Somebody finally folded and this time it was the Bank of England. In a response to apparently gigantic margin call for derivative strategies (LDIs), BoE decided to buy ultra long gilts to ease the conditions for pension funds. A couple of weeks ago, European energy companies were allowed to use carbon allowances as a sound collateral for energy derivative margins. Whichever news source you click, you hear the expression margin calls. What does all of that mean and what is the impact going to be on CROATI€ paper, find out in this brief research piece.

Bank of England (BoE) is set to buy up to 65bn GBP of long-dated gilts in the coming thirteen days, including yesterday’s onset. Yes, you read it correctly – BoE is doing asset purchases in order to stabilize the long-dated bond market. We can say that it’s the first G7 central bank that folded on deteriorating liquidity in the bond market – which from the central bank’s perspective acts as a transmission mechanism through which tighter financial conditions eventually trickle down into lower demand and consequently lower inflation.

The initiative for BoE to turn the corner and start buying assets came from British pension funds which are still running defined benefit (DB) schemes. Although these are closed to new entrants, they still comprise a significant portion of the UK’s financial markets. In general terms, DBs should be a beneficiary of rising long-term yields because this increases their funding ratio, but there’s a catch. Before this year’s surge in yields, almost all of the DBs were running liability-driven investment schemes (LDI) which were essentially tied to the ultra-long part of the gilt curve. By the end of July, Toby Nangle (Global Head of Asset Allocation at Columbia Threadneedle) estimated the size of DB liabilities hedged by LDIs to be 1.5tn GBP (two-thirds of UK nominal GDP). In the past few days, BoE kicked off QT (reduction of the balance sheet) coupled with tax cuts that are essentially increasing fiscal deficit and public debt. With this in mind, gilts naturally sold off, and yields spiked, but this is where those high ultra-long yields started to bite. Nangle also estimated that if the LDI schemes were implemented exclusively through derivative strategies, aggregate margin calls were expected to reach 380bn GBP. If you were looking for an elephant in the room – well there it is.

To substantiate the claim that UK pension funds are behind the demand for liquidity, let’s just point that that one of the sponsors for the BoE asset purchase was Cardano Investment, a UK asset manager that manages LDI strategies for about 30 UK pension funds (according to FT). What’s even more interesting is that LDI managers pointed out months ago that their strategies don’t present a source of systemic risk for the UK financial system in general, but it’s possible that this statement was grounded on conditions of ample liquidity and deep order books on fixed income markets.

Actually, the story of UK pension funds seeking assistance with the buyer of last resort (BoE) is in our view part of a much bigger picture called depleted liquidity and shallow bond order books. UK story is just a case in the point of a much bigger picture in which one marginal buyer has exited the market (central banks) while the others have not yet emerged. JP Morgan’s Nikolaos Panigirtzoglou wrote in a note yesterday that global non-bank investors erased fourteen years of the previous bond overweights and now their allocation to bonds is merely 17% (that’s even below the pre-Lehman average of 18%). There’s a lot of room for adding bond longs, on the other hand, we need to be sure about global CBs pivot, i.e. peak interest rates. So in the end, with G7 ex-US central banks essentially following the Fed to prevent their exchange rates from plunging even further, it all comes down to US core inflation rate. That’s the figure you need to be looking at right now.

From a historical perspective, it’s really hard to accomplish an orderly exit from expansive monetary policy. You probably remember the US repo madness of autumn 2019 (right before the pandemic). US is a really specific market that first saw South-East Asian financial institutions (first CBs, then the rest of financial institutions) as a source of marginal demand for USTs, which was followed by Chinese accession into the WTO and the emergence of PBoC as a giant source of UST demand in order to keep the renminbi undervalued for decades. Right after that, hedge funds came as a source of marginal demand since they were playing the basis trade, however apparently that was reduced as well. With FED pushing its QT in a higher gear beginning September and some international investors trying to sell USTs to protect their exchange rates (yes, BoJ, we’re talking about you), we’re still pondering about the emergence of another marginal buyer. With real yields back into positive, global non-banks being underweight, and equities posed for at least year-long recession travails, we think it’s only a question of time before global non-banks start adding more FI longs to their portfolio. Then illiquidity and convexity work the other way around – just to get an impression, yesterday apres BOE QE announcement 20-year gilts moved from 5% YTM to just slightly above 4% YTM.

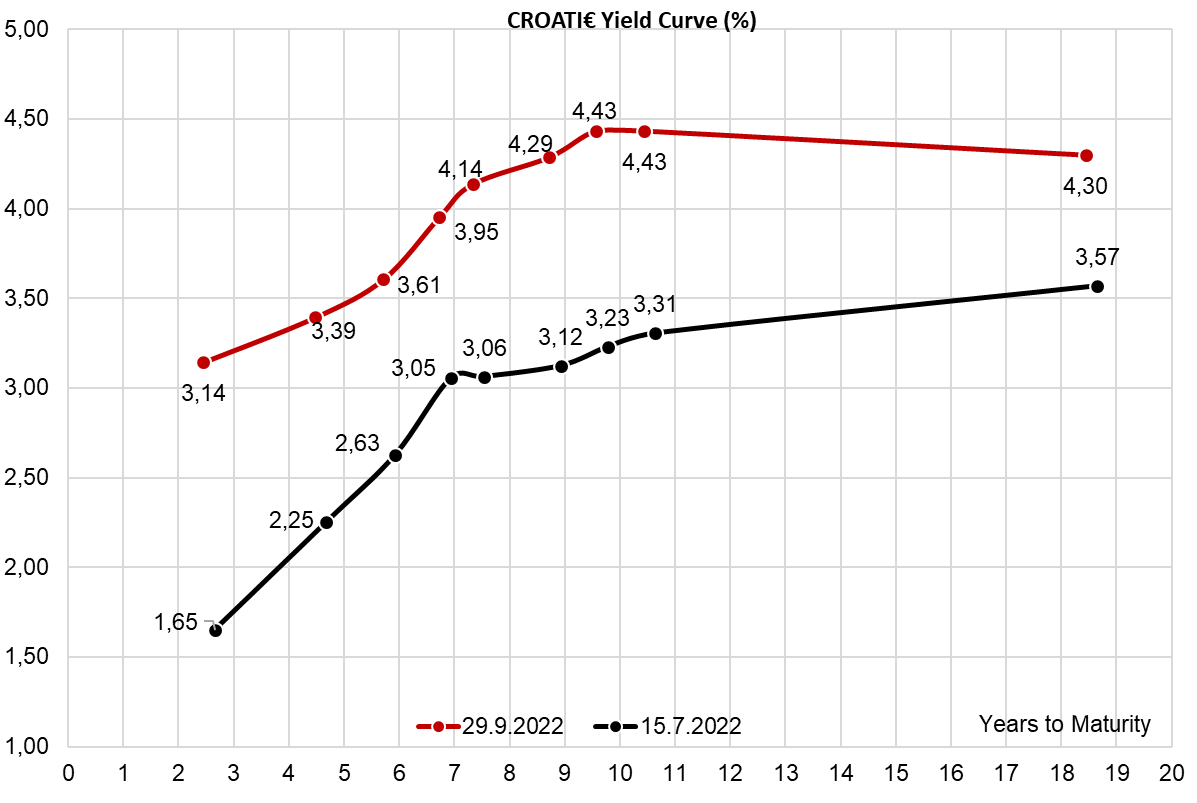

Source: Bloomberg

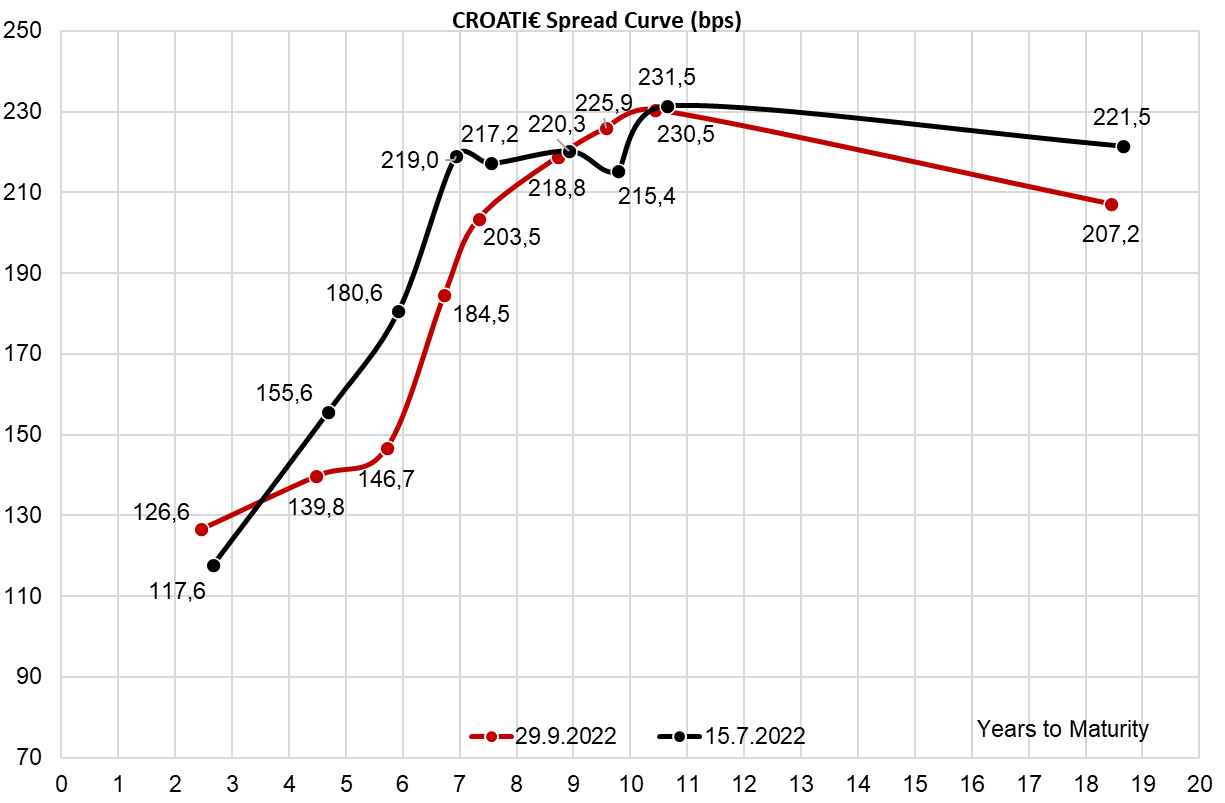

Regarding Croatian international bonds, we haven’t seen much-forced selling, not to mention so-called “puke orders”. Last couple of days we have seen a lot of domestic institutional demand for the belly of the curve (namely CROATI 3 03/20/2027€) which was bought by domestic accounts at 3.30%–3.40% YTM (roughly B+130bps). As you can see from the spread chart below, the CROATI€ long term spread has been well behaved and is roughly at the mid-July levels. The belly of the curve actually records tighter spreads compared to summer levels.

Source: Bloomberg

The reason behind this is the fact that a handful of dealers used the sell-off to close some of their CROATI shorts and we believe two important conclusions might be drawn from recent flows.

First of all, without the outstanding curve shorts bigger sizes of CROATIs might be tougher to sell as we approach the year-end and institutional investors would rely more on interdealer brokers with deep networks of real money accounts to offer execution.

And second of all, the correlation of CROATI€ with the benchmark (German cash bonds) might increase in the coming months. On the other hand, it’s quite possible that in the ultimate quarter of the year Croatian insurance companies come to buy larger chunks of belly of the curve bonds – only time can tell.