Many seasoned EURHRK traders stared talking about their inner compass not working any more – in a weird year like this, it was quite easy to be on the wrong side of the trade. Well, at least 2020 is close to being over. What can we learn about the EURHRK trading régime in these final trading days and what 2021 might have in store for us, find out in this brief article.

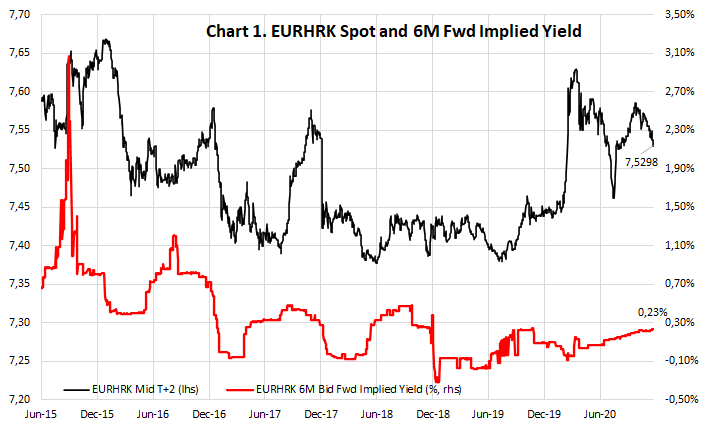

This year has definitely been annus horribilis for FX traders closely watching EURHRK – full of unexpected twists and turns and accompanied by movements atypical for a particular part of the year. As Chart 1. might suggest, the exchange rate was elevated for most part of first semester and only managed to dip below 7.55 in early July when it became clear that domestic economy will record at least a part of previous year’s tourist inflows. Too add more to our travails, we all grew too accustomed to a seasonal move of euro steadily appreciating versus kuna in the last quarter of the year, but this year we fell short of our expectations: between mid-October and beginning December 2020 EURHRK dropped by 550 pips peak to through and currently trades below mid-level of CNB’s ERM II target band (mid @ 7.5345, versus the current market mid around 7.5300). So what’s going on?

In our opinion, the single most important driver in recent days that contributed to this EURHRK dip was a large syndicated loan taken by the Croatian motorway operator in early December (a more detailed description could be downloaded here). The syndicated 12Y loan was earmarked at 120.9mm EUR and it would be used by the company to pay off old borrowings from the German development bank KfW. The syndicate is composed of three lenders: two domestic commercial banks and Croatian Bank for Reconstruction and Development (CBRD). For all three members of the syndicate this is a completely new credit facility and since we’re talking about a EUR-pegged loan, this credit arrangement would have extended their long EUR position if left unhedged. This of course warranted some EURHRK selling in order to keep their position unchanged. For the purpose of explaining the following FX implications of the syndicate, we shall break the loan down into two components: the EUR-linked component supplied by the two commercial banks (62mm EUR, each bank bearing half of it, 6M EURIBOR + 115bps floating interest rate) and a local currency component supplied by CBRD (the remaining roughly 59mm EUR, 1.8% fixed interest rate).

The 62mm EUR component of the commercial banks is a no-brainer: the two banks had to sell EURHRK to remain hedged and judging by the word on the street, this hedging trade has mostly been unwound already (it’s passé). Now we’re waiting for the other shoe to drop: it’s quite likely that in the remainder of the year the motorway operator might contribute to the EURHRK upside because the old KfW loan has to be repaid and settled in euros. At least half of the new syndicate (the CBRD component) is in local currency, meaning that this new credit facility would create EURHRK demand in the final weeks of 2020 and opening weeks of 2021. With target refinancing date set at last working day of the year (31st December 2020), it actually makes sense to be long EURHRK into year end. This is truly atypical and many EURHRK traders got too accustomed to being short into year end, collecting carry and waiting for the summer season and tourist inflows to bring the exchange rate down.

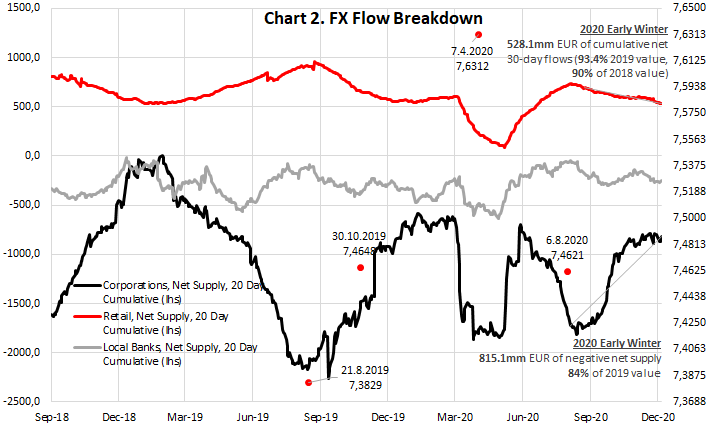

Other factors show weakness of euro inflows into year end, but the weakness is not so pronounced. As Chart 2. would suggest, on December 11th the 20-day cumulative net selling by retail clients (calculated based on CNB’s N4 table) was on 93.4% of the value recorded on the same day last year and only 90% of the value two years ago. Naturally, remittances from abroad are going to be weaker because most of the Europe is still in lockdown, however we’re not seeing a dramatic shift which would warrant higher exchange rate. There is of course the other side of that coin: remittances are obviously slightly weaker, but next year’s retail demand for euros to pay for skiing expenses would also be much slimmer. Looking at the corporate side of the market, net cumulative corporate demand has also been slightly weaker, coming at 84% of 2019 value. It’s worth remembering that this figures should only be used to roughly sketch the interplay of corporate demand and retail supply, but they could not be considered comprehensively since they only include spot transactions (no data on FX forwards is presented).

So where exactly does that leave us? Feedback from the dealing rooms points out that market depth has been much weaker this year because FX volatility observed in March/April drove many market speculators to scale down their positions. Besides that, fundamental flow coming from imports and exports has also been softer than previous years, contributing to a shallow FX market. What was once a lake is now a pond in which any large order drives the exchange rate sideways. Beginning August a 45mm EUR buying order from one Croatian corporate marked the seasonal low of EURHRK exchange rate and drove the exchange rate a couple of hundreds of pips higher. A replay of this episode might be expected in the following weeks, with different corporate in the leading act. However, most of the seasonal FX traders point out that big money would not be made on being long EURHRK because this is the carry negative trade – instead, the real juice comes from correctly predicting a peak and going short on that level. The short EURHRK is carry positive and is predicated on vaccine availability bringing things as close to normal as possible before the tourist season begins. A lot of traders are now trying to “sell the strength/short at highs” and this is the reason why we hardly see EURHRK above 7.60 in the near term. However, it might not be a bad idea to wait for a while and scale your bets because EURHRK dip would probably not be abrupt and it’s quite likely that that exchange rate would move sidewys in a narrow range until after Easter. Between New Year and Easter it’s even possible that short term drivers we aren’t even able predict could move EURHRK as close to 7.60 as possible, opening up new possibilities to scale up short EURHR trades.

Traders have been using the French word régime to describe the complex interplay of fundamental, flow-based and technical factors driving the price of a certain financial instrument. We would like to point out that the original meaning of the word régime was nutrition or diet. In the context of currency pairs, the trading régime would mean either eating carry and paying for it by realized volatility (one trader said: “Carry is what you get paid for having the wrong position“), or paying carry to someone else in order to score on volatility moving your way. Selling EURHRK in winter months has been a very nourishing régime: it was almost a safe way to score both on forward points (if entered at the right time) and volatility. Then March 2020 happened with an unprecedented short squeeze, so traders are now much careful about scaling their bets.

Could it be that in 2021 we might return to a normal EURHRK diet? Well that looks quite likely at the moment, but meanwhile we have two more weeks to go in this clearly atypical 2020 and awkward years require unconventional trading diets. It looks like being long EURHRK in the following weeks is a smart thing to do – but bear in mind that a lot of traders out there are looking to feed themselves off short EURHRK and all that good old positive carry and volatility. When January 2021 starts brace yourself for more EURHRK dips.