If you were puzzled by yesterday’s FOMC meeting, you’re not alone. The feeling in the air is that we have just went past the inflection point of restrictive monetary policy. Is this just one more episode of capricious behaviour exhibited by the bond markets, similar to rates bonanza of summer ’22? It looks like this time it really is different because this time the signals are coming from the corridors of central banks, instead of asset manager’s flows. What does it mean for the fixed income market overall? You’ll just have to skim read this brief research piece to find out.

If you glance over research headlines preoccupied with yesterday’s FOMC, you will notice that nobody mentions the words “hawkish” and “dovish” anymore, the reason being that the overall message from the committee was mixed. True, the sentence about “ongoing increases” was dropped in favor of “some additional policy firming may be appropriate” (this is dovish). True, the median 2023 dot hasn’t moved down and it’s still at 5.125% (this is hawkish). Finally, during the Q&A session, Powell admitted that the committee was discussing a pause after yesterday’s expected 25bps hike (to 4.75%-5.00% target band).

In addition to yesterday’s monetary policy tightening, we would like to add two remarks about the current state of monetary policy. A couple of days ago Apollo’s Torsten Slok said that the recent deterioration of AT1 instrument liquidity had an impact equivalent to +1.50% of rate hikes and the market assumes this is not a made-up number. Slok’s remark adds more credence to the hypothesis that the FED might have even overtightened in this cycle and that if AT1 conditions don’t improve (for banks, not for the holders) credit activity is going to deteriorate to such a degree that the rate cuts might become appropriate. Financial markets are buying into this hypothesis and that’s the reason SOFR swaps are pricing rate cuts as early as in mid-summer:

Notice that we have a month and a half until the next FOMC meeting (May 03rd), meaning that plenty of hard economic data will be made public before the committee makes its next rate decision.

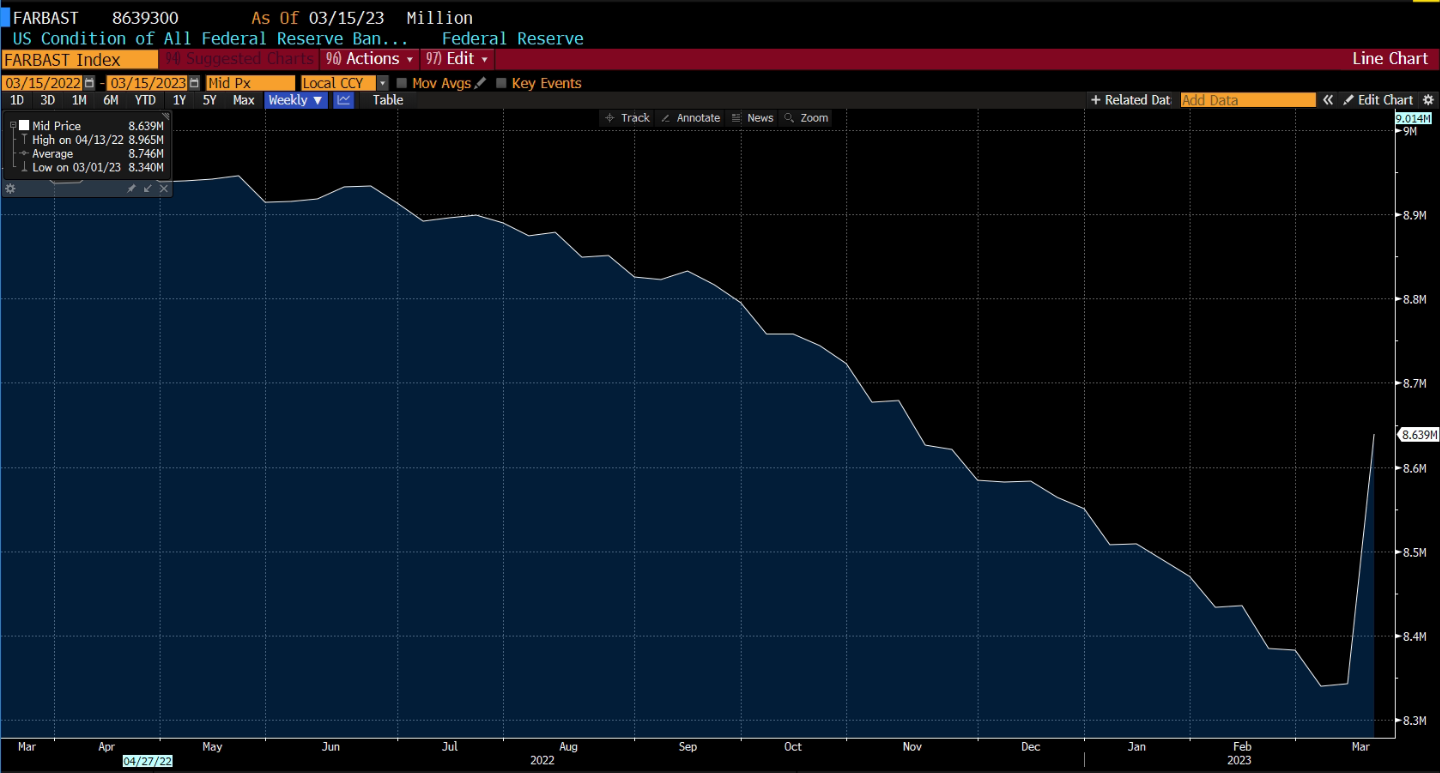

There is a small caveat to this notion that the next move in interest rates will be down. To understand our second addition to FED’s statement, take a look at FED’s balance sheet:

The introduction of new instruments to boost US regional banks’ liquidity could mean only one thing: balance sheet expansion is back in the game. The collapse of a few regional banks such as Silicon Valley Bank (notorious SVB) forced FED to introduce additional liquidity-boosting instruments that inflated the FED’s balance sheet by 300bn USD in merely two weeks of application. Essentially, B/S is back where it was beginning of November 2022, i.e. only two months of QT are left over in the current B/S size. This is an important thought to bear in mind when thinking abut monetary policy across the Atlantic: FED is raising rates, more hikes may be appropriate, but the B/S is expanding in order to provide liquidity for the ailing banks. This feature should provide support for both IG and HY papers, especially if it lasts for a couple of months.

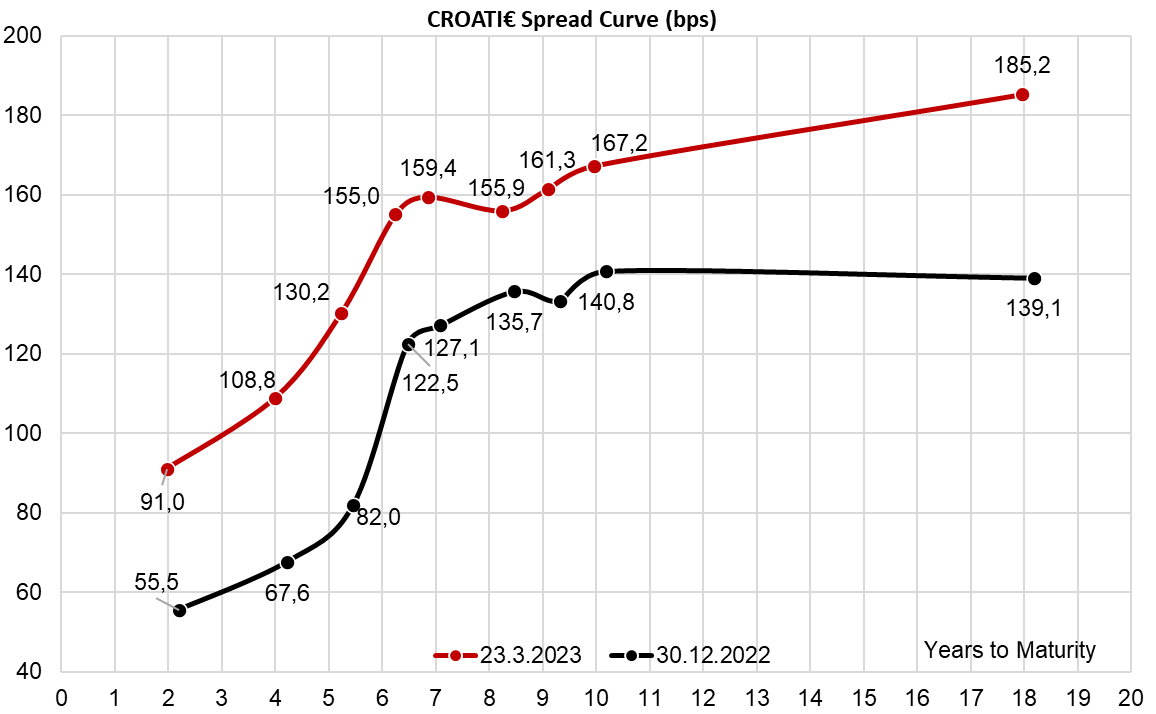

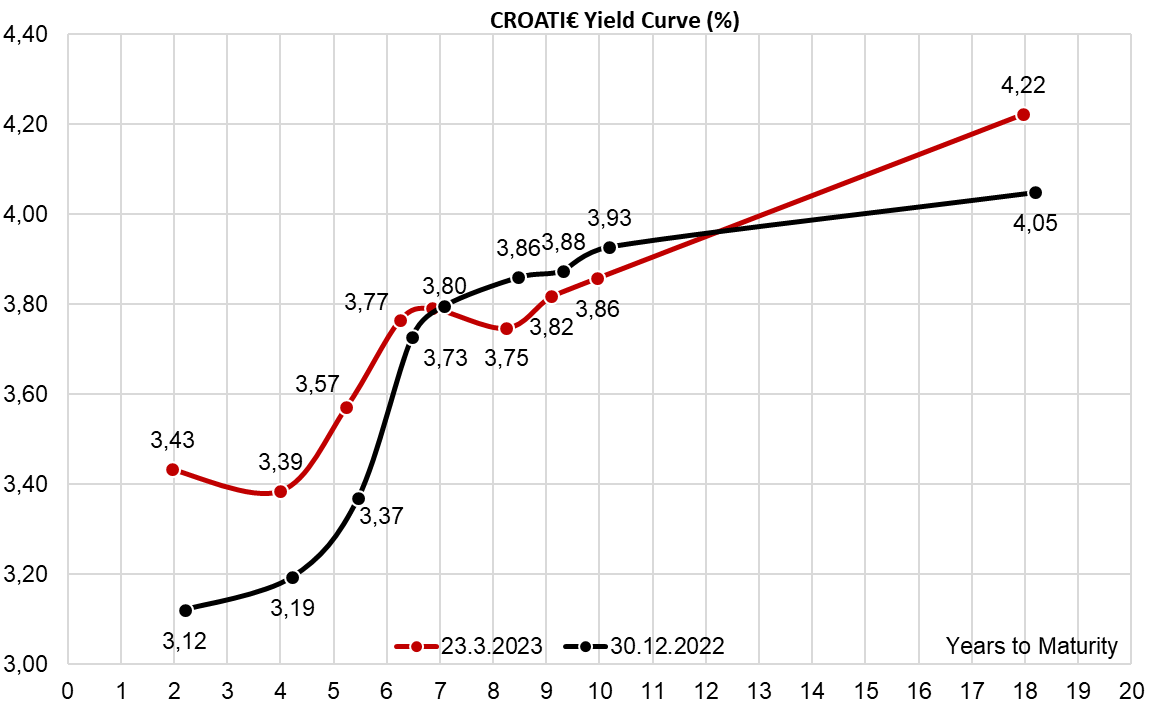

To compress these 400 words into one brief and precise sentence: cash bonds will be supported and are now set to outperform (ceteris paribus) while the spreads (G-spread, I-spread etc.) are expected to be contained and even contract. This conjecture also comes against the backdrop of most CEE countries front-loading a larger part of their financing at the beginning of the year, anticipating that the rates might go higher as summer approaches. There is a handful of countries that still haven’t placed any paper this year and Croatia is one standing out. So let’s take a closer look at the prospect of Croatia placing an international bond any time soon.

Beginning in March Croatian Ministry of Finance placed a 2Y retail bond in size of 1.85bn EUR at 3.65% YTM, roughly two-thirds of the notional going into the hands of households. The proceeds would likely be used to pay off the 1.5bn USD (1.04bn EUR after the FX swap executed at the time of the placement of paper) international bond maturing April 04th. On May 04th some 1.04bn EUR of gigantic T bill (ISIN HRRHMFT318F8) also becomes due, meaning that in the coming seven weeks the Ministry of Finance has some 2.08bn EUR of maturing bonds – and this is 230mm EUR higher than the proceeds received from the retail bond. We believe the Ministry would use the proceeds of the retail bond to cover the international bond settlement (April 04th), while the large T bill would be refinanced by a new international bond placed in April. We don’t believe the T bill would be rolled over into a new local instrument because this particular paper was ideal for banks’ ALM departments back in the days of Croatian local currency; with the introduction of the euro, this particular T bill has no particular value to banks’ ALM departments. With this notion in mind be ready if news about Croatian international bond placement crosses the wires and in the meantime, check out where the existing Croatian eurobonds are traded on the two charts we submitted in this blog.