A spectre is hunting the world – a spectre of reflation. This increased long term nominal yields, but it has also opened up some interesting opportunities on long term bond futures and their derivatives. Also, it has changed our valuation of new Croatian eurobond. What can we expect down the road and how do you hedge against further losses, find out in this brief research piece.

Global fixed income instruments have been fighting for air lately as reflation becomes the word of the day. First of all – what happened? Long term yields have been steadily rising since late summer last year, but the rise in nominal yields gained momentum about ten days ago when US Treasury Department Chief Janet Yellen said on G7 ministerial conference that US might return to full employment as soon as next year. A bold statement came on top of her sentence that it’s time to go big on fiscal spending in order to reduce the output gap, which was actually a signal to US congressmen to hurry up Biden’s 1.9 trillion USD spending plan. The size is actually estimated to be 2-3 times the output gap and it’s reasonable to ask is it possible that this might push the nominal GDP above the potential GDP threshold, a move that would stoke inflation. Macroeconomic minds differ on this one, with IMF chief economist Gita Gopinath claiming that the odds of that happening are quite low due to decades of globalization, capacity buildup and automatization. Needless to say that US was close to full employment back in 2019 and inflation was nowhere to be seen. However, the markets think this time it’s different.

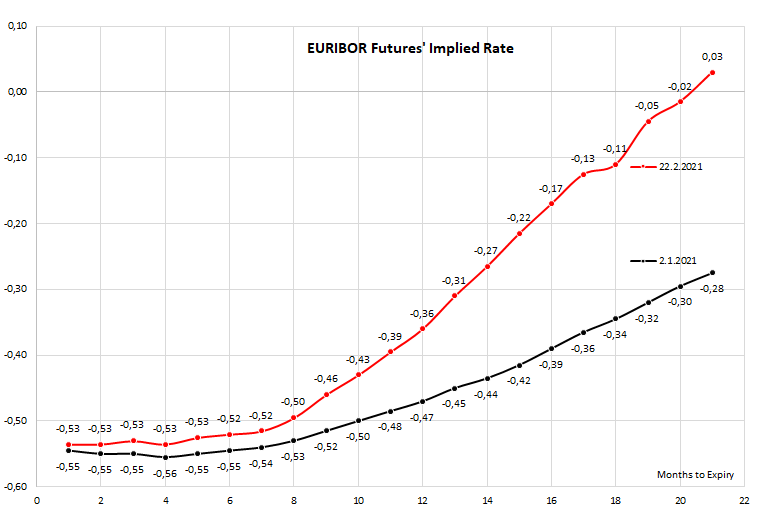

By looking at the chart above (EURIBOR futures curve), it’s easy to spot the nexus between higher inflation expectations and higher yields. The markets are betting on inflation getting out of hand and central banks feeling compelled to lift interest rates in a manner of Paul Volcker back in the 1970s. This is way longer part of the EURIBOR futures curve went up and naturally, long term yields have kept up with the Joneses. It’s worth remembering that both the FED and ECB have been preparing the institutional framework to free their hands if they become victims of temporary inflation shocks. In August 2020 FED Chairman Jerome Powell called the new framework „flexible form of average inflation targeting“ (FAIT) – in a nutshell, it means that the FOMC is no longer worried just about inflation overshooting the target, but also about inflation staying below 2.0% for an extended period of time. The FED might turn a deaf ear to brief inflation overshoots since they only make up for a decade of low inflation and low growth. This means that when Jerome Powell says that the financial conditions would remain accommodative and supportive for extended period of time and that the FOMC is still not considering lifting rates or rolling back asset purchase, he really means it.

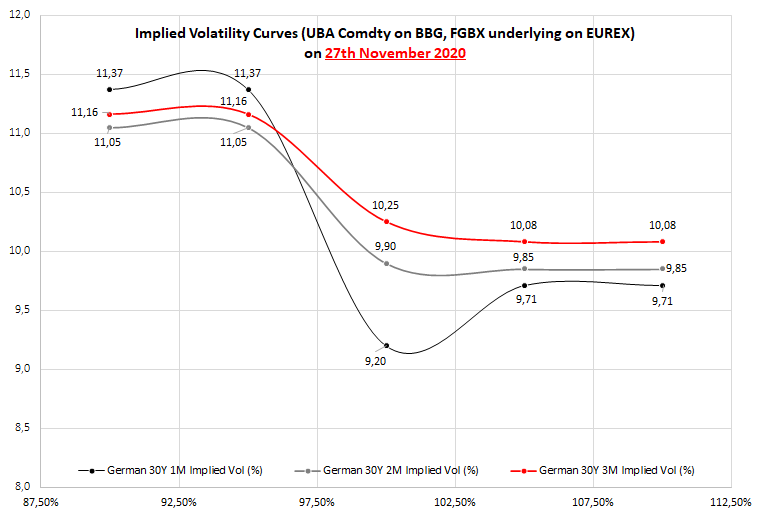

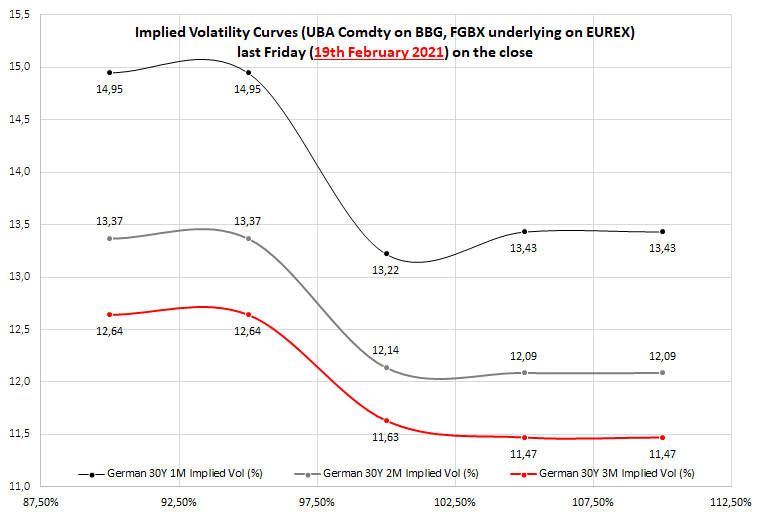

But it’s completely another thing weather financial markets trust him or not. So what do you do in times like these if you have long bonds on your portfolio? From our understanding, the bid-ask spread on long (30Y+) periphery bonds has widened considerably and selling Portugal, Spain or Italy might incurr additional cost. One way to tackle recent bond sell off is simply to hedge your position with BUXL options (UBA Comdty on BBG, FGBX on EUREX). Here’s a curious thig we have seen this morning: the difference between 1 month and 3 month ATM BUXL put implied volatility is at 1.59 (13.22 – 11.63 = 1.59), which is the highest value at least since January 2020 (average 1M-3M put implied volatility was -0.14, so 1.59 represents 3.8 standard deviations from the mean). The curve is obviously in backwardation and that might be an opportunity to create lucrative calendar spreads. To translate that into prices: UBH1 03/26/21 P206.00 can be sold at 3.08 and UBH1 05/21/21 P206.00 can be bought for 4.70, netting a total cost of 1.62 for the overall strategy. This is just for indication purpose and please bear in mind that calendar spread would not protect from further UBA Comdty downside if your strategy is delta positive. What we wanted to underline here is that BUXL backwardation between front months and 3rd month is the highest in a year, meaning that you can cheapen your hedge by selling some short dated BUXL puts.

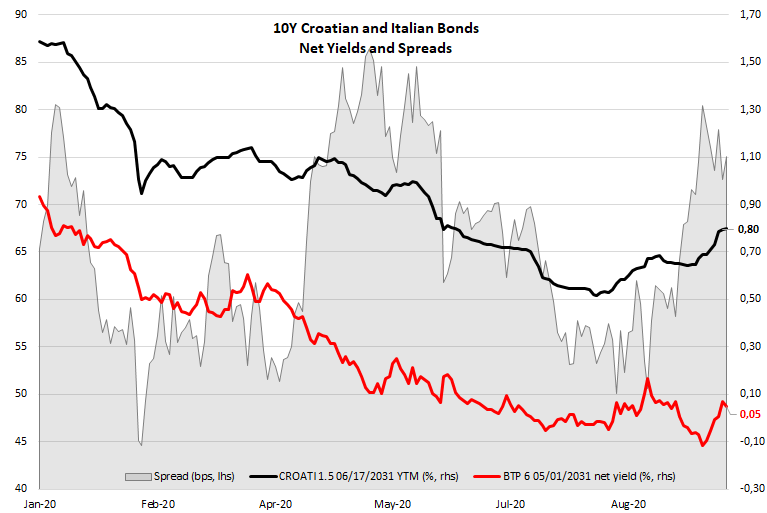

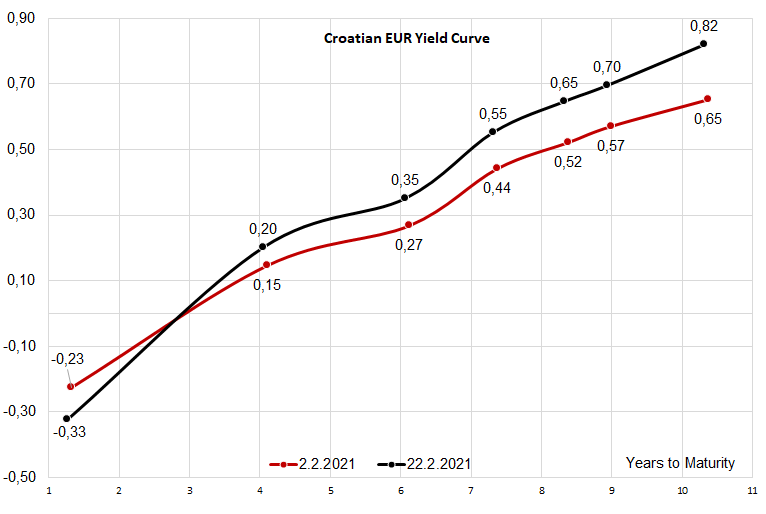

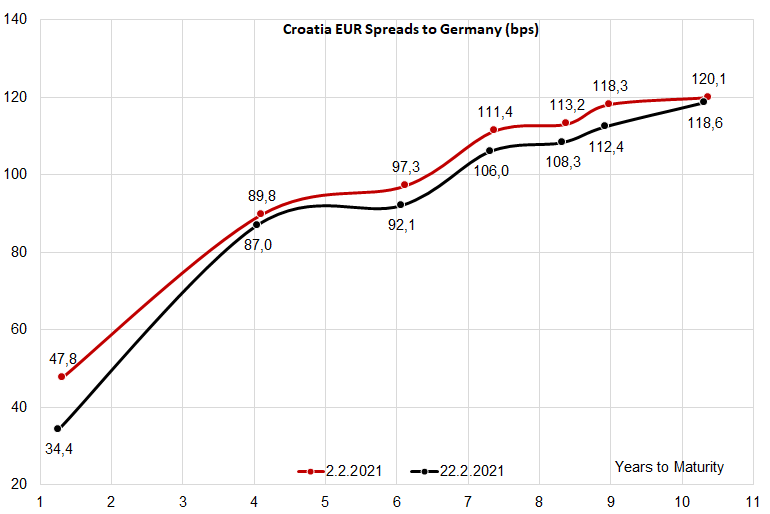

What about Croatian eurobonds? The sell off has been abrupt and intense so some scars are clearly visible. So far we haven’t seen much sellers, possibly because a lot of domestic institutional sellers might be underinvested in the anticipation of new Croatian eurobond. However, by looking at the long end (CROATI 1.5 06/17/2031) we can easily spot the 17bps rise in yield between beginning February and now. Rising yield curve means that the new paper might come at a lower reoffer price, but that doesn’t mean much for UCITS funds loaded with long term CROATIs and ROMANIs – they are in red already and might be inclined to sell if faced with liquidity outflows. The spread hasn’t widened at all – in fact, it even tightened on the longer end, but should the sell off gain foothold, it’s quite likely the spreads would widen.

Related to the new Croatian eurobond which is expected to print in the near future, all of the time we have used REPHUN 1.75 06/05/2035 as a canary in a coal mine for pricing of new CROATI and currently the live bid on this one corresponds to a 1.11% YTM. For the CROATI 14Y duration this might be the yield that investors would receive if they decide to enter the new paper.

Finally, here’s something worth thinking about once you take your eyes off the screen and consider long term trends. Croatian Eurobonds are still relatively cheap compared to Italian bonds (BTPs). We have compared CROATI 1.5 06/17/2031 YTM versus a net yield to maturity on BTP 6 05/01/2031 and found out Croatia still gives some 75bps of extra annualized return compared to Italy. But first, what is a net yield? In Italy there is an interest rate tax in size of 12.5% that reduces your coupon income and with it realized yield to maturity. Subtracting the effect of interest rate tax we get to Italian net yield – this is what your portfolio actually receives once you pay all the taxes. If you have Bloomberg at hand, you can see that BTPS 6 05/01/2031 is currently traded at 152.65–152.75 clean price (0.648%-0.641%) and the YTM’s in parenthesis are used to calculate the notorious lo spread that is carefully monitored by Italian business newspaper. The calculation of lo spread is simply wrong and you should look at the net yield instead, which is far from 0.65% on the screen. If you run YAS function on Bloomberg and plug in 152.65 as clean price, you can easily see that net yield is somewhere around 0.055% (red letters on the chart below). We have calculated historic values of this net yield and calculated the corresponding spread to net yield, which is the grey area on the last chart. The spread was as tight as 45bps before the pandemic and with all good things in store for Croatia, we think it might tighten even blow 45bps as the good times roll (euro area membership, EU recovery fund, relatively low public debt compared against EA periphery peers etc.).