This very Saturday we’re going to exhibit the autumn equinox, one of only two days in a calendar year when the length of day and night are roughly equal, or balanced. This resembles the balanced sentiment of yesterday’s FOMC – if you just glanced at FED’s 2024 median dot (5.1%) and WIRP-implied SOFR rate for end-2024 (4.7%), then you noticed that they are more aligned than they were before. After the autumn equinox, nights get longer and days shorter. Which side is going to give in on rate expectations, FED or the markets – find out in this brief research piece.

To understand the overall sentiment of yesterday’s Summary of Economic Projections (SEP), let’s first take a brief look at how the economic forecast has changed. Notice that the unemployment rate forecasts came down a bit to 3.8% (2023) and 4.1% for both 2024 and 2025 (versus 4.1%, 4.5% and 4.5%, respectively). At the same time, the median 2024 dot moved from 4.625% to 5.1%, indicating merely two rate cuts next year presuming the FOMC delivers that ultimate rate hike in one of the remaining two meetings this year. If FOMC has a change of heart on December 13th, the median 2024 dot expects merely one rate cut next year. Now put this in relation to downbeat unemployment figures just to get the context right – rate cuts can happen even if the unemployment rate doesn’t rise as much as previously expected. So at least one hurdle towards the possible rate cuts next year has been removed and unemployment can remain depressed in months to come.

The largest revision in SEP was observable in real GDP growth, which was raised to 2.1% (2023), 1.5% (2024) and 1.8% (2025), from 1.0%, 1.1% and 1.8%, respectively. Core PCE was slightly revised downwards to 3.8% (2023), 2.6% (2024) and 2.3% (2025), from 3.9%, 2.6% and 2.2%, respectively. These figures are key to understanding the mechanics of that last rate hike that could be delivered on either November 1st or December 13th. First of all, take a look at this morning’s WIRP US function indicating the market sentiment that rate hikes might be over for now:

Source: Bloomberg, InterCapital

To understand the WIRP US function, pay attention to one detail in particular – that the ultimate rate hike that is visible in September 20th DOTS would put the target band at 5.50%-5.75%, while at the same time, there isn’t a single implied rate at WIRP US curve above 5.50% (current higher end of the target band). This is where the market disagrees with DOTS and here’s the kicker – FED expects this year’s core PCE at 3.7%, while the last print was 4.3%. It’s a long way from 4.3% to 3.7% and if core inflation overshoots, the case will grow stronger for FED to hike one last time. Recency bias aside, the recent 150k-strong UAW strike demanding a 36% pay rise across four years looks as if it could have the momentum to spur price growth outside the most volatile components (food and energy). Powell yesterday said that economic forecasters are a humble lot with a lot to be humble about, but still, FED fund rates would follow the path underpinned by forecasts.

OK, so markets and the FED disagree about the last hike in 2023, so what? If it does indeed happen, short-term rates might be more affected than longer ones because the market sentiment goes like this: if they deliver one more rate hike this year, they will probably have to deliver one more rate cut in 2024. This line of thinking is probably right, under the condition that the FED doesn’t amend its economic forecasts once again.

Source: Bloomberg, InterCapital

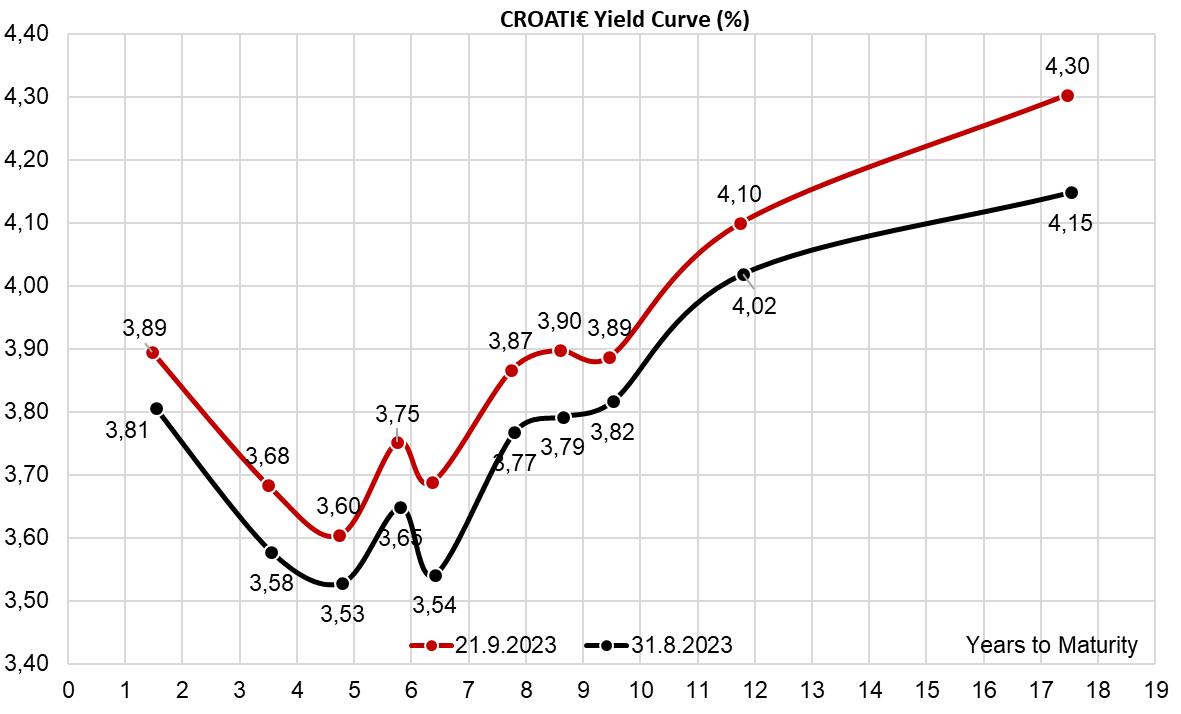

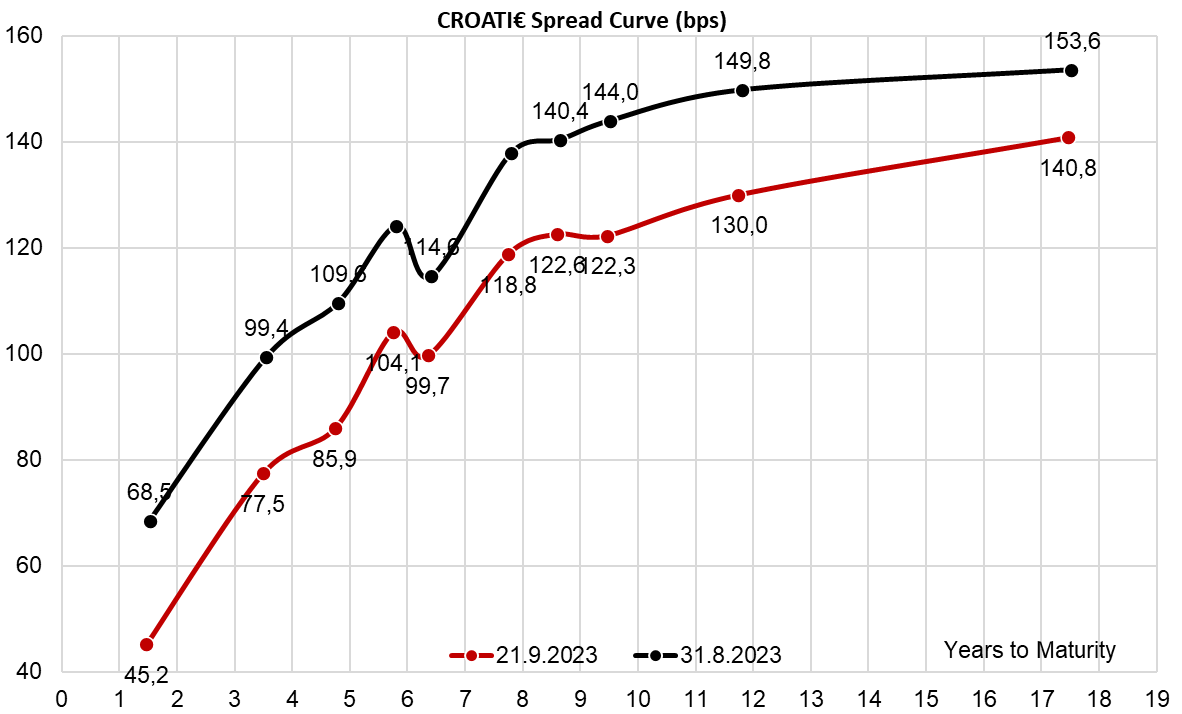

What about Croatian Eurobonds in this brave new world? Curiously, we still see buyers on the long end, evenly distributed across domestic and foreign clients. We were amazed by the fact that the spread between CROATI 4 06/14/2035€ and SPGB 1.85 07/30/2035€ touched 21.7bps, an all-time low.

Source: Bloomberg, InterCapital

Is a spread this tight justified? A few clients buying CROATI€ instead of SPGB€ articulated their appetite for Croatian paper by stating that after S&P raised Croatian outlook to positive, it’s basically a question of time before Croatia goes deeper into IG by next year. Apart from that, a Reuters briefing from the beginning of the week revealed that it’s possible for the ECB to start discussing active APP on the October 26th meeting. The narrative goes that this might cause SPGB€ G-spread to widen, but not the CROATI€ because the ECB holds no Croatian paper in its vast balance sheet. This explanation is vague because if you worked on a fixed income desk for longer than a year, then you are probably aware of the spillover effects; i.e. if the spreads on the periphery widen, institutions are more aligned with buying Spain and Italy than Croatia, so Croatian spreads would probably follow suit. On the other hand, if you read the S&P statement regarding Croatian credit rating, then yes – it’s quite likely that Croatia is going further into IG next year. Fingers crossed.

Source: Bloomberg, InterCapital