Some veteran traders were hoping for a relief rally on equities and risky assets following the US midterms, and this relief did come, albeit for different reasons. Sino-US détente coupled with the Chinese relief package and dovish comments from the big guns of central banking did provide relief. How are Croatian international bonds faring in this environment? Find out in this brief research piece.

Recent fixed income trading sessions have been marked by unusual bouts of volatility with geopolitical newsflow in the background. A couple of days ago, a missile that was allegedly launched from Ukraine as a part of anti-aircraft defense against Russian rockets crashed on the Eastern border of Poland. The knee-jerk reaction of the Polish political establishment, especially in the environment of the fog of war where the origins of the missile were dubious, was to initiate invoking article 4 of the NATO agreement, which would essentially kick off conflict escalation. The United States quickly initiated an investigation themselves, pinning the responsibility on the Ukrainian anti-aircraft defense and calling it an accident instead. This helped defuse the tensions and bring down the EURPLN exchange rate, which was in this environment used by CEE traders as a canary in a coal mine. As one CEE dealer put it: today EURPLN is the VIX of CEE bonds (it’s not quite accurate, but you got the feeling).

This incident was in our opinion given more attention than it deserved, although we are aware of the fact that the course of action might have been very different if the US administration chose the path of inaction instead. Anyways, two major narratives forming on the global Wall Street are focused on China supporting the housing sector and the increasing number of central bankers switching from pronounced hawks to in-the-closet doves. Speaking about the former (Chinese relief to the ailing property sector), the essence of the package is in extending the state-owned bank credit lines even further to help the troubled construction companies. It’s exactly what Japan did in the late 1980s and early 1990s and it worked in the sense that it calmed down the markets, but at the same time it put a lid on productivity growth in decades to come. Nevertheless, the news came from the commanding heights of the Chinese political establishment and it came at the same time as Joe Biden and Xi Jinping met in Indonesia and charted a course of détente in their bilateral relations. This was interpreted as quite a big deal because it defroze the communication lines between the two superpowers that were cut off after Pelosi’s visit to Taiwan (which now looks as nothing more than a trip used to collect political points ahead of the midterms). The relief package and the course of development on the political stage meant only one thing: China is loved by global asset managers all over again, and cash started to flow back to EM funds. Naturally, they bought other EMs as well, causing a contraction of the risk premium we see today as well.

In the backdrop of sino-US détente were the statements by global central bankers, the most prominent of them being Lael Brainard (vice chair of FED and likely Powell’s heir someday). The shadow FOMC chairwoman silently endorsed the 50bps hike in December, which was quickly misinterpreted as the new FED pivot. We remind you of Bernanke’s talk on the stock and flow effects of interest rate hikes, meaning that the FED can still make the monetary policy more restrictive by prolonging the time they keep the rates elevated. This can easily happen if the inflation deviates from the long term goal of 2.0% in the medium term. You are familiar with this adverse scenario – central bankers like to call it deanchoring of inflation expectations. Also, there is that 95bn USD per month QT that already drove the FED balance sheet to about 8.68bn USD (down from the peak by about 287bn USD). Janet Yellen would say that the paint is getting dry.

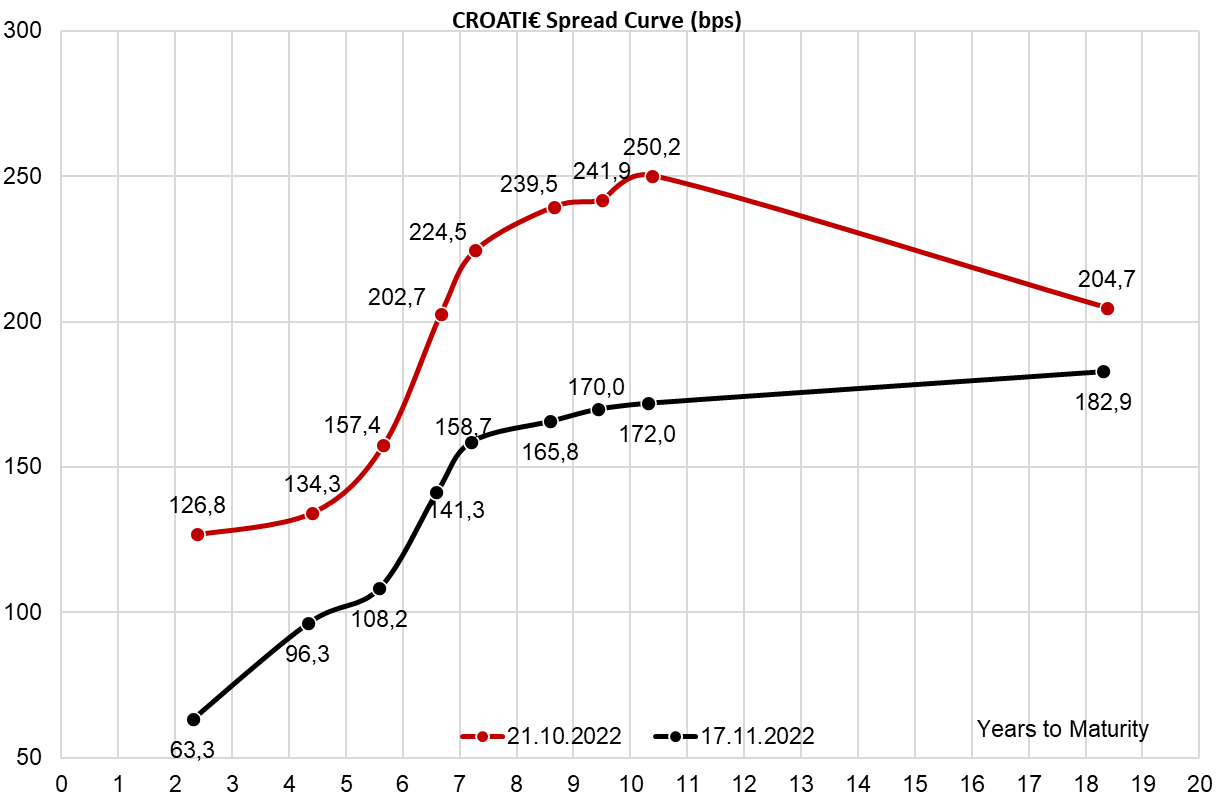

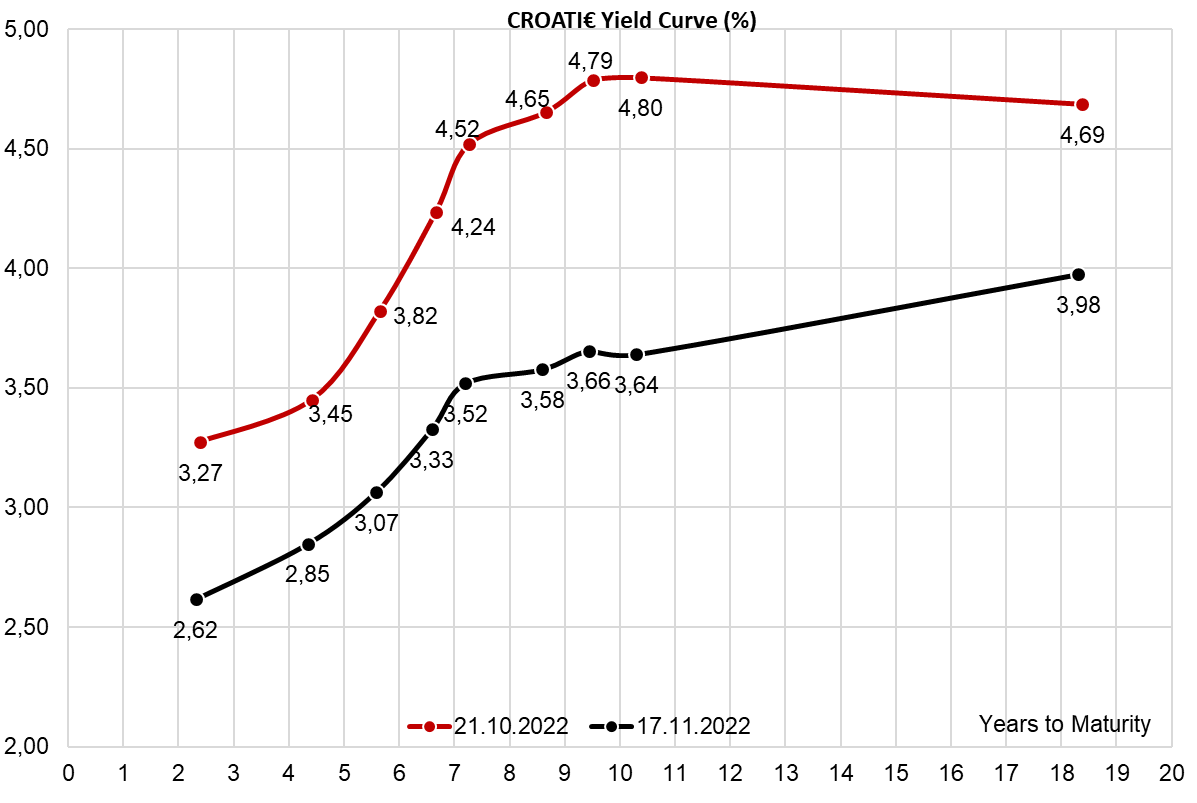

How are CROATI€ going through all of this CEE buying frenzy? What we have seen in the past weeks is that some Street dealers have obviously been opening up short positions on long CROATI€ at B+130bps (lucky ones) to B+150bps (ones who think they will get lucky). This is the only thing providing supply to the asset managers hungry for CROATI€ assets.

Where is the demand coming from? Part of it is certainly homegrown, however, we were informed that quite a lot of CEE insurances showed an appetite for CROATI€. The reason is that Croatian public funding needs are completely covered until early spring 2023, country is enjoying a stable inflow of EU funds (unlike Hungary) and has no issue with the banking sector (unlike Poland). This created a stable buying flow on the CROATI€. We would like to point out that although B+130bps looks really, really tight, one cannot exclude the possibility of the tight spread getting even tighter in an event of long-term benchmark yields going further down. So far, we have seen exactly this setup being formed on the global bond markets.