CROBEX has long been known for its broadness which somewhat affected the index’s ability to accurately portray the situation on the market. Therefore, we decided to examine the index’s movement more closely by reviewing the individual contribution of each component in a period spanning from 2013 up until today.

Market indices are supposed to serve as proxies for investors which would allow them to easily follow the direction in which the observed market is moving. However, in order to function properly, the index must be comprised out of shares that attract enough turnover to actually represent the current market movement and not be exposed to frequent price fluctuations. Meanwhile, CROBEX is currently not that type of index as it consists of a large number of shares that many fund managers would not even include in their investment universe (due to extremely low liquidity, poor corporate governance, going in and out of pre-bankruptcy procedures, etc).

The value of the CROBEX index increased by 13.7% in the observed period (Mar 2013- Jun 2022), which might lead some investors to believe that the Croatian market has either missed most of the bull market or that the coronavirus and the current geopolitical situation was able to erase almost an entire decade of gains. Fortunately, none of that is true.

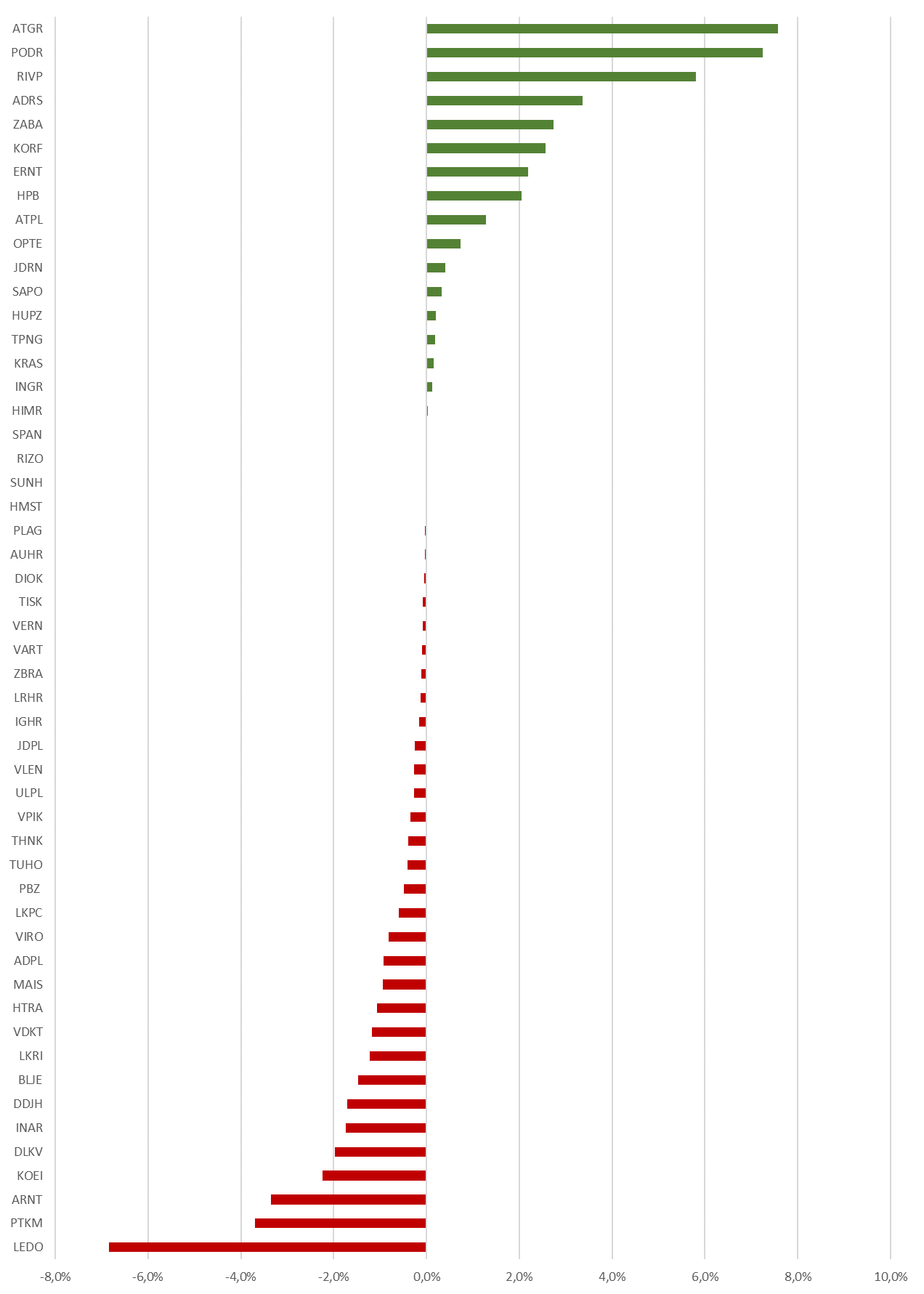

Individual Impact of Shares on CROBEX Movement in the Observed Period (in %)

As one can notice, shares such as Atlantic Grupa, Valamar, Podravka and Adris all had a positive impact on the index’s performance. Atlantic Grupa managed to increase its share price by 2.5x in the observed period due to the successful acquisition and integration of Slovenian Droge Kolineske, successful portfolio management and sell-off its non-core assets. Podravka is the second highest contributor to CROBEX’s growth since 2013. Since the beginning of 2019, Podravka’s share price increased by 112.6%, while investor should not forget about the dividend yield one could gain from holding Podravka’s shares. This increase came on good fundamentals, with Podravka increasing its sales and bottom line in the observed period. Podravka is followed by Valamar Riviera, which recorded relatively opposite situation. Most of it’s growth in market capitalization was recorded before 2019. Valamar was materially impacted by corona due to the immobilization of tourists, still recovering from that shock. Considering that these shares are among the most popular shares for investors, the decrease stated previously seems a bit misleading. On the flip side, the shares which dragged the index down were mostly poor-performing companies from the industrial sector which are prone to share price fluctuations due to their low liquidity and poor corporate governance which puts off many institutional investors from buying those shares. Furthermore, the index was hit hard by the Agrokor crisis with Ledo accounting for a 7% decrease in value. An exception from this group would clearly be Končar and Arena Hospitality who, despite the strong interest from investors, were some of the leading contributors to CROBEX’s negative performance. Končar’s negative contribution to the Index happened mostly as a result of the whole market reporting bullish sentiment in those periods. We should mention that Končar’s share price reported a high increase in price during the time Končar was not in the index, overestimating its negative performance in the observed period, even if it did negatively impact the Crobex value. Nevertheless, Končar positively impacted CROBEX due to it’s surge in price in the last year, increasing c. HRK 100kn per share. Also, Dalekovod had a negative influence on CROBEX due to its high indebtness and liquidity problems. In the last quarter we witnessed Končar’s capital increase of Dalekovod, which further diluted Dalekovod’s price.

To conclude, the Croatian market has certainly been through a rough patch over the past couple of years. However, we believe that the performance of the main market index is slightly exaggerated as its broad size led to the inclusion of shares which unjustifiably dragged it further down. Therefore, we believe that despite the underperformance of the index, the Croatian market still offers some gems hidden in the pile.