Following statements from FOMC members, bond prices have risen sharply since the start of the week both on the long and short end of the curve. The move was stronger at the short end of the curve as more cuts were priced in the market which led to the steepening of the yield curve.

As the recessionary narrative and falling inflation narrative influenced the market over the past month, the week opened with a sharp drop in yields. On Tuesday, one of the FOMC members Chris Waller delivered dovish statements and propped the bond market. The statements were about falling inflation that should be followed by lowering policy rates as there is no reason to hold rates at peak if inflation drops closely to the target level. On the other hand, another FOMC member Michelle Bowman stated that hiking rates should be in place in case of disinflation stalling. However, the market shrugged off her statement even though she is a permanent voter like Waller. Due to the positioning of the market, Waller’s dovish statements were recognized as a trigger for skyrocketing bond prices. Shorting bonds seems to have been the pain trade as the trade became crowded and mild moves in the other direction triggered massive moves. Also, the market is quite sensitive to turning the narrative to the recessionary one as we are probably at peak policy rates in Europe and in the US and the whole market expects that rate cuts are somewhere around the corner, but still not sure when the cutting cycle is going to start. Growth data in Europe is weak, in the US growth is slowing, but not as weak as in Europe yet, however, inflation is closer to the target level than at any point in the last two years and Chris Waller made a great point that there is no reason to hold rates at such restrictive levels and risk crashing the economy if the inflation drops to reasonable levels.

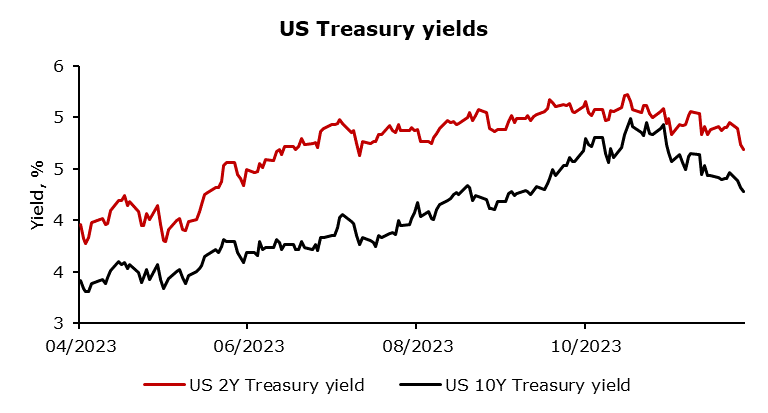

According to the OIS in the US, markets are pricing almost four rate cuts by the start of November of 2024 which is exactly what Chris Waller communicated this week. By the end of the week, more FOMC members will deliver statements as well as Chair Powell which should steer markets to the last FOMC meeting on 13th December. In Europe, the situation is similar and the market prices almost four rate cuts in Europe by October of 2024. This would imply cuts at the same time in the US as in Europe as the inflationary problems should subdue at the same time both in Europe and the US which is quite odd due to the major inflationary spike in Europe as a consequence of rising energy costs (cost–push inflation). In the US, demand–pull inflation is a major issue with heavy wage increases agreed upon this year which should be harder to bring back down implying later cuts. 10Y Treasury yield reached 5.00% in mid-October after a sharp rise in yields over the summer. 10Y Treasury yield is at 4.30% which is a 70bps drop within a month and a half. 2Y Treasury yield reached 5.25% at the same time as 10Y and retraced 55bps since then.

In conclusion, the recent surge in bond prices, particularly at the short end of the yield curve, reflects a market responding to dovish signals from FOMC member Chris Waller regarding the potential need for rate cuts amid falling inflation. This contrasts with the stance of other members like Michelle Bowman, indicating a divergence in views within the committee. The market’s sensitivity to recessionary narratives, coupled with differing inflation dynamics in the US and Europe, has led to significant volatility. As markets await further statements from FOMC members and Chair Powell, the divergence in inflation source between the US and Europe adds complexity to the global economic outlook.

Source: Bloomberg, Intercapital