This year we have seen several rounds of inflation and recession ‘fights’ that push rates in the opposite direction. For the last few weeks, inflation rhetoric has been all around us with natural gas in Europe going wild and yields are once again marching higher. In this article we are looking at the latest macro news and what to expect from central banks in the following months.

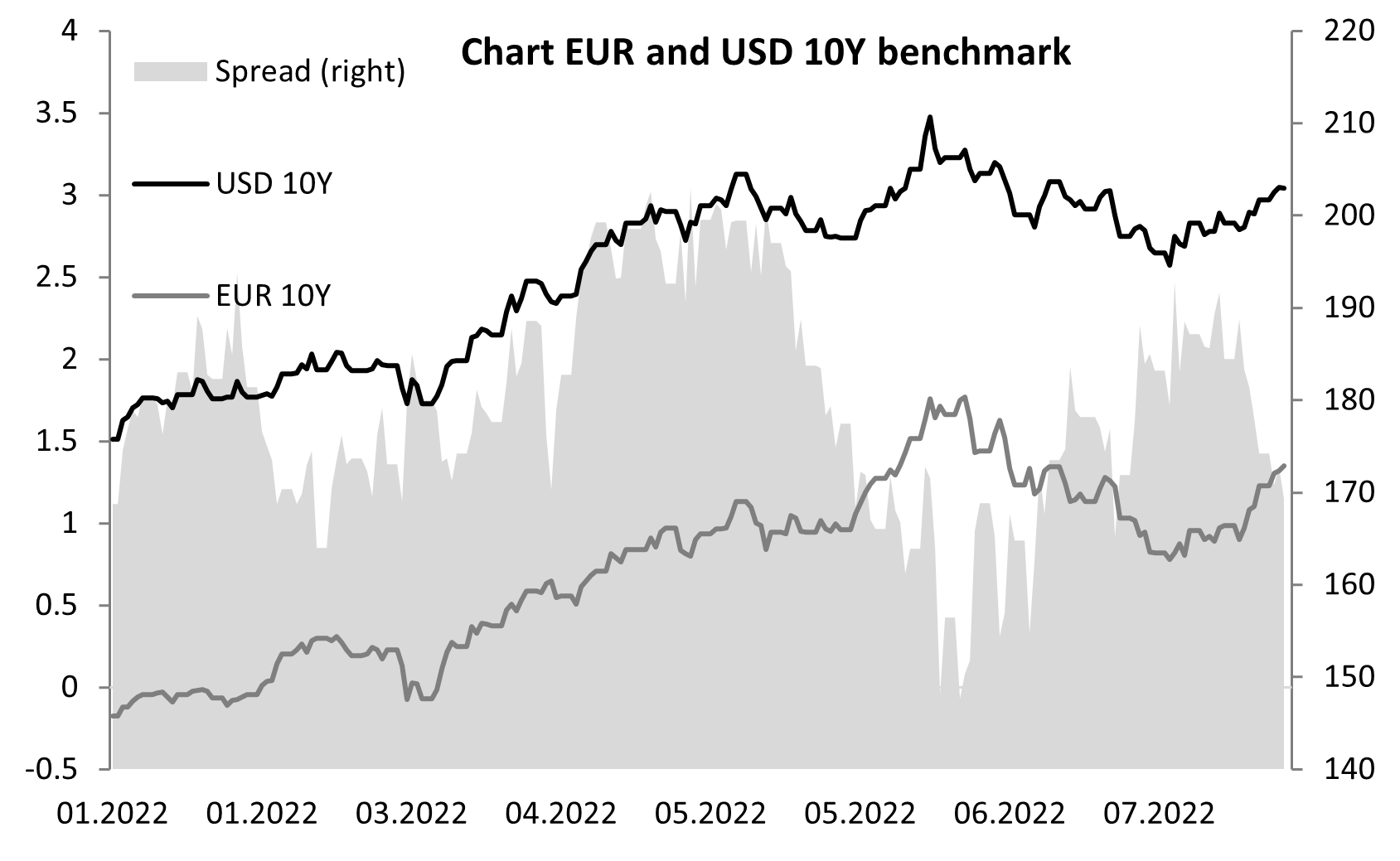

In mid-June, yields reached their peak (for now) as fear of higher inflation i.e., more, and faster rate hikes had driven investors to sell most of their fixed income assets. Nevertheless, this trend reversed with several economic data showing that recession is almost inevitable and market participants started to price that central banks will have to decelerate their pace of hikes and cut rates in the US already in March 2023. On top of that, many long only managers were underinvested in bonds while traders were net short, which had driven the race for the last bond – the story we have seen for the last few summers. Scare of recession and positioning pushed yields on the EUR 10Y benchmark from 1.90% to below 0.70% in the 45 days while many rate hikes were erased from 2023.

However, every summer must end, and summer for bondholders ended at the beginning of August, with the bond sell-off accelerating since then. The drivers were rather obvious. Despite CPI data in the US showing that the YoY CPI peak could be behind us, the inflation story is all but over. Yes, prices of many commodities have fallen significantly, and oil is trading around USD 90 per barrel (WTI) but the service sector has been showing more and more pressure in terms of prices. So, the market once again decided to swing to the inflation side with the same 10Y EUR benchmark we mentioned before reaching the 1.38% level yesterday after being at 0.70% at the beginning of the month, meaning that bund futures have fallen by 900 pips in terms of three weeks!

We saw several senior market analysts saying that they have never seen the market being so polarized with one camp believing that a strong recession will dampen inflation and force central bankers into looser monetary policy while the other camp believes that inflation could decelerate but still to the levels way above central banks’ targets and CBs will have a tough call but will choose their primary objective (only objective for ECB) and leave rates higher for longer.

As we said before, in July we saw data showing that price pressures eased across the globe due to energy falling below peaks but the situation in Europe with prices of natural gas and electricity seems to be quite different than all the others as utility prices for companies could go up by almost ten times. This does not represent inflation worries anymore but state emergency and full economic worries. However, we still have not seen any European country with concrete measures besides the instructions to reduce energy usage. There are several options and none of them seems to be perfect for the European economy. The first one is to leave the market to go on its own, which would force many companies into bankruptcy while the European economy would go into a deep recession. Another option for the EU is to give some allowances to companies and households but that will come at the cost of more inflation and larger deficits.

The reality will be somewhere in between, meaning that we will see even more polarization in market participants. This means even more swings in bond markets at least until ECB decides what is their priority and how it will deal with it. Now, we think that the market is right pricing the terminal rate in Europe at 2.0% and we think that central bankers will leave rates for longer this time to be sure that double-digit inflation is behind us, even with the large cost for the economy.

Chart 1. EUR and USD 10Y Benchmark

Source: Bloomberg, InterCapital