In the last few months we have seen modest recovery of the economic data in both US and euro area which was followed by rise of inflation. ECB acknowledged trend stating that risks are now almost in balance. However, there is this corona virus that could harm mentioned recovery while oil prices fell sharply in the last few weeks. What happened and what could we expect next read in this brief article.

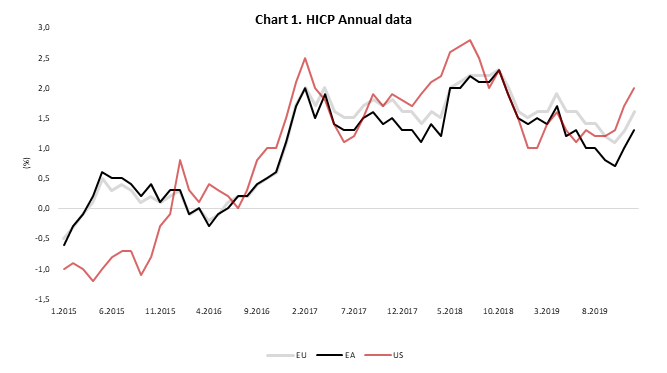

2019 was all about slower economic growth and possible recession in 2020 due to geo-political turbulences which had (among other reasons) driven industrial recession in several countries in EA including Germany. Despite house prices and wages rose by solid pace, inflation in euro area kept falling and reached bottom of 0.70% in October 2019. However, in September 2019 there were some signs that slowdown of economic data and leading indicators could see inflection point and could reverse. Last three months of the decade confirmed the trend although quite modestly which coupled with higher prices of oil set the stage for inflation to start rising once again. In December 2019 euro area’s HICP reached 1.3% (annual change) and Bloomberg’s survey now shows forecasters expecting it to rise to 1.4% in January.

Talking about expectations, last week ECB maintained monetary policy meeting which was mainly non-event as there weren’t any new policy signals due to start of strategic review which should be finished in the end of this year. After the announcement that ECB will continue to make net purchases and make core sovereign bonds even more ‘limited edition’, Mr Lagarde stated that some of the geo political risks receded since December and inflation picked-up which was in line with their expectations but seems that for ECB risks are still tilted to the downside. In case inflation keeps rising in the following months, we do not expect ECB to react rather to say inflation can overshoot for some period of time as it underdelivered for few years.

Source: Eurostat, InterCapital

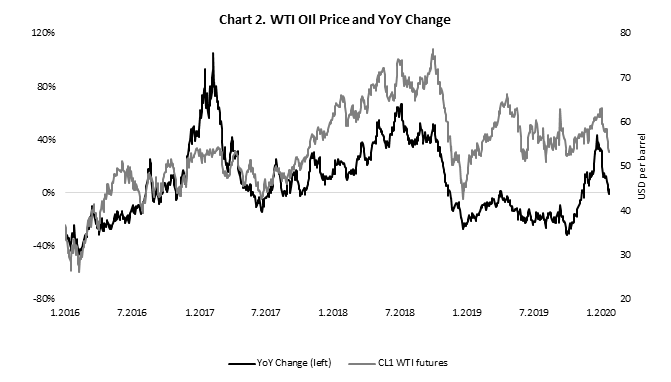

What could stop inflation from rising to ECB’s close but under 2.0%? First what we could think now is oil price which witnessed sharp drop in the last few weeks as concerns about increased global supply keep mounting and in case it stays close to these lower levels, inflation will inevitably go South. ECB’s most targeted measure is core inflation which excludes prices of oil but looking at the correlation between the two, it’s obvious that oil is still one of the main inflation drivers. Second, corona virus could show way more serious that market now thinks which would damage global trade and probably push inflation lower due to slower demand. Furthermore, ECB will most likely be on auto pilot for the whole year as they have to review the economy and they do not have more tools to fight slower growth or lower inflation. Also, US president in Davos said that he could impose tariffs on EU cars if they don’t reach some trade deal.

Source: Bloomberg, InterCapital

On the other side, US seems to be in the right spot for growth acceleration due to phase one, Chinese growth being above expectations and FED’s last year’s easing. FED still has some room to react in case of slowdown or fall of inflation and at the moment market expects them to cut reference rate once again in September 2020. Also, one shouldn’t forget about Mr Trump who will try to keep economy rolling at list until the end of this year when he will most likely take another mandate as POTUS.