This week marks an era as ECB ended its net asset purchases. Furthermore, in three weeks, we will see ECB lifting its rates by at least 25bps while in September rates could be lifted by 50bps or even more. In this brief article we are looking at the history of bond purchases in Europe and what could we expect next on monetary policy.

At the end of last year, Ms Lagarde stated that rates are unlikely to be lifted in 2022. Back then it was expected that PEPP could be ended in March 2022 but there were some speculations that PEPP could be replaced by some other program that will not have ‘pandemic’ in its name. APP was not expected to end any time soon. Six months later, PEPP net purchases are history, APP net purchases ended this week while rates are to be lifted in three weeks’ time.

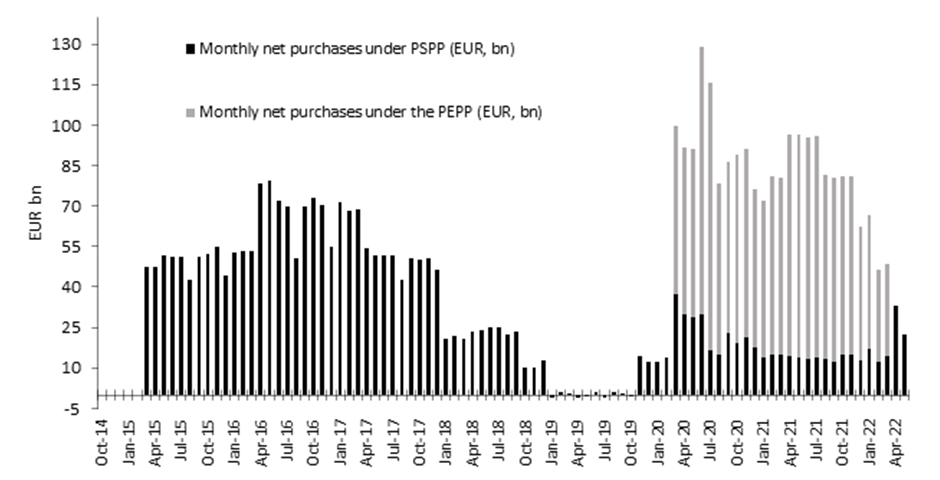

We are all aware of changes that occurred in the last six months so we will skip a summary on inflation and recession worries. However, we think it is worth our while to look at the history of APP and what was the driver of ECB’s decisions in the past. In October 2014, ECB first started buying asset-backed securities and covered bonds (the first program was conducted in 2009 but lasted only a year), and shortly after (March 2015) started buying sovereign and corporate bonds. The program was implemented due to subdued inflation and slow growth in the euro area. As inflation and growth started to accelerate slowly, the APP program was decreased at the beginning of 2018 from EUR 60bn a month to EUR 30bn a month. In May 2018 Euro Area’s inflation stood at 2.0%, peaked at 2.3% in October, and already in December of 2018 stood at 1.5% as the industrial recession in Germany weighed on the European economy strongly. Nevertheless, ECB decided to end APP in December 2018 but continued reinvesting redemptions. Only 11 months later, ECB had to step in once again as economic slowdown was obvious while inflation was close to 0.5%. Since November 2019, ECB has been buying EUR 20bn worth of bonds until this week with minor increases after the close of PEPP. Of course, the program was increased dramatically in corona crisis with PEPP program under which ECB bought an additional EUR 1.85bn worth of bonds. To sum it all up, in the period since October 2014, ECB bought close to EUR 5tr worth of bonds which are all basically to be rolled for an extended period. In Chart 1., the monthly pace of ECB’s net purchases of sovereign bonds is presented.

Chart 1. ECB’s net asset purchases of government bonds

Talking about APP, this week we have heard from MS Lagarde at ECB’s Forum on Central Banking in Sintra in which she said that end of net asset purchases is a done deal and set in stone that ECB will be lifting rates by 25 bps in July’s meeting. Nevertheless, the market was focused on her notes regarding anti-fragmentation tool. Unfortunately, ECB’s governor only confirmed the written statement from the ad hoc meeting of the ECB Governing Council that occurred on June 15th when the Italian 10Y paper overjumped 4.0% and its spread versus benchmark almost touched 250bps. The statement said that ECB will apply flexibility in reinvesting redemptions in the PEPP portfolio meaning that when reinvesting the principal, ECB could buy more BTPs, SPGBs or GGBs against some core countries to ‘close’ spreads. Furthermore, there is special Eurosystem Committee formed to design this new anti-fragmentation tool that should be released to the public by July 1st, as stated by Ms Lagarde in Sintra. There were also some articles in the media that ECB could go into QT on core bonds i.e., that ECB could start selling core bonds outright to buy more peripheral papers. However, no official confirmed the speculation.

Talking about core countries, yesterday we saw another volatile day on bund although we are getting used to 200pips moves. Namely, yesterday we saw North Rhine Westphalia region being the first to report June inflation data and it surprised the market on the downside. At 6.30 in the morning bund futures price skyrocketed in a minute by almost 200pips with liquidity in the early morning being close to zero. Nevertheless, 2 and a half hours later Spanish report surprised markets on the upside with YoY CPI being at 10.2% compared to 8.7% in May while in MoM terms it stood at 1.8% (full 1.0% higher compared to 0.8% MoM in May). Spanish surprise pushed investors to sell bund once again and futures lost all the gain from the early morning. And after lunch, we got the data from Germany which showed that inflation decelerated in Germany, but it seems that both rise of inflation in Spain and the fall in Germany reflect temporary factors such as short-term policies by the government.