On its yesterday’s meeting ECB decided to continue PEPP buying at moderately lower pace compared with two previous quarters, but Ms Lagarde said it is not taper but recalibration. In any case, ECB did something in the opposite way we are used to see although any real tightening of the monetary policy looks miles away. In this brief article we are looking at the brief past which led to this monetary policy meeting and what to expect further.

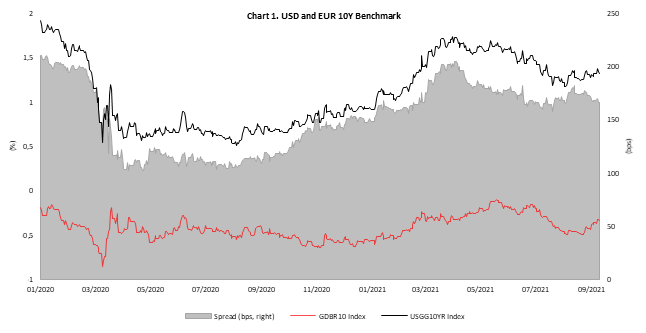

On July 8th ECB concluded its first strategy review in last 17 years on which it decided to adopt symmetric 2% inflation target over the medium term rather than keeping old target „close but below 2.0%“. However, more important news for markets came two weeks later at the monetary policy meeting. Namely, in their statement, ECB said that “the Governing Council expects the key ECB rates to remain at their present or lower levels until it sees inflation reaching two per cent well ahead of the end of its projection horizon…” and “…until it judges that realized progress in underlying inflation is sufficiently advanced to be consistent with inflation stabilizing at two per cent over the medium term”. Markets saw this statement as dovish as it is because ECB put itself in wait and see mode for a bit longer or at least to ensure that inflation proves transitory. EUR 10Y benchmark yield reached -0.50% level in August, level last time seen in the beginning of February 2021 when reflation trade accelerated.

Meanwhile, inflation in eurozone kept rising and reached 3.0% YoY in August 2021 (published on August 31st), being at the highest level since November 2011 while inflation expectations measured by 5y5y inflation swap breached 1.70%. Simultaneously, revised GDP data showed that eurozone growth stood at 2.2% QoQ compared to 2.0% on the flash estimate with personal consumption expectedly being at the front wheel. Economies opened in large extent, but delta variant cases are still increasing in many of the eurozone’s countries which is still one of the strongest cards in the dove camp. However, after the inflation print, most prominent hawks became louder and publicly started to question PEPP calling it ‘pandemic’ program and not ‘permanent’. Since the end of August yields were rising once again as markets started to price in higher inflation that could drive ECB into announcing end of PEPP or disconnect APP with rate hikes.

Talking about end of PEPP, it seems like markets were too worried and thought that ECB could become more hawkish while it is actually one of the most dovish central banks in the world. Namely, on its yesterday’s monetary policy meeting ECB did announce a bit slower PEPP buying compared to last two quarters when it was buying close to EUR 80bn worth of bonds a month through PEPP only. This means that ECB could buy EUR 60-70bn through PEPP and another 20bn through APP a month until March 2022. However, we still did not find out whether PEPP will end in March 2022, or it will be recalibrated to some form of APP to keep fulfilling ECB’s first mandate of price stability. ECB did increase their inflation forecasts and now it expects inflation to reach 1.5% in 2023, 10bps higher compared to last forecast.

To conclude, ECB could announce end of PEPP in March 2022 but at the same time it will most likely increase APP or introduce new program to reach its mandate and to keep yields at these depressed levels as long as needed, especially when there are chances of political change in Germany which will most likely be keen to higher deficits and larger support from the ECB. On the other hand, combination of loose fiscal and monetary policy could mean too much inflation and overheating. So, ECB could have one more thing to put in their growth of the economy – inflation puzzle.

Source: Bloomberg, InterCapital