A recent JOLTS report catapulted the core yields to multidecade highs, but then a combination of weak ADP and FED speak managed to put a floor on the rise in yields. Some asset managers are espousing the view that if yields continue to march higher, equities will have to give and the knee-jerk reaction in switching away from equities and into fixed income might strip the momentum out of the potential further rise in yields. Do we make sense of this view at all? Read this in this brief research piece.

It’s been quite a volatile week if you are a fixed-income investor and most of the realized volatility came from US labour market data. It’s no coincidence that the eleven-year high on the German 10-year yield (3.02%) recorded during the October 04th trading session came just a day after the US JOLTS report that managed to beat the consensus by as much as +795k job openings (9.61mm reported versus 8.815mm expected by consensus). The sharpest reaction was reported on ultra-long bonds and HY (BTPS belong to this bracket as well) and just a day after the widow-maker JOLTS report, Bloomberg terminals were full of screens such as this:

This is the price of an Austrian ultra-long bond maturing on September 20th, 2117. Correct, it matures in merely 94 years, so your grandchildren might have the luxury of receiving the principal payment if you had such bad luck to buy it at an all-time high in early 2020. Bloomberg TV pointed out that with ultra-long bonds losing between 50% and 75% of their value since early 2021, the accumulated losses have roughly exceeded losses on equities reported after the dot com bubble. We’re going through an unprecedented period of fixed income volatility and very few people are confident in predicting the turning point. What most of the analysts are certain about is that the turning point in the direction of yields would be underpinned by a change of heart at the inner sanctum of G10 central banks (led of course by the FED) and the message delivered from there is quite the same: our job is not done, we’re going to continue the tightening by keeping the nominal short term rates high(er) (the “higher for longer” narrative). In other words, even if the inflation does come down in late 2023/early 2024, we’re going to keep on tightening through rising real yields. Until something breaks.

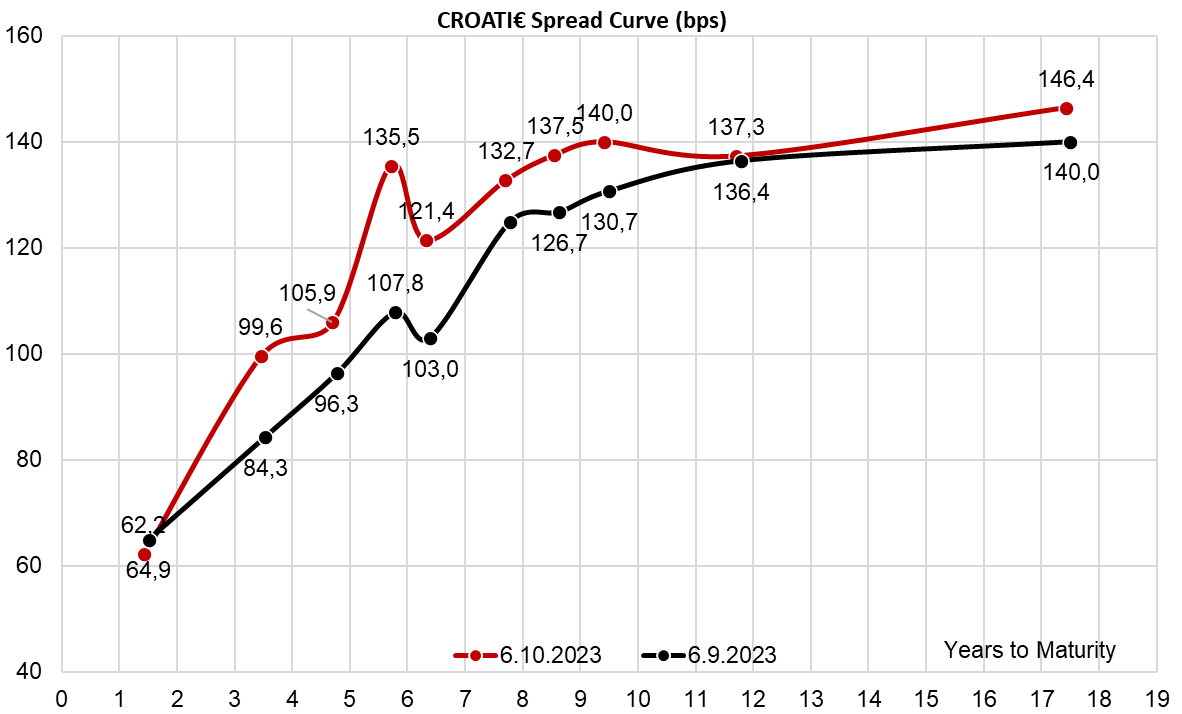

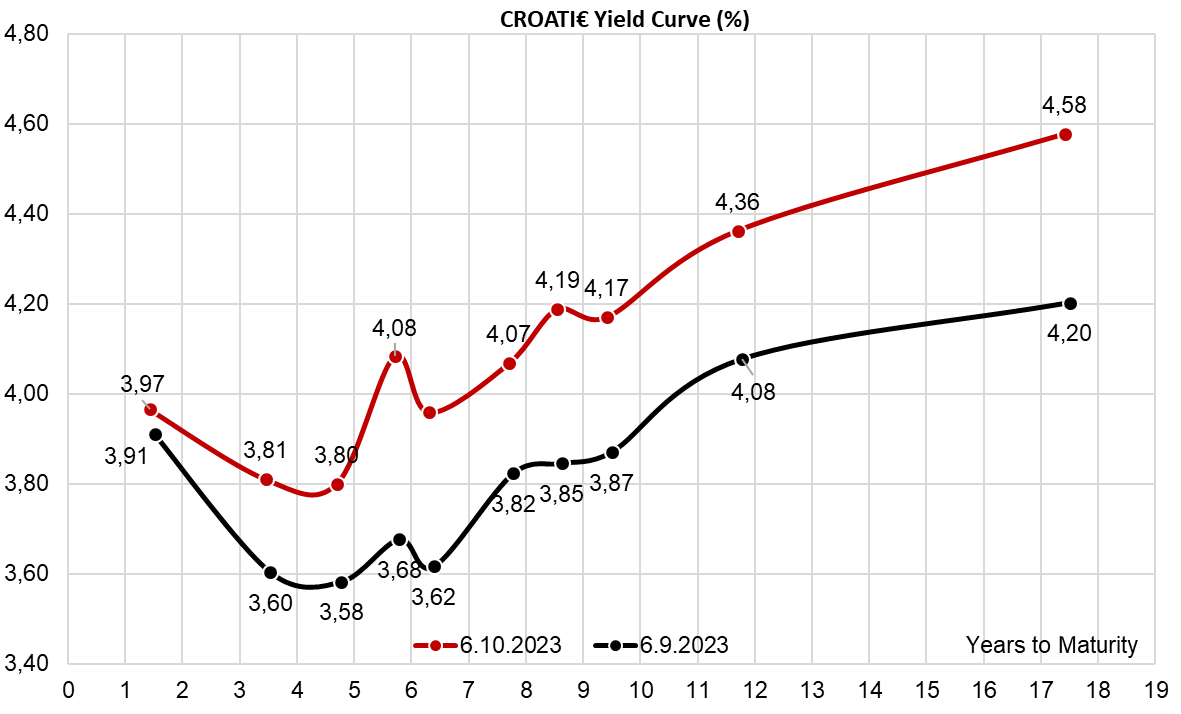

Croatian international bonds gave in to the moves lower in liquid benchmark bonds, nevertheless, the spreads seem to be contained, with some notable exceptions such as relatively illiquid CROATI 1.125 06/19/2029€ (that’s the spike at B+135.5bps you might have noticed on the spread chart submitted below). We have seen mostly buying interest while the German 10Y yield approached 3.00%, but after the round 3.0% mark the buyers got anxious and tried to make sense of the move altogether. After that, we have experienced some buying interest on the short-dated corporate paper, such as RABROM 7 10/12/2027€ placed yesterday (300mm EUR of 4NC3 paper placed by Raiffeisenbank Romania SA at a reoffer price of 100.00 and reoffer yield of 7.00%). The short-term paper priced at 7% is quite tempting for asset managers afraid of duration and the direction of long rates. As one asset manager (correctly) pointed out yesterday: “Once there was a saying that you can’t get fired for buying IBM. Today we say the same for short-term paper. Who can ever get fired for buying IG rated 1Y-4Y paper at 4.0%-7.0%?” We wonder as well.