In today’s blog, we decided to review last week’s development in Croatia. The government’s introduction of the sixth package of measures demonstrates a proactive approach to tackling economic challenges, while the decision to keep electricity and gas prices steady aims to support final consumers. Additionally, last week should’ve also been marked by an update in Croatia’s credit rating & Outlook by S&P Global Ratings – however, the rating update was skipped (not an unusual thing). However, below you can see how the market reacted. We expected S&P to improve Croatia’s credit rating. Finally, last Friday, the President of Croatia announced the new elections for the Croatian Parliament will be held on 17 April 2024.

Croatian government adopted the sixth package of measures to protect households and the economy from rising prices, with a total value of EUR 503m, which ensures the continued stability of electricity and gas prices, aiming to help socially vulnerable citizens. The main goal of said package is to keep low energy prices and, consequently, contribute to lower CPI growth. To put things into perspective, looking at Croatia’s latest available CPI data, prices increased 0.2% MoM, mainly driven by Energy MoM increase of 1.5%. Besides Energy, Services is the only category to note 0.5% MoM increase, while Food, beverages & tobacco noted a decrease on a monthly basis.

Croatian CPI YoY growth (February 2013 – February 2024, %)

Source: Croatian Bureau of Statistics, InterCapital Research

The temporary measure of limiting electricity prices is being extended until 30 September 2024 with the unchanged price. Further, as a part of the package, the Government also reimbursed part of the cost of diesel fuel, if used in commercial transport. Finally, the price of gas does not change either.

EU CPI Electricity

Source: Bloomberg, InterCapital Research

Apart from the mentioned package interfering with the market prices, the government will make a one-time payment, affecting c. 830k pensioners.

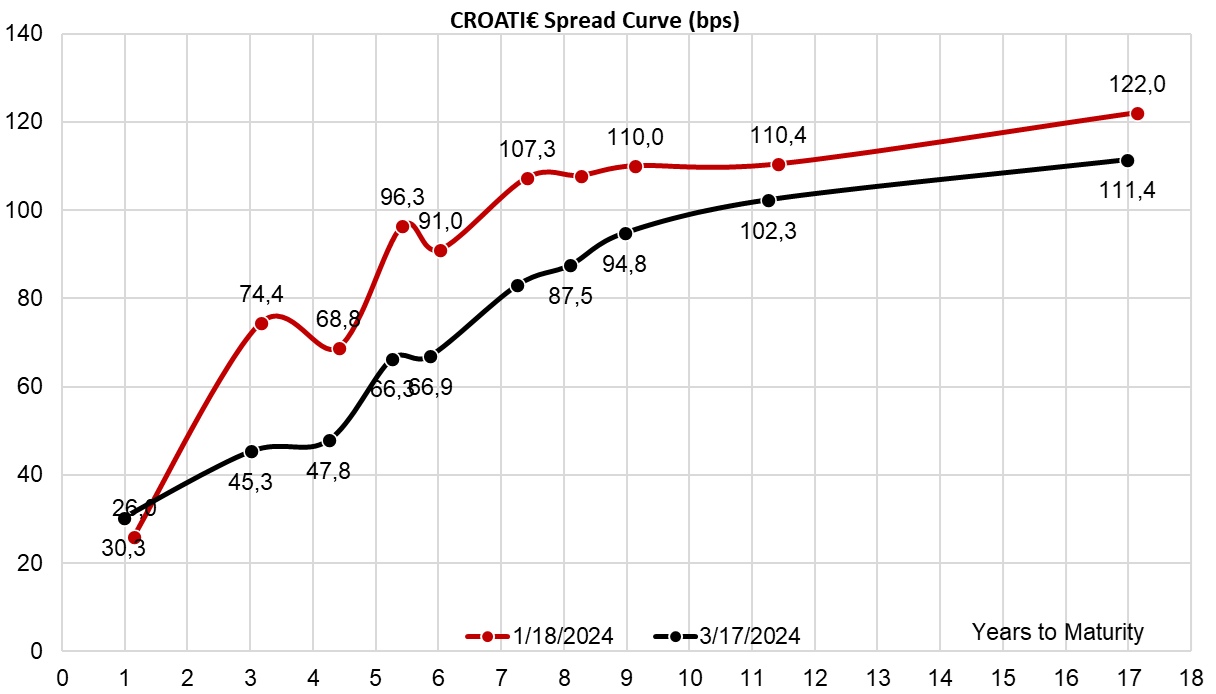

Besides the government’s efforts to ease inflation, last week was supposed to be marked by the S&P Global Rating updating Croatia’s credit rating. However, the rating agency skipped the revision – and we note that this is not an unusual thing in the region. We expected the rating agency to raise Croatia’s credit rating. InterCapital’s assumption was mainly based on a positive impact from 2023 & 2024 expected GDP growth of 2.6% (published by the European Commission) as well as the positive development of Croatian public debt. At the end of 2023, public debt stood at 64% of GDP, while the rating agency expects it to amount to 60% of GDP by 2026. Nevertheless, how did the market anticipate/react? Again, nothing unusual. Spreads in Croatia have narrowed on a YTD basis, which is not unusual because we see a similar trend in, for example, Italian bonds. The Italian spread is trading at only 125bps and has narrowed by as much as 42bps since the beginning of the year.

Source: Bloomberg, InterCapital Research

Finally, last Friday, the President of Croatia announced the new elections for the Croatian Parliament will be held on 17 April 2024. According to the media pole, the party currently in power might win the elections. However, we emphasize that the outcome is unpredictable with still a month left until the said date.