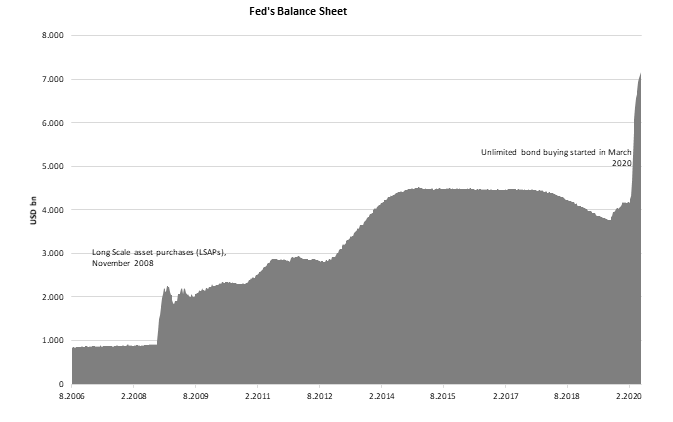

Last week Fed published interest rate projections that showed Fed fund rates should stay close to zero for the next two years. However, markets went risk-off due to fear of second wave of corona virus in China and rise of cases in biggest states in US. After equity indices corrected by 10%, Fed stepped in again saying that it will start buying individual corporate bonds and make its own fund, giving markets another injection of optimism which tightened spreads and pushed equity markets closer to their highs.

One week ago, the Fed left its policy unchanged but published its interest rate projections which show that most of the officials expect fed fund rates to stay at their bottom for the next two years and even beyond. Furthermore, analysts which hoped yield curve control could be introduced were not disappointed as Fed’s governor Jerome Powell stated that there was some discussion on yield caps. Until that day, June 11th markets have been skyrocketing with SPX jumping above 3200 levels, being in green YTD. However, fear of second wave in China and acceleration of new cases in Texas, California and several other states in US pushed investors into risk-off sentiment once again. On that day, major US equity index fell by almost 6.0% with 499 out of 500 stocks being in red while on Monday we have seen another round of selling as news from China and US worsened further. But on Monday Fed stepped in again.

On Monday, FED announced it “will begin buying a broad and diversified portfolio of corporate bonds to support market liquidity and the availability of credit for large employers”. In short, they will start buying individual corporate bonds (under its SMCCF program) with maturity of up to 5 years that are investment grade or being investment grade on March 22nd (fallen angels). SMCCF (Secondary Market Corporate Credit Facility) is one of 11 facilities that Fed uses to provide liquidity and stabilize prices and was already introduced in March when Fed stated that it will start buying corporate bond ETFs. Now the only change was that it will also create its own portfolio of individual bonds. When asked about corporate bond buying, Mr Powell said that “I don’t see us wanting to run through the bond market like an elephant snuffing out price signals”. Nevertheless, that was signal for market to go bullish once again, resulting in equity indices recovering from their recent correction.

On top of that, in his semi-annual testimony before US Congress, Mr Jerome Powell stated that Fed officials were looking into details on Reserve Bank of Australia and BoJ which implemented yield curve controls. Just to put things into perspective, BoJ had yields capped even before corona while RBA targets yield on 3-year Australian government bond at 0.25% with cash rate being at the same level. Bearing that in mind, Mr Powell said that Fed still did not decide to choose this tool but indicated that they might use it on some part of the curve if needed. That statement further strengthened Fed’s forward guidance provided on their meeting last week. Going on, Fed’s governor Clarida in his speech said that aggregate demand will decline relative to aggregate supply in near and medium term meaning that deflation trend could continue.

To sum it all, Fed continues with extremely loose monetary policy and its unconventional tools although we have seen some recovery in economic data. As recovery accelerates Fed could decrease number of used tools but in case of another wave and economic shutdown, more policies could be involved. Markets ask what is next? If they will be following Japan, equity buying is close.

Source: FRED, InterCapital