West Intermediate prices have been falling rapidly since the end of September. Prices reached a high of 95$ per barrel on the 28th of September and fell to 72$ as the demand concerns are growing both in Europe and across the Atlantic. However, the boost for prices coming from the supply side is restricted as recent OPEC+ cuts haven’t made any impact on rising prices.

The oil market has been very strong in the third quarter of the year as the concerns over supply deficit drove markets higher and the US economy seemed solid and well protected against recession. At the start of the fourth quarter, oil prices have been falling even as the escalation in Israel has been brought to attention and Iran threatened to be involved in the war. Also, at that time Energy Information Administration released a report showing that the oil demand was exaggerated, thus leading to further downward pressure on oil prices. The labor market is less tight than previously thought according to recent Nonfarm Payrolls and JOLTS data.

On the 30th of November, OPEC+ announced additional cuts totaling 2.2 million barrels per day for the first quarter of 2024. Most of the market had already expected the rollover of the Saudi and Russian cuts. Therefore market reaction after the meeting was to the downside as they did not deliver surprises. In the future, further cuts are probably not on the table as most current cuts are voluntary and it seems that the cohesion of the OPEC countries is not at the highest level right now. They are currently open to extending cuts into 2024, however, the price paid for the cuts is high as the economy of Saudi Arabia is highly dependent on oil production. Furthermore, the loss of the OPEC market share reduces their overall global political power as the US is raising production. They did not manage to raise prices and do not have many more options on the table to further reduce supply. The upside to the oil prices is losing ground, therefore leaving more territory to more downside pressure as the economy is slowing down due to the restrictive monetary policy and rising oil inventory levels.

The upside to the price might be due to the potential escalation of the Guyana-Venezuela conflict which might prop up oil prices back as there is high exposure of Exxon and Hess in the offshore oil production and worsening of the diplomatic relations between the US and Venezuela which raised hopes of Venezuela coming back to the oil market. Huge repricing on the bond market due to falling inflation and worsening economic outlook did not impact oil markets, however, correlation has probably worked the other way around (lower oil prices lead to lower inflation, thus leading to lower bond yields).

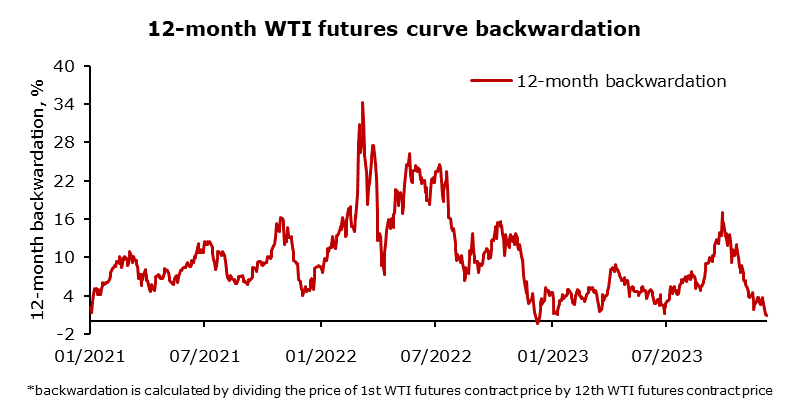

Futures spread on the oil market remain weak. Backwardation has weakened heavily over the past two months as the front end of the curve even transformed into contango until May 2024. Backwardation is calculated by dividing the WTI price in the first and the twelfth-month futures contract and currently amounts to 1%. On the 28th of September, 1-year backwardation was around 17% and sharply reduced to 1% in a matter of two months. This is a significant bearish signal for future oil prices as supply disruption and deficit concerns weaken. However, crack spreads are behaving differently and rising over the past two months after plummeting in September. Crack spreads may stabilize, however, the divergence between oil prices and crack spreads may indicate at least a small recovery in oil prices.

The oil market is navigating a complex landscape, witnessing a rapid decline in prices due to escalating concerns over demand and limited impact from recent OPEC+ cuts. Supply-side pressures haven’t compensated for the downturn, with geopolitical tensions failing to significantly buoy prices. Prospects suggest diminishing upside potential as economic slowdowns, restrictive monetary policies, and rising inventories converge to exert further downward pressure. However, potential geopolitical escalations, notably in the Guyana-Venezuela conflict, could offer a reprieve. Yet, the weakening futures spread, particularly the sharp decline in backwardation, signifies a bearish sentiment for oil prices, despite crack spreads showing signs of a slight recovery.

Source: Bloomberg, InterCapital