking and waiting to come back into focus with the elections untangling, and the lack of a significant growth scare in Europe meaning further scope for widening if the economy keeps printing lower and lower growth rates.

Source: Bloomberg, InterCapital Research