FED’s monetary policy committee appears to be set up for one more rate cut at the end of this month. Nevertheless, the minutes from the latest meeting revealed a lively debate behind closed doors about the need to target average inflation rates, instead of nominal ones. This would allow the US central bank to weather periods of slightly higher inflation without the imminent need to pull the plug on expansive monetary policy. The newly exposed monetary fexibility is one more star in the constellation of possibly higher inflation rates in the future, but we need to see actions, instead of just words.

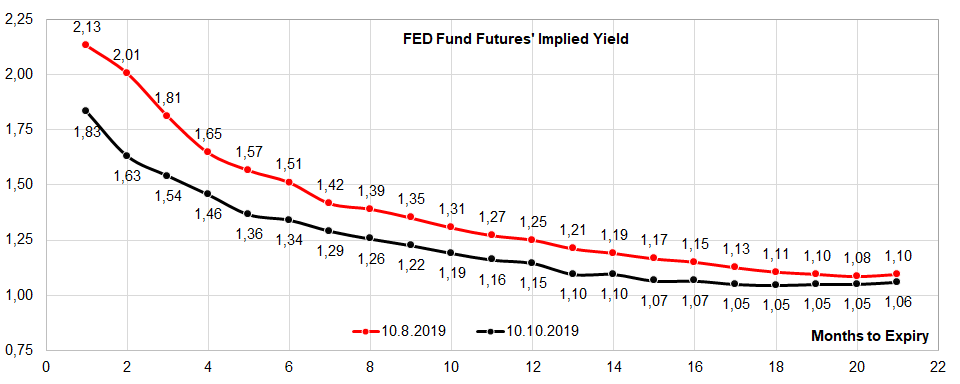

The minutes from FOMC meeting held on September 17th-18th reveal that committee members harbor a wide range of views on the appropriate timing of the rate cuts, as well as communication about the future direction of interest rates. Two things are certain: future monetary policy decisions are “not on a preset course”; and FED’s decision-making process is data dependent, meaning that with the recent ISM flop financial markets are completely right to expect a third rate cut this year on the October 29th-30th meeting (as depicted on the chart below). A handful of participants that favored keeping rates intact said that the FED should react to data, instead of risks. Additionally, the hawks on the committee argued that too much of a stimulus now would leave “monetary policy with less scope to boost aggregate demand in the event that such shocks materialized”.

This part of the minutes was mostly anticipated, but the really interesting paragraph comes once you get to the inflation portion of the report. The persistently low inflation and, more importantly, inflation expectations anchored well below 2.00% (5Y5Y inflation swap @ 1.90%, the lowest since Trump got elected) are changing FED’s attitude towards inflation targeting. According to the minutes, most participants are now open to the idea that the best way to get to 2.00% goalpost is to target the average inflation rate over time. This would give FED more headroom to implement monetary stimulus since committee members would not be worried about short term inflation overshooting the target. Nevertheless, committee members are just starting to debate average inflation targeting and we should watch closely for the future FOMC minutes to see how the policy making process goes.

A similar approach to inflation is also considered by the ECB’s Governing Council and it’s worth mentioning that looking at Europe, it seems that core European countries are preparing for a more meaningful fiscal push. For instance, in the middle of September news began to circulate about Dutch government planing to enact a 50bio EUR infrastructure investment, corresponding to approximately 6.4% of the Dutch 2018 nominal GDP; it’s also worth mentioning that Netherlands is particularly exposed to trade wars and Brexit due to the structure of it’s GDP. Additionally, in the beginning of October heads of three German economics institutes (DIW, Halle Institute for Economic Research and BDI) called for additional fiscal stimulus in the midst of manufacturing recession. To put things into context, the setup for higher inflation expectations is gradually building up, however so far it’s only been talking the talk; bond yields might start to rise once we get to walking the walk part.

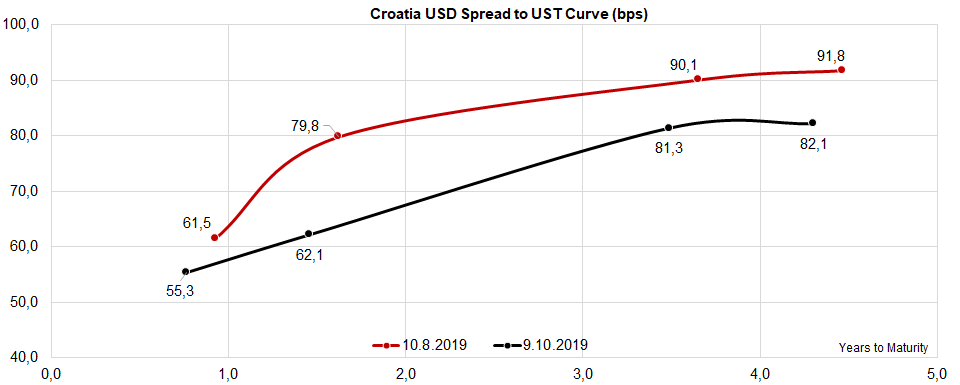

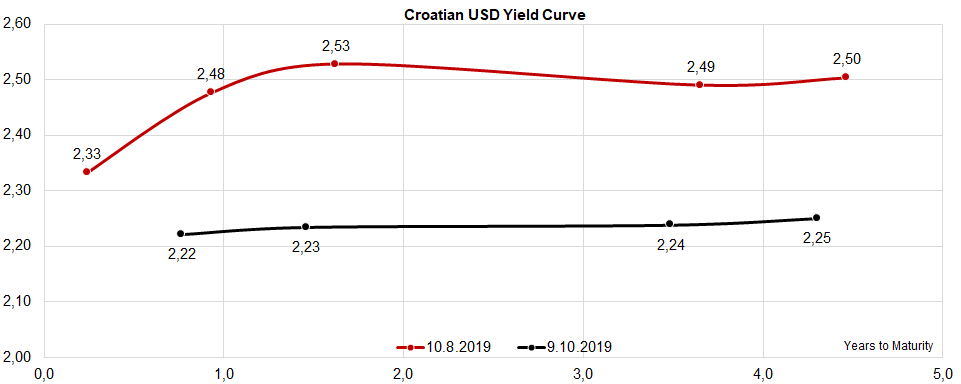

Speaking about Croatian USD Eurobonds, the yield curve is as flat as it gets (it’s worth mentioning that CROATIA 2019 USD has been removed from most of the curves due to maturity getting near). Back in July Croatian banks held about 118mio USD of CROATIA 2019 USD (according to the central bank data) and it’s quite likely that once the paper becomes due, the proceeds might be reinvested along the remaining four USD-denominated Eurobonds. Since the beginning of the year, Croatian banks were net buyers of CROATIA 2021 USD (increasing their holdings by about 40mio USD) and CROATIA 2023 USD (buying a net of about 20mio USD). It’s quite likely that holders of the shortest Croatian Eurobond might once again target these two bonds, nevertheless tight supply will continue making it difficult to buy larger chunks of Croatian dollar debt instruments.