On this week’s testimony to the Senate Banking Committee, Fed’s chair Jerome Powell said that it is time to retire the word transitory and that buying program could be ended few months earlier than expected before. In this article we are looking at the details of the Powell’s speech and the consequences on markets.

Last week, US president Biden nominated Mr Powell for a second term to serve as chair of Fed, and Lael Brainard as a vice chair after several weeks of speculations that Powell could be replaced by more dovish member. We do not know whether the decision changed anything in Fed but only a week after the decision Mr Powell sounded way more hawkish and decided to move the word transitory from his forward guidance after defending the term for months. On Monday, Mr Powell said that covid waves are inflationary as they reduce people’s willingness to work, resulting in higher wages and further deceleration in supply chains. However, market was more surprised on Tuesday when Fed’s governor said that inflation shouldn’t be described as transitory anymore and that “it is therefore appropriate, in my view, to consider wrapping up the taper of our purchases, perhaps a few months sooner”. On its latest meeting, Fed decided to start reducing monthly purchases by USD 15bn in both November and December meaning that from January Fed could decrease pace by USD 20bn or even more. That would imply end of the purchase program in May the latest or before if they decide to reduce by more than USD 20bn. Omicron is still big unknown, but it is obvious now that Fed can not tolerate inflation being at the highest levels in the last 30 years and not decelerating but the opposite. Oil pries fell dramatically in the last two weeks due to fears of new waves which will decrease inflation pace and most likely mark peak of the inflation in October. However, core inflation shows that inflation could stay above 2.0% for much longer than expected in the beginning of 2021.

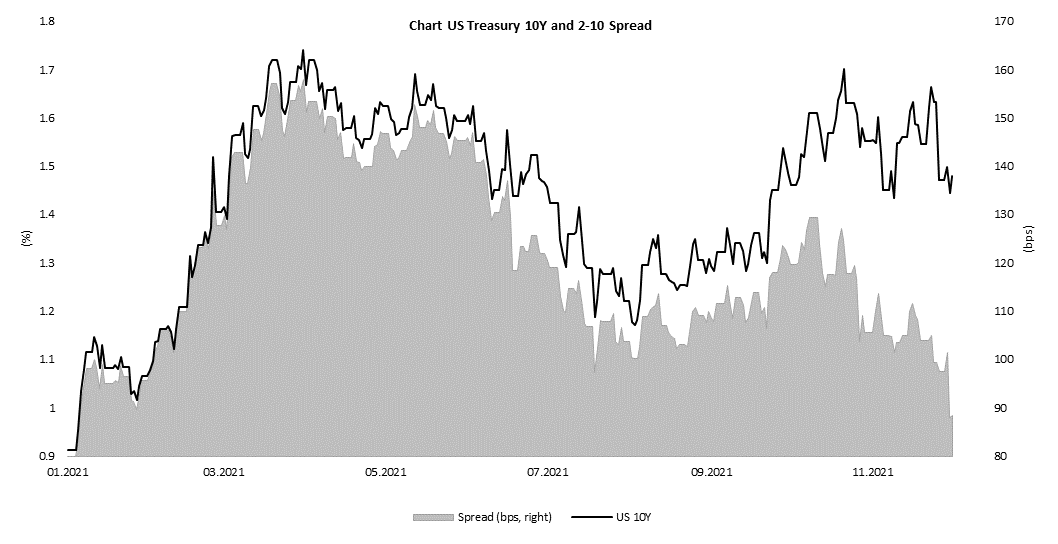

So how did market react on Powell’s remarks? First it is important to say that yield curves repriced significantly since last week due to fears of new variant of corona. On the chart submitted below you could see how yield on USTs fell sharply on Friday and Monday with UST reaching 1.40% on Tuesday before Powell’s testimony. However, Mr Powell surprised markets and yields shoot up with US 2y rising from 0.45% to 0.60% almost in a day, while yield on US 10Y increased by almost 10bps, resulting in further flattening of the US yield curve. In any way, seems like fear of new corona wave is stronger than this hawkish surprise as US 10Y is still below 1.50% and 20bps below the level (1.68%) seen last week.

Looking at the EUR benchmark, one would say that Powell did not end transitory era while omicron did not have the same impact on bund as it did on UST. That is most likely because EUR benchmark was already very high i.e., yields on 10Y paper are below -30bps and there were several explanations for this. We like the one that says that bund became quite rare while due to year end, buyers are looking for quality to close their balances. On the other hand, swap spreads are widening and showing that there are more and more investors who think that yields in eurozone are too low considering inflation that surprised us once again this week. In November, eurozone inflation stood at 4.9% YoY while core was at 2.6%, compared to 2.0% a month before.

Source: Bloomberg, InterCapital