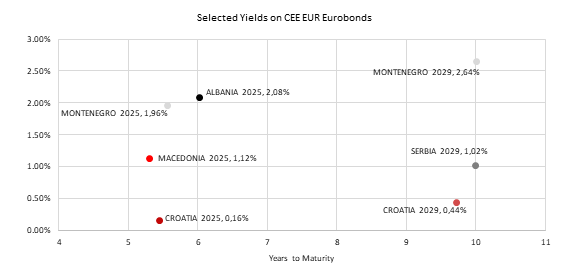

In this years’ yield hunt, we have witnessed some of the East European countries coming into focus as they still had/have some yield to provide to yield thirsty investors. Namely, EUR denominated Eurobonds of Croatia, Serbia, Montenegro, Macedonia and Albania were in high demand which resulted in significant spread tightening. Also, Serbia and Montenegro managed to issue new 10Y EUR papers so it’s worth our while to look how the auctions went and where yields stand today.

Last week investors received a call regarding new 10Y EUR denominated Montenegro Eurobond that settles today. State of Montenegro issued EUR 500m at 2.80% with spread of 338.2bps versus benchmark although the first indication was that paper could be issued at 3.125% – 3.25% level. Nevertheless, CEE and other investors’ demand was high, with more than EUR 1.8bn in the books which decreased yield to the mentioned levels. In the end books stood slightly below EUR 1.5bn with asset managers buying the most part of the paper, according to one of the joint lead managers. Looking at the distribution by geography, heaviest part went to CEE (22%), UK (21%) and Germany (15%). Interesting feature of the paper is that it could be called 3 months prior to maturity at 100.00 but only in full amount, i.e. EUR 500m. Today, on the secondary market paper could be bought at 99.15 meaning that it already went up in price by some 130pips (as it was issued below par, 97.846 with coupon of 2.55%), and YTM now stands at 2.65%. As it was announced by Montenegro’s finance minister Darko Radunovic a month ago, EUR 500m of proceeds are to be used to fill this year’s budget gap that’s planned to fall below 3% of GDP.

Talking about 10Y papers in the region, Serbian Ministry of Finance decided to go to Eurobond market few months ago when it issued 10Y EUR denominated paper in amount of EUR 1bn at 1.619% with spread over benchmark close to 190bps. This was first Serbian EUR denominated Eurobond and demand skyrocketed due to rare auctions and low yield environment and as it was the case with Montenegro yield on auction was decreased several times. Funds were used to pay off USD papers, namely, Serbia 2020 and 2021, in amount of USD 700m and 400m, respectively. After the auction Mr Mali said that Serbia plans to come to Eurobond market again in the next 12-18 months but not to refinance its outstanding bonds but for financing of several projects that weren’t disclosed at the time. As yields in euro area kept falling and macroeconomic situation in Serbia kept improving, yield on Serbia 2029 fell even below 1.0% and now you should be happy if you find it above that level.

Meanwhile, Serbian credit rating was upgraded to BB+ with stable outlook by Fitch, pushing Serbia just one notch below investment grade. Main driver of the upgrade that took some of the analysts by surprise was more stable macroeconomic position. Namely, inflation seems stable around 2.0% which allowed NBS to cut interest rates twice since June while EURRSD stayed put due to NBS increasing FX reserves to curb appreciation forces. Furthermore, Fitch expects Serbia to continue with fiscal consolidation that resulted in surplus in 2017 and 2018 and that debt could fall below 50% already next year. In their decision they praised debt structure as around 75% of new debt was issued in dinar and as already mentioned, Serbia decreased their exposure to the USD denominated Eurobonds buying total of USD 1.75bn. Despite GDP growth decelerated in the first half of 2019, Fitch expects it to accelerate once again taking full year’s growth above 3.0% due to rise of personal consumption and construction investment. In case GDP continues rising at the current pace, Fitch forecasts that debt could fall to 37.4% of GDP in 2028.

Source: Bloomberg, InterCapital