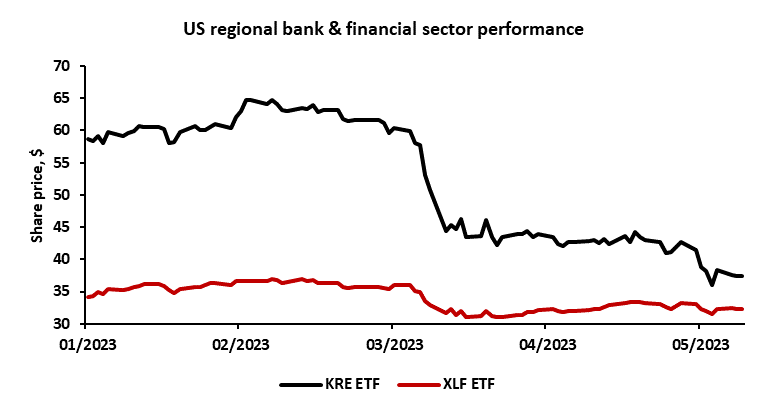

Banks have had a tough last week as First Republic did not manage to survive the tightening cycle. As a result of the collapse and sale of First Republic to JP Morgan, other banks weren’t immune to the market reaction. PacWest, Zions Bancorp, and Western Alliance were the most negatively impacted banks resulting in huge losses of market capitalization. How to stop further fallout and occasional panic with anti-inflationary monetary policy in place is the million-dollar question. The self-fulfilling prophecy of market losses fueling deposit outflows seems to be the story of 2023.

Renewed stress in the financial system spurred interest in additional policy support for banks. The issues and obstacles are still unchanged as they were two months ago when the failure of Silicon Valley Bank and Signature Bank put them in focus. The main issue is deposit insurance which still lies at the $250k limit approved by FDIC. After the fall of SVB, the systemic risk exception has been reintroduced to cover all deposits. Moreover, the deposit insurance limit managed by FDIC can only be raised with the approval of Congress which is currently focused on the expansion of the debt ceiling. If more banks that are considered systemic fail, insuring all deposits needs to be reconsidered to prevent malicious effects of the state intervention and bring back market competition.

On May 3rd, Chairman Powell mentioned significant interest rate risk at SVB which he labeled „alarming” leading to significant safety breaches. As a result of poor financial regulation, banks managed to build unhealthy portfolios which weren’t valued at mark-to-market value. Consequently, those issues led to the failure and sale of both SVB and FRD to other banks. He pointed out that the consolidation of the banking system has been a factor for more than 30 years and this crisis might create even bigger megabanks (First Republic sold to JPM, SVB sold to First Citizens). Both deals were done with FDIC running the closure and sale of the closed bank. Fifteen years after the fall of Washington Mutual, the reaction to the collapse seems to be changeless. Back in 2008, Washington Mutual was acquired by JPM after the bank run which resulted in a bank crash. Furthermore, it should be kept in mind that the regulators might reintroduce restrictions on short-selling bank shares similar to 2008 to prevent the self-fulfilling prophecy mentioned before. However, those policy measures have both positive and negative consequences and haven’t been mentioned yet, but they might be considered again in the near term as parallels to 2008 are drawn. Back then, the restrictions on the short sale of stocks covered almost 1000 financial institutions.

In comparison with 2008, it seems that the banking issues are resolved in the same way which might lead to further consolidation of the banking system with stricter regulation in the future. On the one hand, the main issue to point out is the need for smaller banks to raise their deposit rates to attract deposits which raises their funding cost. On the other hand, megabanks do not need to raise deposit rates as they are considered to be safe in times of crisis. Higher funding costs for smaller banks complicate the situation for smaller banks and mega banks do not need to do that as their deposit inflow is supported by the instability of the system. To conclude, interest rate hikes help big banks to acquire new deposits without the need of raising deposit rates which boosts their profitability and further consolidates the financial industry.

Source: Bloomberg, InterCapital