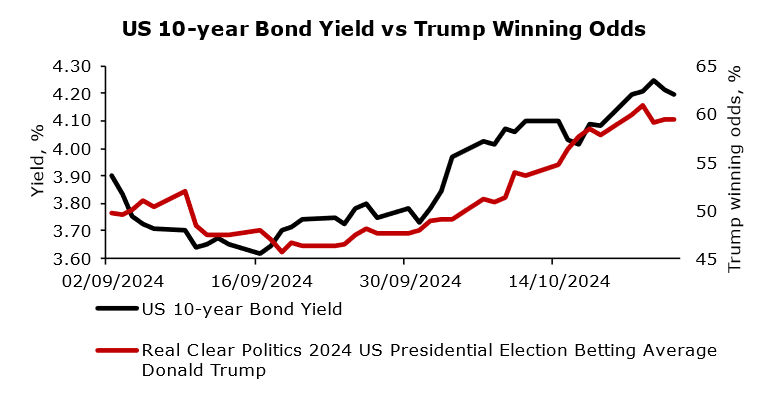

Over the past month, markets have responded strongly to the potential re-election of Donald Trump and potential Republican control of both the Senate and the House. Consequently, markets experienced heightened volatility and priced potential implications of higher tariffs and higher deficits in the next presidential term.

Due to a potentially higher budget deficit in the US in the next presidential term along with potential significantly higher tariffs, markets have lived through significant repricing. The bond market suffered as Israel did not retaliate for the rocket barrage conducted by Iran along with polls showing the strength of the Trump campaign. The first derivative of the potential re-election of Donald Trump leads to a stronger dollar and probably less rate cutting by the Fed due to a higher budget deficit. Tariffs are the main reason for the strengthening of the dollar across the board, trade deficit with China should be lower than over the previous two decades. The major beneficiary of this volatile market and potential old-new US president is gold and VIX sitting well above this year’s average of 15.37. Also, gold is the beneficiary of potential chaos after the election if an event similar to the January 6th Capitol attack is a result of recency bias on the markets. Significant repricing of rate cuts on the OIS market in the US and ECB going down its path (further rate cuts) have significantly boosted the spread between the US 2-year bond yield and Schatz along with the US 10-year bond yield and Bund. I would argue that the 2-year spread is influenced more by the delay or outpricing of the rate cuts by the FED and the 10-year spread with higher deficits and tariffs in the future. ECB and the economic outlook of Europe did not change significantly and most of the recent moves on the markets should be attributed to the US economic outlook, FED, and the US elections. Thus, recent events led to a weakening of the EURUSD currency pair.

However, as election looms and economic data keeps coming higher than expected (US PMI, Durable goods orders) and US 10-year did not make another new low after October the 23rd. One could argue that the bottom is in and that the hedging for Trump win is almost completed and that the risk reward is better for bullish bond trades. However, I would not argue for bottom in 10-year US Treasury in case of Trump winning the election.

In conclusion, the market’s reaction to the potential re-election of Donald Trump and Republican control of Congress has led to notable volatility, with concerns about higher tariffs, increased budget deficits, and a stronger dollar. This has influenced bond yields, diminished rate-cut expectations by the Fed, and affected spreads between U.S. and European bond yields. Gold and volatility indexes (VIX) have surged as investors brace for economic and political uncertainty, especially with recent memories of prior unrest. Additionally, the dollar’s strength points to an anticipated decrease in the trade deficit with China. Despite strong economic indicators, such as the US PMI and durable goods orders, the market appears cautious on bonds. The hedge for a Trump win seems to have largely unfolded, leaving some opportunity for bullish bond trades, yet continued caution on the 10-year Treasury in the event of his re-election is advisable given future fiscal policy risks.

Source: Bloomberg, InterCapital