Today’s monetary policy meeting of ECB’s Governing Council should be classified as a non-event. However, market will be interested into Ms Lagarde’s speech and her comments on rising inflation and short-term rates expectations. Furthermore, market will look at any hints on how ECB plans to replace its PEPP program.

With their balance sheet being higher than ever and rates being lower than ever, every step by central bankers is watched with much scrutiny. Although market does not expect Ms Lagarde to announce any changes on today’s policy meeting, this event is still the main dish of the investors’ week as Ms Lagarde has several tasks today. First, she should push back market’s expectations that EUR interest rates will be lifted already in 2022 as Euribor futures show. After BOE’s governor stated that central bank will have to act against inflation, markets started to price larger rates in UK but there were some spillovers into EUR and USD, i.e., 3M Euribor maturing in December 2022 decreased by more than 10ps. Several ECB officials led by chief economist Lane already commented on the topic saying that markets did not “fully absorb rate forward guidance”.

Next, Ms Lagarde could slowly start introducing new program that should replace PEPP once it ends in March 2022. PEPP’s envelope of EUR 1.85bn will most likely be used in full until March 2022 and the latest data show that ECB did not slow down purchases after September’s meeting although they announced slower purchases compared to Q2 and Q3. Market expects ECB to announce new program in December 2021 which would ensure smooth transition from PEPP and favorable financial conditions for eurozone beyond March 2022. However, the main question is how much flexibility ECB wants to leave for the new package. Capital key, monthly pace, Greece, just to name a few. We expect ECB to include Greek bonds into purchase programs going further and to leave capital key flexibility like PEPP. However, new package could be only ad-hoc rather than having projected monthly purchases. More on that most likely only in December. Talking about ECB’s tools, we should mention TLTRO also, as ECB will have to prepare new tranches of the program to avoid any liquidity issues.

In the end, market will look at Lagarde’s comments on inflation risks, as last time she said that risks were broadly balanced. After the last meeting, energy prices continued rising strongly, while CPI growth did not show any signs of decelerating. Nevertheless, ECB’s stance is that most of the inflationary shocks were only temporary, and it sees inflation to drop below 2.0% already next year. Their forward guidance on rates stated that rates will remain at current levels or lower until inflation reaches 2.0% well ahead of the end of projection horizon which could be forever. Their guidance leaves room for ECB to keep saying inflation is transitory for few years if they see it applicable.

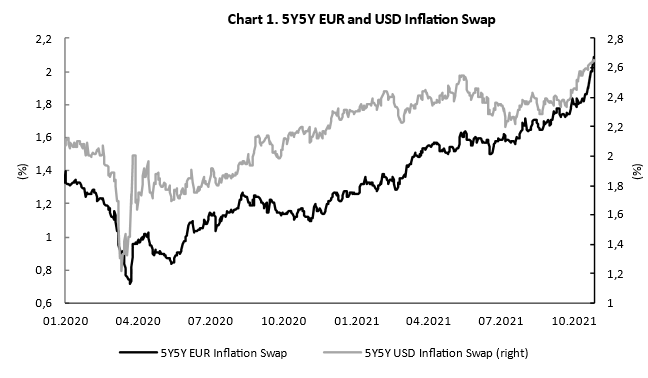

However, looking at 5Y5Y inflation swap that looks at 5Y average inflation beyond 2026 which is above 2.0%, it seems market does not believe ECB. Lagarde could leave inflation expectations to increase unlimited as financial conditions are still under loose and control, but we think that would be mistake as increased expectations would lead to self-fulfilling prophecy. So, ECB’s governor will most likely try to ensure market that slower wage growth, normalization of supply chains and energy costs will leave CPI below 2.0% in 2022 and curb inflation expectations.

Source: Bloomberg, InterCapital