This week we have seen March inflation data for several European countries that showed inflation is accelerating further reaching levels which have not been seen in a couple of decades. Most of the inflation came from energy although higher energy prices for longer are being included in the price of all goods and services. In this article provide more details on the data published this week and what are the consequences on financial markets.

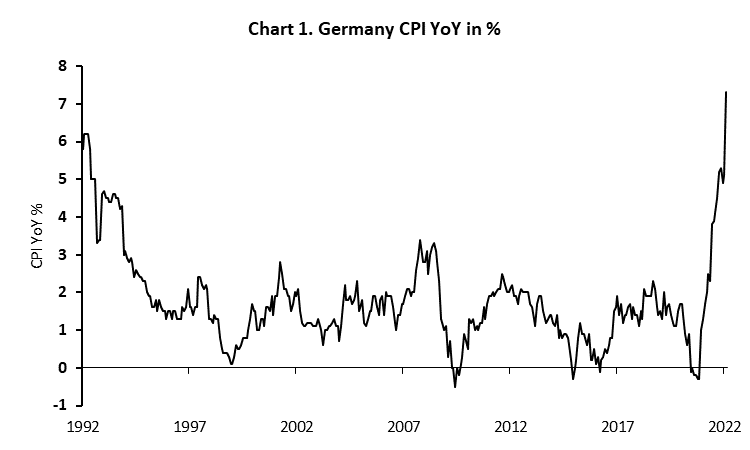

On Wednesday, the Spanish statistical office was the first one to publish flash estimate of March’s inflation which showed that CPI in the country stood at 9.8% YoY compared to 7.6% in February and way above all expectations on BBG (consensus 8.0%). Although most of the increase could be explained by higher energy costs according to the statistical office, core inflation also increased, from 3.0% in February to 3.4% in March. On the same day, Destatis informed us that German inflation also accelerated in March, to 7.3% YoY while yesterday we saw data from France and Italy which followed the trend. This means that inflation in Europe is now at the highest level in at least 30 years that we have comparable data and extrapolating energy cost for another month show that we could see even stronger YoY levels due to more and more goods and services calculating in for more expensive inputs.

Talking about energy costs, March’s data for Germany showed that energy inflation shot up in March to 39.5% from 22.5% in February. However, we are still in no man’s land in talks with Russia on energy and everything became even more complicated once Russian president decided that from now on European countries should pay for Russian oil and gas with Russian rubles. Officials from Germany and other EU countries denied paying in rubles due to a breach of contracts so we still do not know what will happen once current contracts end. Furthermore, Russian invasion of Ukraine continued for the second month and every additional day of war moves us away from any agreement between Russia and the west going forward. So, the only thing that is currently for sure is that prices of oil and gas will continue showing extreme volatility for some time. This means that producers will have difficulties with pricing their goods and will increase prices to customers in the maximum extent which was showed on the latest PPI from EU countries that were above 30% YoY in March. European TTF natural gas is currently trading around EUR 110 per MWh while Brent oil stands at USD 107 per barrel which is 20% below March’s highs but still some 100% above the average level in the last five years.

Inflation is becoming a real challenge for the economy it was shown this week also when we got European business and consumer survey which stood at the 12-month lows while consumer confidence index fell to the lowest level since April 2020 when we were closed in our homes. This means that economic slowdown is practically inevitable while yield curves are showing that we are close to another recession, but with high inflation rates. This further complicates the problem for central banks although we saw that high inflation is their priority number one which makes sense, but the question is for how long and how much of the economic downfall could central banks tolerate before they take the blame for both i.e., inflation and recession.

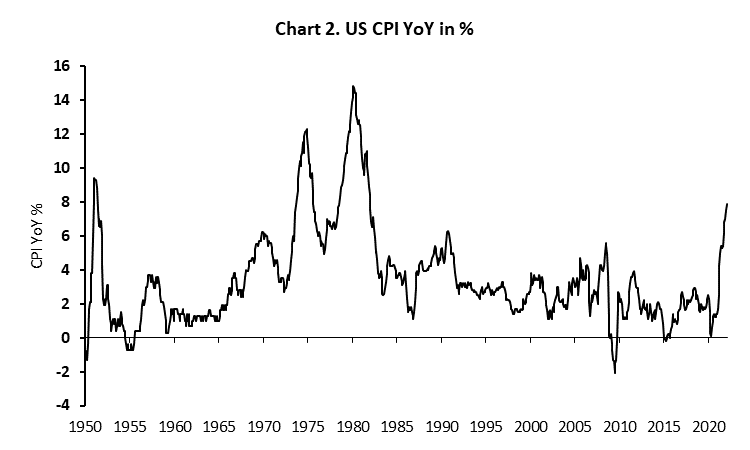

What do markets have to say about the current situation? Obviously, bond yields are rising at the fastest pace we have seen in years, but they are still low if you compare them with inflation as real rates are deeply negative. This week we have seen, EUR 2y benchmark coming to positive territory for the first time since 2014, while 10Y overjumped 70bps for a short period of time. On the other side of the Atlantic, we have seen 2s10s inverting intraday, with 2Y paper being at 2.40%.

Source: Bloomberg, InterCapital

Source: Bloomberg, InterCapital