If you think that Serbian USD debt placement last Monday was nothing extraordinary, then you haven’t been paying close attention. Don’t worry, that’s why you have us – to draw your attention to the important stuff. Serbia basically bought back 900mm USD of the old debt, placed 1.2bn USD of the new one and hedged the remaining USD liability for the first time ever. According to the central bank data the new notes were placed at 2.35% YTM before cross currency basis swap and 1.066% after the swap. This was an excellent job for the Ministry of Finance. But what about the investors? Well, find out in this brief research piece.

Serbia returned to the US dollar market after a seven-year long pause with a 1.2bn USD December 2030 note (SERBIA 2.125 12/01/2030 on BBG). The bond placement was preceded by a tender offer to buy back the 900mm USD of the outstanding note maturing in September 2021 at 105.70 (about 0.32% YTM). The tender was successful and the outstanding size of the short note was hence reduced from 1.6bn USD to 700mm USD. One part of the motivation to place the first greenback paper since 2013 came from the fact that Serbia was close to losing it’s EMBI+ status, which was quite important to the sovereign in the previous years (a detailed description of the four criteria could be found here; third condition of eligibility requires that the instrument included must have at least one year of remaining maturity, which 2021 notes lost this September).

When the orderbook opened up on Monday, the leads were flashing IPTs @ MS+190bps, which tightened to MS+170bps around 14.00 CET before finally settling @ MS+150bps at the closing of the book (2.35% YTM and 98.00 clean price). On Friday we have spotted the new note trading at 98.40 on “grey market” (MS+147bps, indicating 3bps of tightening), however in the days following the primary market we have heard of trades being executed as high as 98.75 (that was a hair’s breadth below MS+140bps because at a time EUSA10 was higher as well). Spread tightening was a mirror image of weak allocations received by the participants: a 1.2bn USD placement was met with 4.8bn USD orderbook (4.0x bid-to-cover) but insight from the leads revealed that short term note holders participating in the tender were given a priority in allocations. Unless you had the short paper and wanted to convert, you were quite likely to be allocated 5.0%-10% of the total order submitted.

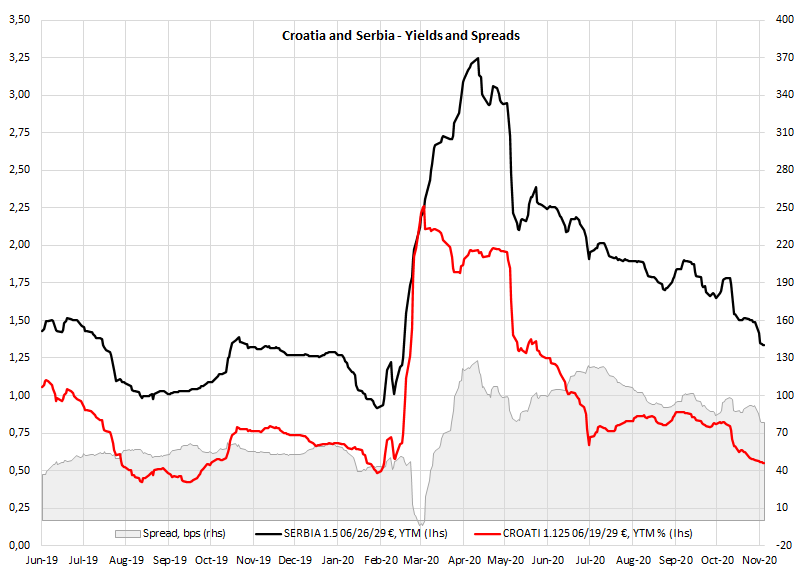

Nevertheless, in our view the current valuations offer support for the Serbian outstanding notes maturing in 2027 and 2029. Namely, if you have a EUR-denominated balance sheet, a quick and dirty hedging of the Serbian 10Y USD paper will cost you about 0.43% per annum through selling a plain vanilla EURUSD 10Y FX swap (we have used EURI10Y Index on BBG for calculation, priced this morning at -.4785/-.4393; since you would be lending euros/borrowing dollars on a 10Y term, you would have to lift the offer at -0.4393%). This FX hedging trade would push your premium from reoffer MS+150bps (if you were lucky enough to get any allocations at all) to about MS+107bps. A quick look on the screen shows that SERBIA 3.125 05/15/2027 is traded at clean 112.25 (1.14% YTM; MS+155bp) while SERBIA 1.5 06/26/29 is traded at clean 101.65 (1.29% YTM; MS+161.5bps). You see our point – both notes are traded at a wider FX-adjusted spreads, although the main issue here is liquidity (can you really switch a larger size of SERBIA 2.125 12/01/2030 into any of the two shorter notes?). For this purpose we see a lid being put on the further narrowing down of the risk premium carried by the brand new Serbian greenback bond, but the outstanding two notes might be supported by switching away from SERBIA 2.125 12/01/2030 and into SERBIA 3.125 05/15/2027 or SERBIA 1.5 06/26/29; i. e. the spread in these two now might have room to tighten. A similiar conclusion could be derived from taking a glance at the spread between Croatian and Serbian 9-year € notes (also bear in mind that Moody’s is scheduled to review Serbian credit rating on December 11th, about a monght after upgrading Croatian sovereign rating by one notch on November 13th):

Some investors still think that SERBIA 2.125 12/01/2030 is a buy opportunity and the only argument they have at their disposal is the fact that it can still be purchased around 2.30% YTM levels, which can be as high as 2.00% on an FX-adjusted basis (some investors can borrow USD at 0.30% 1w repo rate). At first this is much better than 1.14% offered on SERBIA 3.125 05/15/2027 or 1.29% offered on SERBIA 1.5 06/26/29, right?

Wrong. We advise caution with this methodology since short term borrowing and investing in the long-dated bonds exposes you to the roll risks, reducing your P&L should the short term interest rates go up. This is especially problematic in the case of US dollar because American economy is likely to be the first one to start recovering from Covid-induced recession (reasons are numerous: it’s the most competitive economy in the world, demography looks OK and long term growth potential is still untapped), which vouches for higher short term interest rates later down the road. For this purpose we have been comparing the three Serbian bonds on I-spread basis, accounting for FX hedging as well.

But forget Serbian international paper, here’s something worth knowing about Serbian local paper. In February this year (before the pandemic) Serbian finance minister Siniša Mali announced a memorandum of understanding signed with Euroclear in order to allow settlement of the Serbian local paper through ECLR/CEDEL. Actually, a similar memorandum was signed with Turkey as well, meaning that Euroclear might be delivering a push to include more EM local debt in their pool of tradable assets. At the same time the Ministry of Finance is pushing to raise the share of foreign investors in the local short term paper. With inflation and EURRSD in check, SERBGBs might be the trade of the year in 2021 when most of the investment houses forecast considerable inflows into EM assets.

On the same day that Serbia was placing an international bond, Serbian Minister of Finance Siniša Mali was presenting a draft 2021 budget in the parliament. The Ministry of Finance expects a +6.0% GDP growth in 2021, one of the reasons being large infrastructure projects planned for next year. Serbian government plans to borrow up to 2.7bn EUR in 2021 alone from Chinese banks in order to finance projects such as Bubanj Potok – Pancevo bypass road (680mm EUR) and Belgrade-Zrenjanin-Novi Sad motorway (510mm EUR), to name just a couple of big-ticket projects. Serbia also plans a 1.5bn EUR deficit next year (revenues @ 11.4bn EUR, expenses @ 12.9bn EUR) and foreign borrowing in size of 3bn EUR (the remaining 700mm USD of the 2021 notes have to be refinanced).