The main story of the previous week regarding the next Fed meeting and their Inflation path is employment and hiring figures. Considering that the usual inflation indicators in the Fed’s focus are showing slowdown signs towards the 2% goal, labour market indicators are now the key figures to keep an eye on as they are painting a somewhat different picture. Going into the blackout period after Friday’s data release, what should we expect from the Fed’s next meeting?

The moment for the Fed to initiate rate cuts is closely approaching, which is something we are all aware of. What the real question is – what will be the size of their first move? Bureau of Labour Statistics (BLS) released the latest US labour market reports on Friday which have been expected to cast more light on the Fed’s next step at their meeting scheduled for September 18th. The unemployment rate came in at 4.2%, in line with expectations, and lower than July’s 4.3%. To be fair, July’s print was in part influenced by workers who were put on temporary layoff rather than permanent. Furthermore, the nonfarm payrolls report indicates that the U.S. economy added 142k in August which fell below the expected 165k (market consensus). While the jobs growth showed some resilience, it was still a deceleration from prior months, adding to concerns about a potential economic slowdown. Another data that also provides a view on inflation movement is Average Hourly Earnings which came in at 0.4% vs anticipated 0.3% MoM (3.8% vs 3.7% YoY) which only further bolstered some Fed members’ view that inflation is still sticky.

After the data had been released, we heard from two Fed members. John Williams, New York Fed President, spoke immediately after the release of August jobs data and confirmed that he feels comfortable with a 25bp cut, adding that monetary policy is “well positioned” and “on a path” that can prevent undesirable weakness in the labour market. On the other hand, a few hours after Williams Fed Governor Christopher Waller said that “it is important to start rate cutting process at next meeting”, adding that “if the subsequent data show a significant deterioration in the labour market, FOMC can act quickly and forcefully to adjust monetary policy”, opening the doors for a possible 50bp rate cut. So, in terms of whether to expect a 25bp or 50bp rate cut, this jobs report hasn’t provided an obvious signal. The headline figures aren’t bad enough for the Fed to initiate a 50bp cut, but on the other hand, with revisions of the numbers pending, it seems that it is not enough to completely put a 50bp cut off the table. Instead, we now have a 50-50 situation and something that the Fed will be sweating over until September 18th.

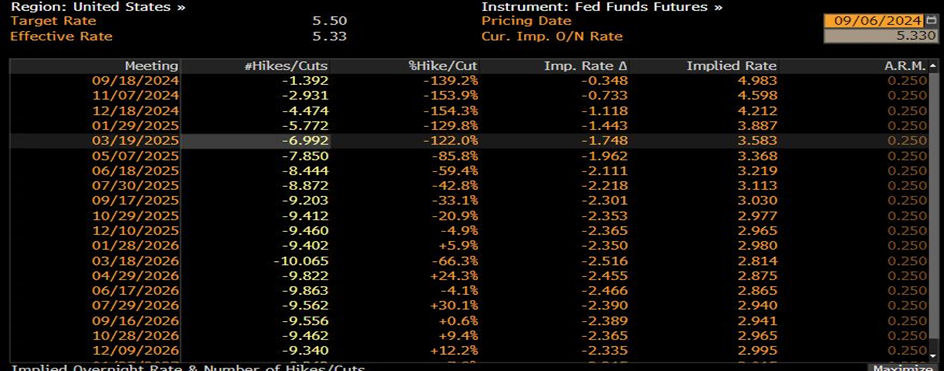

World Interest Rate Probabilities (WIRP) showed market expectations on future rate cuts after Friday’s prints:

Source: Bloomberg, InterCapital

As previously mentioned and demonstrated in the picture – the market anticipates one 25bp cut with about a 50% chance of another 25bp at the Fed’s next meeting with the story being pretty much the same for the Fed’s November meeting, so it is not impossible that we really do see 50bp cut. Bund saw some volatility after the data release and Fed’s members’ statements, but pretty much remained at the level of 134.60, in line with the opening on Friday.