Fixed income deluge continues in the coming week as a plethora of sovereigns and corporates come to the market to lock up funding. Demand for paper is ample and nearly all placements ended up with grey market prices above reoffers, regardless of the direction Bund took. Which other placements can we expect? Find out in this brief research piece.

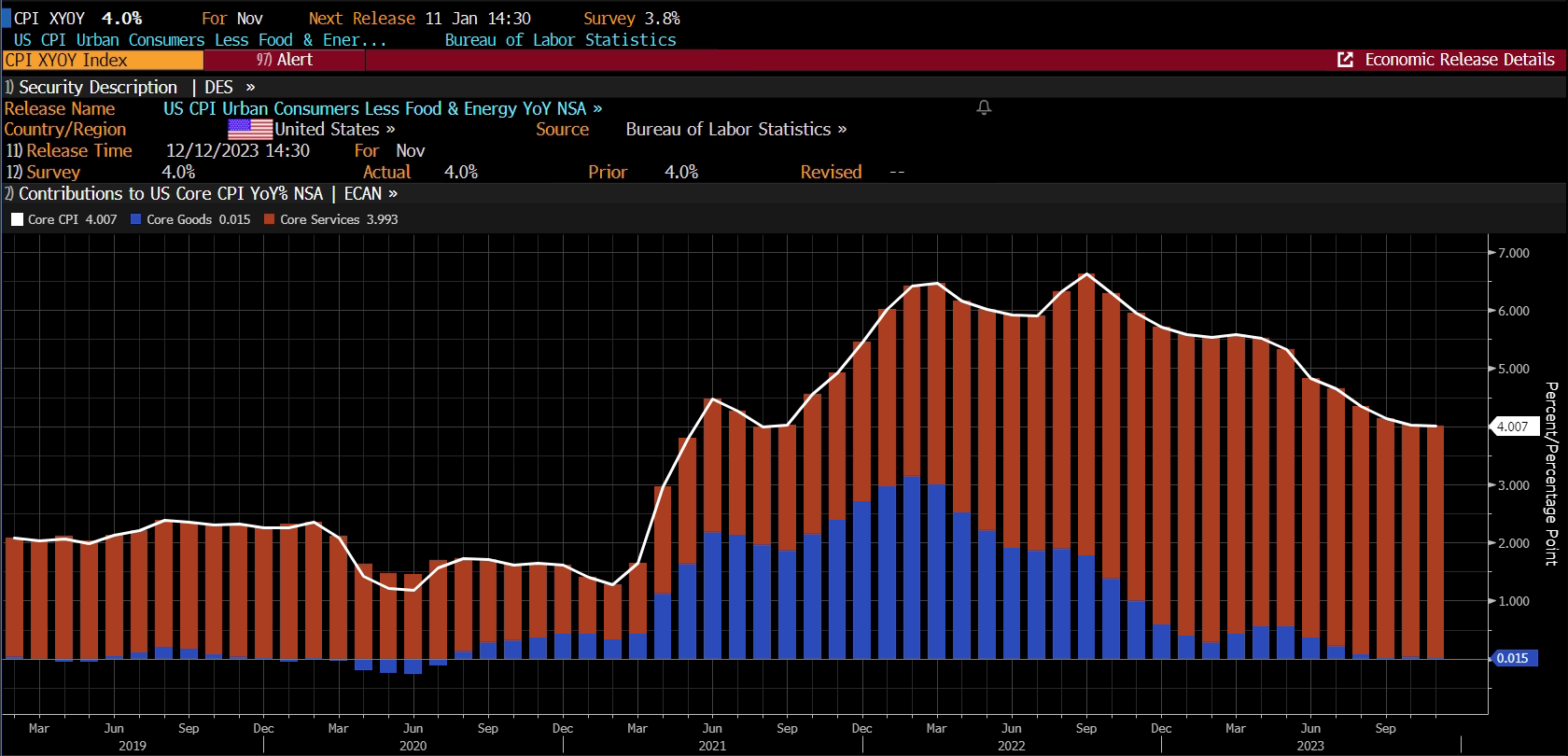

Regarding fixed income markets, the opening days of 2024 have been similar to early January weather – cold and harsh. Yields on the long-term paper reversed course in the last two days of 2023 and have continued to rise ever since. Last Friday the ISM figure managed to override the labour market data and pushed yields even higher in the process. Today we have another piece of hard data coming from the US, namely the December CPI print. We advise focusing on the core component because this is where sticky inflation continues to bite. The new print that would be delivered today at 14.30 CET has a consensus estimate of about +3.8% YoY (Bloomberg), which is some 20bps lower compared to the December read. So far the trend looks like this:

In plain man’s English, the recent drop in core CPI came almost exclusively from goods inflation (diminishing blue area) and so far the only way core can get to +3.8% YoY is if core goods disinflation turns to deflation. This is not impossible, but we deem it improbable. It’s quite likely CPI core prints +4.0% YoY, equal to the November print and bond yields might continue their march up.

The beginning of the year was also marked by immense bond placements by euro-area countries that were followed by historically high bid-to-cover ratios and book sizes. Just to get a feeling of the market, yesterday’s 10bn EUR placement of SPGB 3.25 04/30/2034€ at 3.25% YTM (existing 33s+9bps) was met with an all-time high demand of 138bn EUR versus 15bn EUR placement (bid-to-cover of 9.2x). Placed at 99.92 reoffer, it’s now traded at 100.50 (3.19% YTM), which is still some 6bps above the existing SPGB 3.55 10/31/2033. Some tightening did occur, but there might be more to go through.

Apart from Spain, Poland placed a dual tranche last week: 2.5bn EUR POLAND 3.625 01/11/2034€ at DBR 2.6 08/15/2033€+158.1bps (3.716% reoffer yield and 99.25 reoffer price) that was met with a 6.2bn EUR book (2.48x bid-to-cover) and is now traded at DBR 2.6 08/15/2033€+147bps (11bps tighter); and 1.25bn EUR POLAND 4.125 01/11/2044€ at DBR 3.25 07/04/2042€+178.1bps (4.175% reoffer yield and 99.331 reoffer price) met with 3.4bn EUR book (2.72x bid-to-cover) and is now traded at DBR 3.25 07/04/2042€+167bps. What’s even more interesting is that this spread tightening (10bps in both cases) came against the backdrop of the political crisis in Poland that has yet failed to override the sound fundamental story. Slovenia, Estonia, Hungary, Belgium and Italy also placed their paper and were met with ample demand, while Ireland is expected to place a 10Y paper today at razor-tight MS+1bps and it’s quite likely that bid-to-cover could again exceed 14.0x (42bn EUR book versus 3bn EUR placement).

So what do we expect going forward? The recent placement of T2 instruments by Belgian KBC and Greek Piraeus Bank might be bellwethers for other regional banks. Piraeus (B+ by Fitch) for instance placed a 500mm EUR 10.25NC5.25 at 7.375% and was met with a 1.5bn EUR book (3.0x bid-to-cover). Regarding sovereign paper, it’s reasonable to expect Romania to place soon, but don’t be too surprised if the SEE country goes with a greenback issue since USD paper trades at 224bps G-spread, while the EUR paper is traded at 362bps spread. The nearly 140bps difference is the reason why any minister of finance would be looking at the American market to get cheap funding, especially in times of higher interest rates. Due to the funding needs of the Romanian treasury, it’s quite likely that both EZ and US markets would be tapped this year, but it’s quite likely that first they touch US market and get a decent size cheaply, and then go to the EUR markets later in the year. As a matter of fact, something similar has already been done by Hungary last week.