With all Romanian companies publishing their Q1 2021 results, we decided to bring you a short overview of their performance.

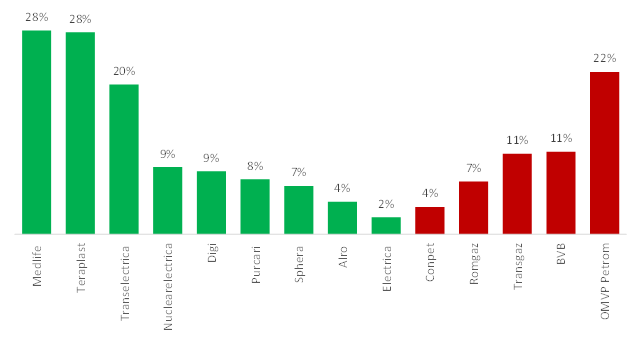

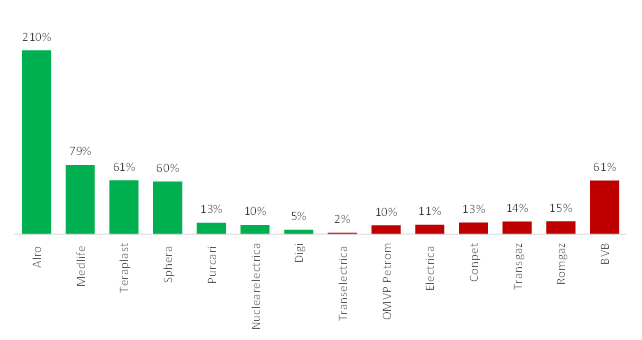

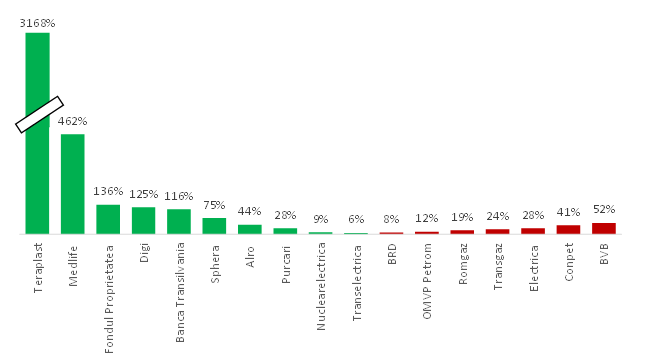

Among all BET components, Medlife posted the strongest Q1 sales increase. Namely, the company’s sales were up 27.9% YoY on the back of significant growth in all business lines, except pharmacies, and due to acquisitions completed by the group so far this year. With OPEX up only 15.6% YoY, EBITDA jumped 79% YoY. As a result, net profit soared and was up by 462% YoY to RON 36m.

BET Components YoY Change in Sales

Teraplast followed in second with sales up by 27.6% YoY. Meanwhile their EBITDA soared 61% on the back of higher sales coupled with operational efficiency based on economies of scale. However, while the improved top line and EBITDA did certainly have a positive impact on the bottom line, the main contributor to the high YoY increase was the profit from the sale of the company’s steel products division worth RON 373m. Note that the results do not account for Somplast, TeraPlast’s latest acquisition, since the approval of the competition council was received in the Q2 2021.

Transelectrica’s sales were up by 20% YoY mainly due to higher electricity quantities delivered to consumers, by indexed average transmission tariff and higher balancing market revenues. However, OPEX followed thus dragging EBITDA down by 1.7% YoY. Meanwhile net profit was up 6.2% on the back of lower D&A costs and an improved net financial result.

The Bucharest Stock Exchange posted lower results on all lines as trading in Q1 2021 was lower than in Q1 2020 when panic selling occurred due to the outbreak of the COVID-19 pandemic.

Transgaz posted an 11% YoY decrease in sales as higher commodity revenue was somewhat offset by lower commodity transmission tariffs. Furthermore, the company recorded a 65% YoY decrease in revenue from the international transmission activity. Lower sales transferred down the P&L resulting in a 14% YoY decrease in EBITDA and a 24% YoY decrease in net profit.

Sphera was able to increase their sales by 6.6% YoY despite the ongoing restrictions caused by the COVID-19 pandemic. With restaurant expenses kept in check, mostly due to lower payroll expenses due to state aid received from governments and lower FTE, coupled with lower advertising costs, EBTIDA soared 60% YoY. Meanwhile the bottom line remained negative, but the loss was significantly lowered to RON -3.1m (from RON -12.3m).

BET Components YoY Change in EBITDA

Romgaz’s revenue fell due to a decrease of sales in natural gas by 4.8% YoY, while revenues from underground gas storage operations shrank by 28% YoY. Also, revenue from electricity sales fell by 20% YoY. EBITDA fell 15% YoY due to rising cost of commodities sold as well as changes in inventory of finished goods and work in progress.

Nuclearelectrica’s sales were up by 9.2% YoY, mostly due to a 13.5% rise of the weighted average price of the electricity sold in the period. This translated to a 10.4% YoY increase in EBITDA. Below the operating line, the company’s net financial results deteriorated to RON -0.4m from RON 16.9m in Q1 2020. However, despite this, the bottom line went up by 9% YoY to RON 234.5m.

OMV Petom’s sales fell by 20% YoY due to lower sales volumes of natural gas, petroleum products and electricity, as well as lower prices for natural gas, partially offset by higher prices for electricity. This in turn drove both remaining lines downwards as well.

Digi’s Q1 sales rose due to an increase in in sales in Romania and Spain. In Romania, growth was mainly the result of the increase of cable TV and fixed internet and data RGUs in the period, due to organic growth, as well as the entering into force of the Networking agreement between RCS & RDS and Digital Cable Systems, AKTA Telecom, respectively ATTP Telecommunicatios in 2020. The increase in Spain was due to an increase in mobile telecommunication services RGUs. Higher sales translate down do a higher EBITDA, but the surge in net profit which more than doubled in Q1 2021 was due to an improved net financial result (EUR -25.9m Vs. EUR -98.1m). The improvement was due to an absence of strong negative FX movement as seen in Q1 2020.

Alro’ sales edged up 4% due to an increase in amount of goods sold, coupled with an increase in aluminium price. However, this was partially offset by an unfavourable exchange rate, in spite of an international economic environment still fighting the coronavirus pandemic. EBITDA turned positive, amounting to RON 33.5m from RON -30.6m, primarily due to the decrease in the purchase prices of raw materials and utilities. However, this still wasn’t enough for the company to record a net profit, but only to decrease the net loss by 44% YoY.

BET Components YoY Change in Net profit

When observing the net profit of Romanian banks one can notice a mixed performance with Banca Transilvania doubling their net profit, while BRD Bank saw an 8% YoY decrease in net profit.

Fondul Proprietatea managed to post a net profit of RON 701.4m, which marks a considerable improvement from a loss of nearly RON 2bn witnessed in Q1 of last year. This is of course due to the recovery of the financial markets which saw a strong decline last year amid the outbreak of the COVID-19 pandemic.