The first ECB meeting this year is taking place today and markets have been quite quick to price in additional hawkishness coming from Frankfurt. Could it be that the tide might start turning starting from today? Hawkish in Davos, but dovish in Frankfurt? Read out in this brief research piece.

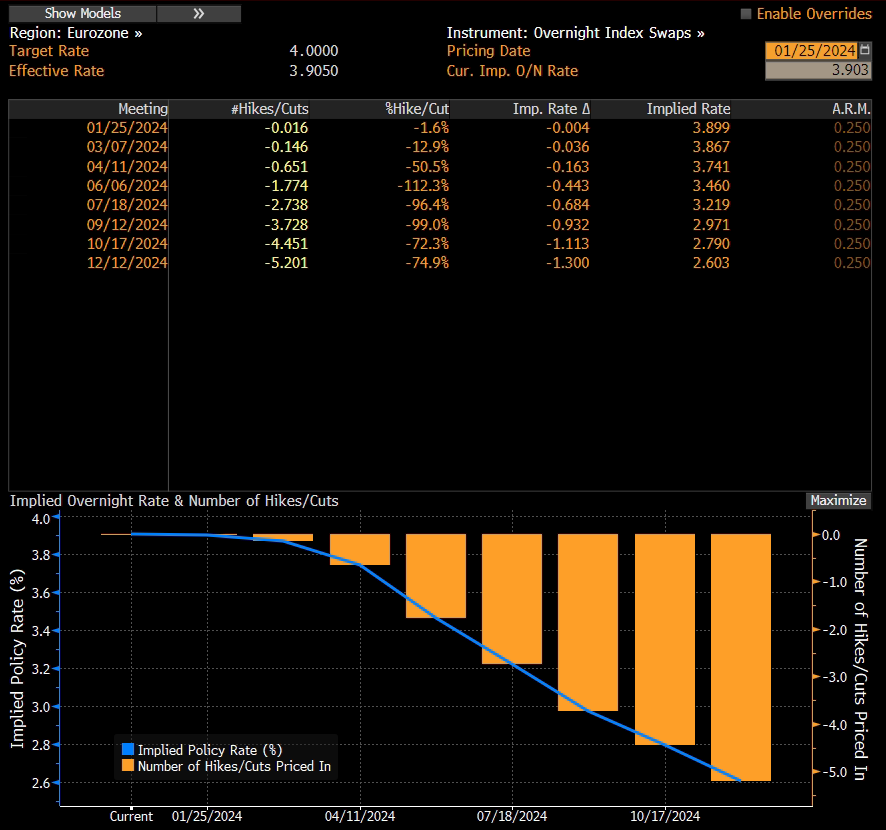

Thoughtful central bank watchers are under the impression that Davos was as a de facto January ECB meeting because everything importan has already been said. Christine Lagarde reiterated data dependence, emphasized focus on wages because wage growth is at the driver’s seat of recent bout in services’ inflation and briefly mentioned summer rate cut as a hypothetical possibility. Financial markets that have been hooked on monetary stimulus since at least 2015 turned this hypothesis into a wet dream. Right after her Davos statement, Lagarde’s comments were overruled by Joachim Nagel who again emphasized data dependence and that at this time it’s too soon to talk about rate cuts. If two of the core ECB members distribute such hawkish statements, why are markets still pricing a 66.4% probability of an April cut (as per the WIRP EZ BBG function submitted below)? Could it be that the markets are again ahead of themselves?

A string of leading indicators such as seasonally adjusted EA manufacturing PMI have been hoovering below neutral 50.00 since summer of 2022. This means a year and a half of manufacturing malaise and the show goes on! With recent general strikes in Germany which have so far included all the economic sectors from agriculture to transportation by alphabetical order, it’s quite likely that eurozone GDP will continue to decline. The problem for the ECB is that wages will continue growing, fuelling the vicious circle of strong inflation prints. Nevertheless, the way companies operate in the recession is that they start cutting margins first and lay off workers second. According to some anecdotal evidence, this process has already been brewing in construction and could gain momentum in the first quarter of the current year. That might force the ECB’s hand at frontloading the first cut while at the same time keeping QT in play and reminding the market of the existence of TPI.

So could it be that soft data malaise (PMIs) transfers into hard data weakness and forces the ECB’s hand earlier than communicated on Davos? We beg to differ, based on two considerations. First of all, ECB staff would emphasize the importance of wage data and dismiss the weakness of economic activity as a direct consequence of general strikes. Monetary policy deals with economic climate, not economic weather. And second of all, IMF’s Gita Gopinath who was handpicked by Madam Lagarde back in the days warned about cutting rates too soon. Gopinath stated that early cuts meant that all the ground gained in a pricey fight against inflation (which ended up transitory after all) would be forfeited for nothing. Wisdom of her words is further amplified by the notion that if the ECB cuts ahead of the FED, EURUSD would weaken and euro area inflation could exhibit another spike higher.

But enough about macroeconomic musings, what’s going on with financial markets? End of the longest month of the year was marked by record-breaking IG issuance in size of 294.97bn EUR (13.7% higher than in 2023). Thoughtful analysts point out that SSA activity took the main stage. Also, Poland, Slovenia, Spain, Portugal, Latvia, Estonia… all went to the markets to lock in cheap funding, despite rates giving back all the gains post-Christmas rally. Some sovereigns decided to skip international funding and decided to turn instead to domestic resources. Croatia is a case in point. This Friday (26th January) CROATI 6 01/26/2024$ will mature – this is 1.75bn USD before the hedge or about 1.4bn EUR after FX swap. According to CNB data, Croatian banks would receive about 140mm EUR in dollar equivalents and start reinvesting the proceeds into other CEE$ bonds. More importantly, the Ministry of Finance would pay off the international bond from the cash it has at hand at the central bank and wait for retail treasury placement in the first weeks of February. International bond placement is still at play, but we’re looking at early summer when CROATE 5.75 07/10/2024€ becomes due. So stay tuned.