The Croatian Ministry of Finance is ending another successful placement of retail fixed-income instrument and now it’s time to focus on institutional demand. Smart money likes duration these days since it minimizes the reinvestment risk in times when a global macro picture looks a bit gloomy. The orderbook for the new Croatian local 10Y will be open tomorrow morning. What can You expect? Read in this brief research piece.

It’s been a big week for Croatian public finances, at least from the funding perspective. Yesterday was the last day for submitting binding orders from retail investors for the inaugural retail treasury bill, 1Y duration at 3.74% YTM. Ministry of Finance planned to place a total of 440mm EUR, but the demand ended up at 985mm EUR and this is coming from households alone, not including institutional investors grouped under the sobriquet smart money. It’s very likely that an additional 100mm EUR would be scooped up by institutional investors (the results are still pending), putting the total notional amount to about 1.1bn EUR. So what are the implications of such a successful inaugural T-bill placement?

Well, first of all, the Ministry needs to place a smaller notional size of new local bond than initially thought. The orderbook for the new institutional bond (RHMF-O-33BA) opens tomorrow morning and we expect the placement size to reach 1bn EUR with a small chance of exceeding it. It seems that the supply would be met with quite a heavy demand from the institutional buy-side (pension funds and insurance), implying a very tight new issuance premium.

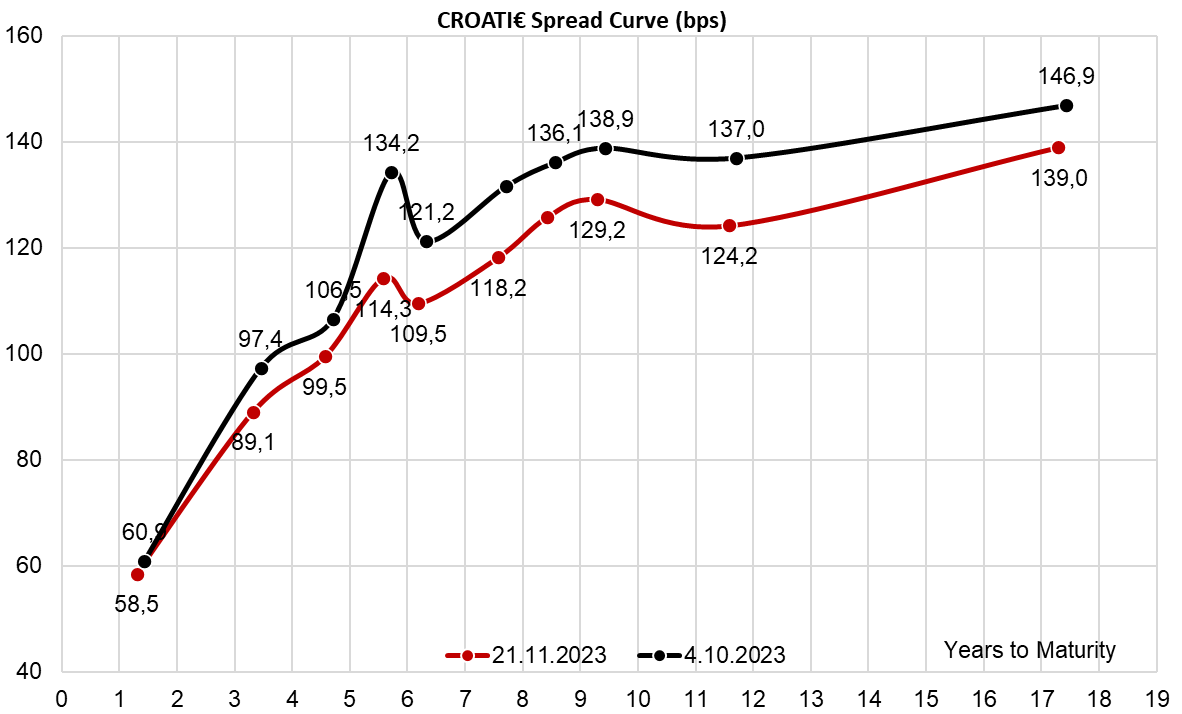

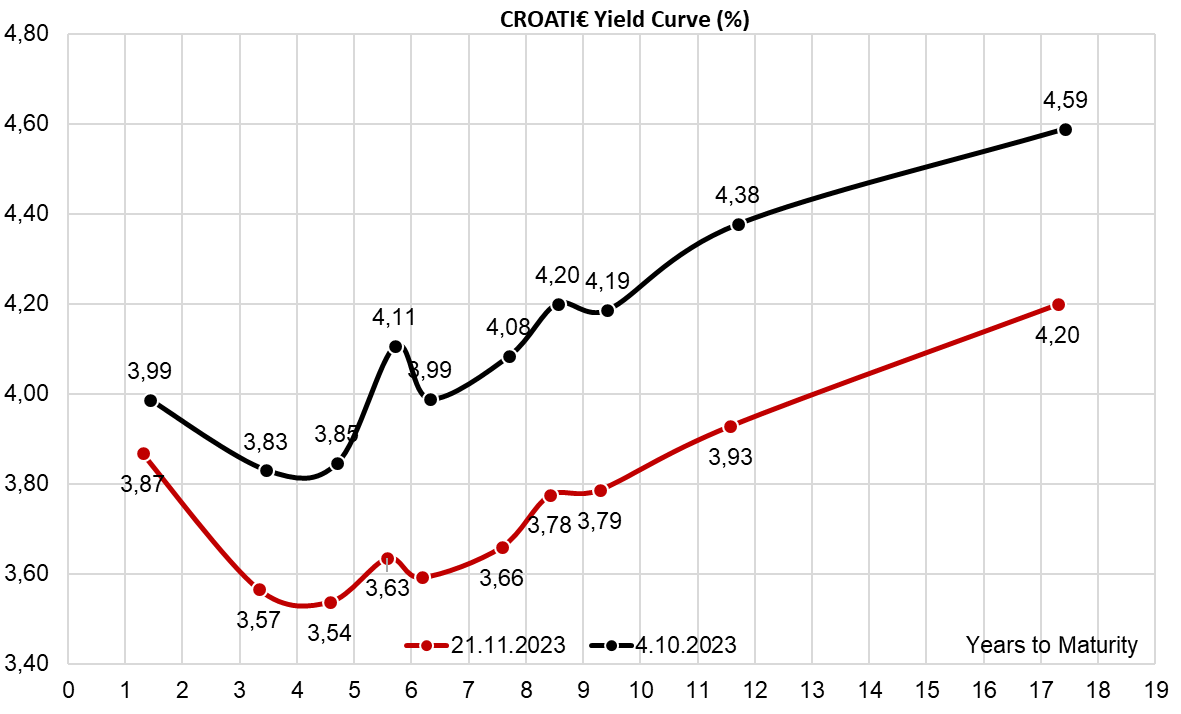

With this we have arrived at the only question worth answering – which yield can we expect on the brand new domestic 10Y? It’s contingent upon the international bond used as a benchmark. CROATI 1.125 03/04/2033€ should be a natural benchmark because of the closest duration, however, this paper is rather illiquid and from our understanding, a handful of dealers are running a short positions that need to be covered by year-end. That’s why this paper is traded relatively rich compared to the rest of the curve – BVAL bid of 79.05 implies a 3.85% YTM and DBR 2.6 08/15/2033€+126bps. Instead, we advise focusing on the most liquid international placement, that is CROATI 4 06/14/2035€. This paper has a BVAL bid of 100.26, 3.97% YTM and it’s DBR 0 05/15/2035€+129bps. It’s merely 3 basis points in the spread, but anybody who traded Croatian international bonds recently can confirm that CROATI 4 06/17/2035€ is much easier to find, trade and price. The 33s are liquid only if you are a seller.

Due to ample demand, we don’t expect much NIP to be plugged into the pricing, so we stick to the expected yield of 3.85%-3.95%, indicated by BVAL bids on the two international bonds we have mentioned. On the secondary market, we do expect additional buying interest to take shape because as the turn of the year gets closer additional buy-side investors might step in to get rid of excess liquidity. These buying interests are tough to settle on the international market because of a lack of supply, so the local market remains the point where supply would meet demand.