After most of the major central banks around the globe made their move to defend their economies by cutting interest rates, today we are looking at Frankfurt and ECBs actions. Of course, monetary policy is not going to be enough to counter the escalation, but we expect strong fiscal package also that would decrease negative impact from the new virus.

In the last two weeks it became obvious that corona virus will have significant impact on world economy and as several countries in Europe are already in quarantine while many of them are looking for stronger measures to stop the spread of the new virus that accelerated in both Europe and USA. It is a bit calming that situation in China is stabilizing while seems like number of new cases in Italy decreased on March 9th after three weeks of rising. As many European countries and US are lagging in terms of new cases (in relative terms compared to Italy), we expect number of new cases to accelerate further for a week or two and then could see an inflection point in case most of them extended their measures such as closing of schools and limit bigger events.

After G7 countries’ finance ministers and central bankers decided to take measures to reassure markets last week, FED was the first one to react slashing its reference rates by 50bps in one cut on last Tuesday while the same was done this week by BoE. That move wasn’t nearly enough to calm the markets so at the moment finance ministers are competing which package will be bigger. For instance, Italian Prime Minister Gisueppe Conte announced they will spend around EUR 25bn on stimulus to defend its economy from crisis which at the moment looks inevitable. Package includes help for temporary workers, compensation for firms, moratorium on some loans and so on. Talking about fiscal package, yesterday we have seen UK’s Rishi Sunak announcing giant fiscal stimulus to help their SMEs and National Health Service, saying “Whatever it takes, whatever it costs, we stand behind our NHS”. On the other side of the Atlantic, President Trump and his lawmakers began talks on relief package which could include cut of payroll taxes that could make up to USD 700bn-900bn which is more than 2008 bailout package. However, package doesn’t seem to be close as there are many details to discuss and political points to win as we are heading closer to the elections.

Attention now turns to the main event today, ECB’s monetary policy meeting. Market expects at least 10bps cut while many other options are also on the table. First, more negative reference rate, i.e. -60bps would even more hurt banks so ECB could be prone to uplift its tiering limit to even more than 6 times mandatory reserves. Going on, asset purchases could be lifted from current EUR 20bn a month to 30bn or even more but then they will have to lift capital keys and limits of 33% of each issue. Moratorium on some loans or change of TLROs are also in their toolkit. So, it seems that there are still some tools left, it just depends on whether Mrs Lagarde is prepared to go ahead of the curve and if she thinks the same measures will help against completely different type of crisis compared to the one in 2008 and in 2013.

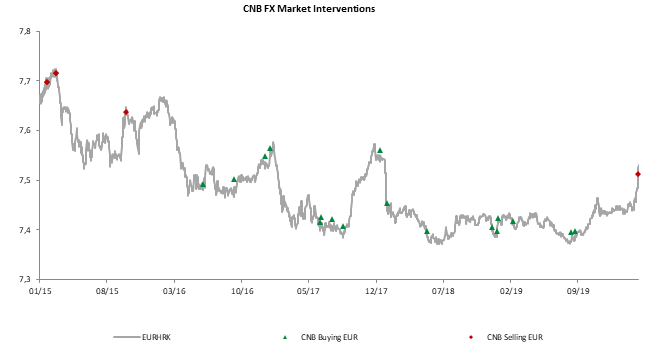

Talking about central banks actions, we should just mention that this week we have seen Croatian central bank coming to FX markets to intervene as EURHRK went North sharply. In the last few weeks, HRK started to depreciate most likely due to several factors. Namely, global uncertainties, local FX bonds auction, larger corporate buying of single currency and lower income from the tourism sector. CNB decided that 7.56 level was enough and sold EUR 387m at average price of 7.512738 but only day after HRK started to depreciate again and this morning, we see offers at 7.5800. which is level last time seen in December 2017 and December 2016.

Source: Bloomberg, CNB, InterCapital