In today’s blog, we’ll summarize the development of earnings in Croatia in the last 8 years, as well as try to answer the questions of what influenced this growth, and what can be done to support continued growth going forward.

In 2015, the average gross earnings in Croatia amounted to EUR 1,010, while the average net earnings amounted to EUR 743. Since then, the earnings have steadily increased. As of June 2023, this increase amounted to on average EUR 587 for gross earnings, and EUR 408 for net earnings. In nominal terms, this would mean that the gross and net earnings increased by 57% and 55%, respectively.

Gross and net earnings development in Croatia (2015 – June 2023, EUR, monthly)

Source: DZS, InterCapital Research

Of course, this is to be expected. What is a more interesting question is, what contributed to this growth? If we look at the inflation rate in the same period, since 2015 on average, the inflation grew by 27.8% (as of June 2023, to provide a better point of reference). That would mean that in real terms, net earnings increased by around 27%.

Croatian CPI growth since YE 2015 (January 2016 – August 2023, 2015=0, cumulative, %)

Source: DZS, InterCapital Research

If we were to compare these to some of our regional neighbours, like Slovenia and Romania, there are some interesting things to be noted. In Slovenia during the same period, net earnings increased by 41%, while inflation amounted to 27.5%, meaning that in real terms, Slovenian earnings increased by 13.8%. Romania on the other hand, recorded an increase in net earnings of 123% in the same period, with the inflation rate at 46.6%, meaning that in real terms, the net earnings grew by 76.4%. Of course, both of these cases are to be expected: Slovenia was relatively wealthy to begin with, with an average net earnings of EUR 1,013 back in 2015, while Romania had an average of EUR 416. As it is a larger country with a larger population, and relatively undeveloped, its convergence with the EU standard, and thus growth is expected. Besides inflation, there are many other key factors that influence earnings growth. One of the most important ones is the level of productivity.

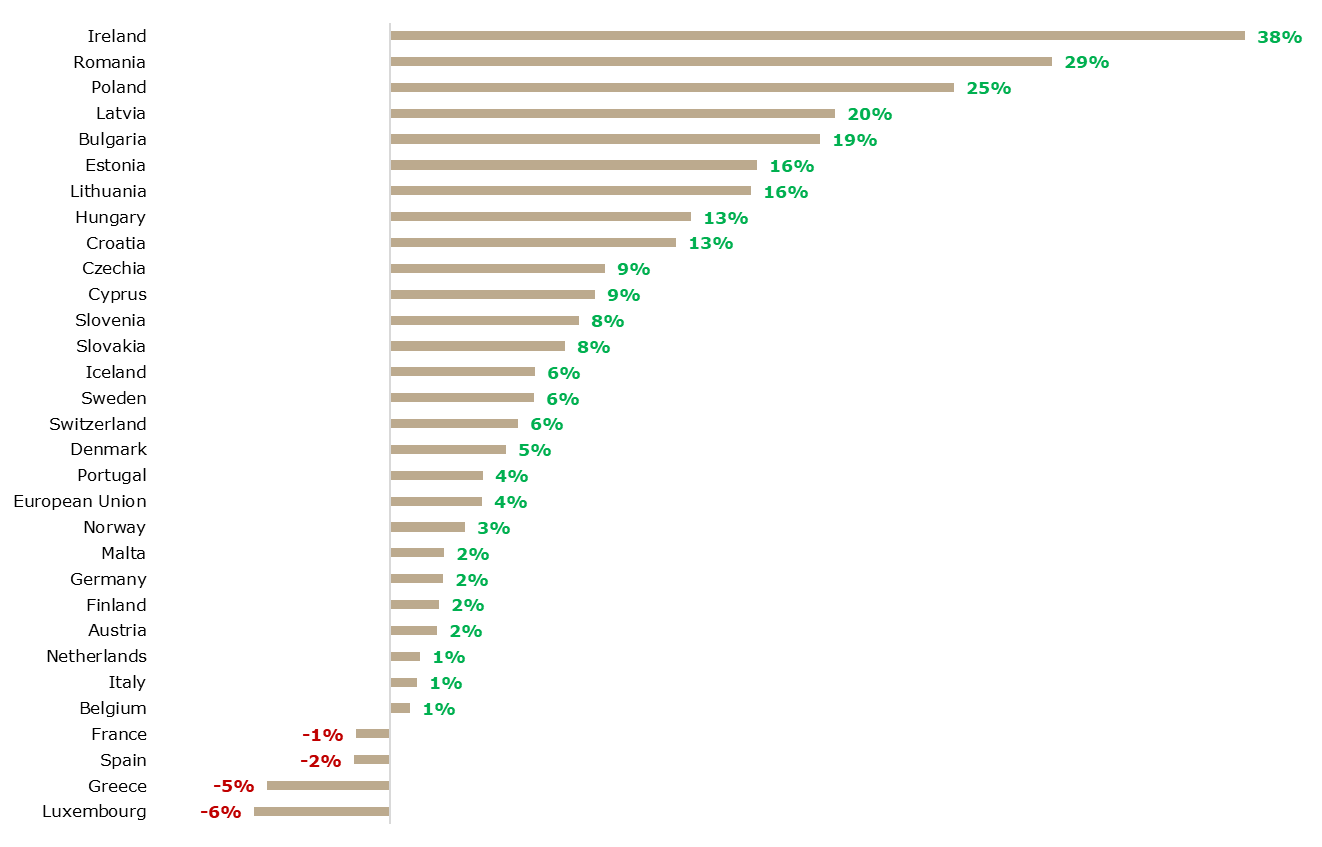

Real productivity per capita* change in the EU and EU countries (2022 vs. 2015, %)

Source: Eurostat, InterCapital Research

*Measured as real GDP in volume terms divided by total employment

As we can see in the graph above, the productivity story is quite interesting. In the period from 2015 until 2022 (latest available data), the overall productivity increased by 4% in the EU, meaning that employees are able to create 4% more value per person as compared to 2015. For Croatia, productivity grew by 12.6%, over 3 times higher than the EU average. Furthermore, Slovenia’s productivity grew by 8.3%, while Romania’s grew by 29%. The absolute leader in productivity growth is Ireland, where productivity grew by 37.6%. In general, we can see several trends appearing. Firstly, countries that were poorer, with a lot of potential for expansion and growth, have on average recorded stronger productivity growth. On the other hand, already developed economies have recorded only marginal growth in productivity or even decreases in productivity. This is to be expected, when countries develop their economies, it becomes harder and harder to achieve the same growth as when they were developing.

Of course, there are outliers to this. For example, since 2015, Switzerland managed to increase its productivity by 5.7%, Sweden by 6.3%, Norway by 3.3%, and Denmark by 5%. There are many factors influencing this, such as the quality of education, technological advancements, improvements in the labour market mobility, monetary and fiscal policies, innovation and entrepreneurship, cost of living, or just the overall composition of the industries in these economies, with a larger focus on higher value-adding industries.

Coming back to Croatia, there are several other interesting observations to be made. Firstly, the 12.6% growth in productivity might have seemed delayed, as Croatia was in a technical recession up until 2015. Secondly, Croatia recorded a decline in population, and whilst no comparison can be made to 2015, in 2021 as compared to 2011, a decline of 413k people or 9.6% of the total population was recorded. Given that it’s usually the younger people who are the ones leaving the country first, the hit on the available workforce is even higher. On the other hand, unemployment levels are currently at historical lows, and the lack of employees has somewhat been compensated by foreign workers. As such, the 12% growth in productivity seems even more impressive. Even though no data is available for 2023, it could be assumed that 1-2% can be added for the year. As such, if we combined inflation and productivity growth, there is still about 15% of earnings growth that would have to be explained by other above-mentioned factors. Whilst all of them factors had an impact, lately the largest impact could be attributed to the monetary and fiscal policies, as well as the overall cost of living. Cost of living in particular, with the strong growth in housing prices we have seen in the last couple of years, could significantly influence the demand for higher wages.

Going forward, perhaps a couple of lessons could be learned from countries that managed to improve the standards of living of their citizens rather quickly, and in ways that exclude fast growth based on commodities.

Some of these lessons could include the following:

1. Improvements in the education system, in ways such as orientating it towards the actual demand on the labour market, and specific higher value-adding industries as was done in Germany, or lately the Baltic countries.

2. Legislative and law improvements to all impediments to the ease of doing business.

3. Incentives for younger families, and beyond the ones that just drive up the housing prices like the subsidized loans. Of course, improvements in the conditions of these loans could be the first step in enabling more young people to stay and work in Croatia. In the long term, such policies would support the demographic structure.

4. Continued improvements to infrastructure and govt. support for projects, especially given the amount of money available in various EU funds could also support improvements to the standard of living.

5. Diversifying the economy into more high-value-adding industries. This is especially true when we consider the fact of how dependent is the Croatian economy on the tourism industry. As the COVID-19 pandemic has shown us, tourism can come under extreme pressure, and the whole economy suffers. Another example is the over-reliance on the construction sector. This can be seriously detrimental to the growth prospects of the economy in the medium to long term. One only has to look at the 2008 Financial Crisis in the US, or the current issues facing the Chinese real estate market to understand this.

Overall, improvements to earnings, and by extension, the standards of living could be made. However, this requires a structured and systemic approach from multiple sides, rather than short-term promises. As history has shown us, these usually don’t lead to anything more than problems down the road.