In this blog, we will focus on the valuation side of SBITOP and put the index in a wider perspective. We still find SBITOP to be a fairly solid long-term buy due to its current pricing at a P/E of 6.0x and relatively optimistic outlook, which we will explain in more detail.

In the recent blog, we looked at the market movement of regional and some global indices in the first 9 months of 2022 (you can read it here.) The data clearly showed that the last three quarters were quarters of stagnation and decline due to the negative sentiment in the market, which is expected to continue. Today, we decided to look at the valuation of SBITOP and put it in a wider perspective – comparing it to the S&P500 and looking at the historical relative ratio between indices.

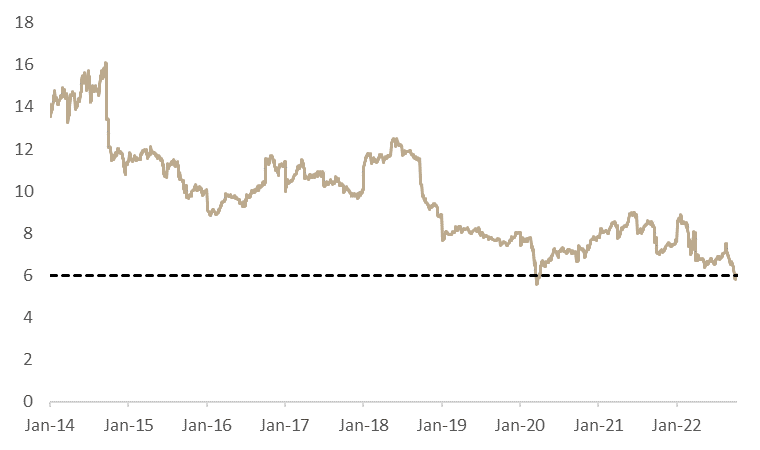

First of all, one can notice the current SBITOP P/E multiple is substantially lower than its 8-year average of 9.7x, which we in find relatively attractive overall. Also, nothing unsurprising, the big recent decrease in multiple was recorded on a YTD level, with P/E decreasing all the way from 7.6x at the beginning of 2022 to the current 6.0x P/E.

SBITOP’s P/E [2014 – Jan 2022]

Source: Bloomberg, InterCapital Research

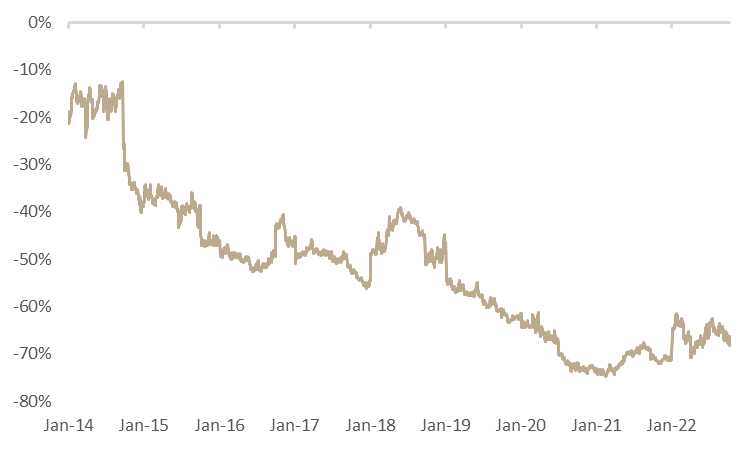

Looking at the US market, we can notice this market’s representative, S&P 500, is traded at a quite higher multiple than SBITOP. To put into comparison, Slovenia, which can be considered a pure value play, is traded at a significant discount to developed markets. SBITOP’s discount to developed markets still remains a large one. Taking into consideration that certain discount is reasonable (due to the regional specificities), we still find the valuation gap relatively wide.

SBITOP trading at a deep discount compared to developed markets – P/E gap [2014 – Oct 2022]

Source: Bloomberg, InterCapital Research

Light at the distant end of the tunnel

As we are all aware, we have a looming macroeconomic situation pointing into a recession, rising interest rates from both Fed and ECB, a still-present semiconductor shortage and war in Ukraine. But here, we’d like to emphasize the rising interest rates. What’s the industry that long-term benefits mostly from the rising interest rates and generally high-interest rates environment? Exactly, financials.

SBITOP composition

SBITOP currently has 35% of its weight in the financials, which is composed of NLB, Triglav and Sava Re. We previously mentioned the decrease in SBITOP’s P/E from 7.6x to 6x happened in 2022. Naturally, the decline in multiple was partially driven by financials. On a YTD level, financials took a pretty solid hit. The main reason for this is that higher interest rates drag the valuation of financial companies significantly. When the rates rise, naturally the outflow from equity happens and consequently, financials suffer just like the whole equity as an asset class.

Regarding price decline, as a cherry on top – insurance valuation (Triglav and Sava Re) was also affected indirectly by rising interest rates (also a short-term effect). Due to the nature of their operations, insurances hold a lot of financial assets and some of them are classified as „Available for sale“. The change in the price of such instruments is recorded directly in equity (through comprehensive income), not through P&L. As a result of mentioned rising interest rates environment, equity and consequently, valuation, of the mentioned insurance companies directly took a hit.

Nevertheless, what are we trying to emphasize is – expectations. Financials (both banks and insurance companies) perform relatively better in higher interest rates, as banks can achieve higher Net Interest margins, while insurance can achieve higher future portfolio returns on their investments as current interest rates are higher. So, 35% of SBITOP’s weight in financials might have a relatively better performance over time on the market.