So far, 2024 turned out to be an amazing year for Slovenia, with several regional and global indices reaching their all-time high values. In this blog, we’ll review development in Slovenian capital markets, as the year is almost finished.

First, to kick off this blog, let’s put Slovenian equity performance in relation to other regional peer indices, as well as global ones.

YTD 2024 performance of select indices

Source: Bloomberg, InterCapital Research

2024 noted solid growth for many indices. However, SBITOP outperformed most of the indices we decided to show you, such as CROBEX10, BET, S&P 500, and others – all of them reaching their ATH values during this period. There are many reasons for this sentiment in general, but the most important would be the fact that inflation has largely cooled off across the board, leading to more optimistic investor sentiment. Consequently, interest rate reductions, both in Europe and the US, followed and are expected to continue in the same trend. However, the inflation did note higher rates than expected in the latest data (November) – you can read about it in the other one of today’s news. Finally, of course, the geopolitical situation still remains uncertain, unfortunately.

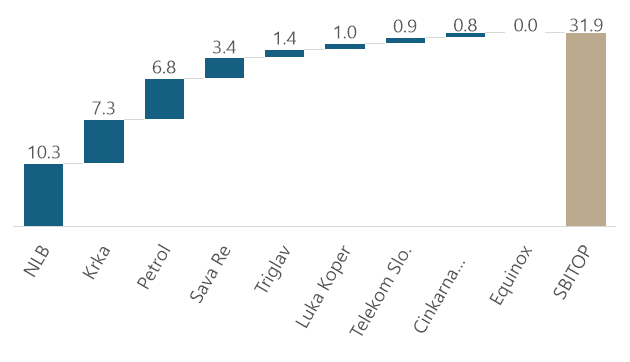

Growth contribution of SBITOP constituents to the overall index growth [2024 YTD, p.p. contribution to overall growth]

Source: Bloomberg, InterCapital Research

Focusing on Slovenia, SBITOP outperformed the rest of the shown indices with a strong double-digit 31.9% growth! Where did the growth itself come from? More or less from each constituent, both heavyweights and smaller-cap companies. NLB definitely leads the way with over 50% YTD return. NLB’s solid growth continued, supported by the elevated interest rates for most of the year. While the ECB did start the rate cuts in the summer, this has yet to reflect on NLB’s financials. The full effect should take several months after each cut to take effect. Besides this, NLB has failed to achieve its M&A of Addiko Bank, although due to ECB investigations into the Serbian investors, this might not be the end of the story. Finally, The Group held its Investor Day, detailing its strategy by 2030, which includes doubling the assets, and recurring income, as well as reaching a 55-60% dividend payout ratio. In regards to dividends themselves, NLB already paid out one, and recently proposed another dividend tranche, with a total amount of EUR 11.00 DPS.

Krka, as well, noted a strong double-digit growth due to solid results. Insurers did not go unseen as well. We can see that this year, Sava Re and Triglav noted a 44.1% and 14% return, respectively. Both Slovenian insurers noted solid further top-line growth, with improved profitability KPIs. Triglav managed to almost fully offset the loss in supplemental health premiums in Slovenia, resulting in “only” a 4% decline in the top line. If we were to look at a comparable basis w/o this business, Triglav reported an 8% real growth rate in business volume.

However… let’s not forget the 2023 returns that SBITOP constituents offered for anyone invested in Slovenia. We would just like to remind you of the strong double-digit SBITOP return of c. 20%. Lastly, these are returns without the dividends! Let’s not forget about the dividends. Reminder: SBITOP offers the best dividend yield in the region, amounting to over 6% at the current prices. Where does the DY from SBITOP come from? Well, from almost all constituents. NLB and Telekom Slovenije offer the highest DY of 8.4% and 8.3%, respectively. They are followed by Petrol and Krka, both also offering an attractive DY of 5.7% and 5.4%, respectively. Finally, Slovenian insurers, Triglav and Sava Re both offer DY of 4.4% at the current prices.

Liquidity supports strong sentiment but is still a drag

Arguably the largest challenge of all regional markets is the lack of liquidity which has been more or less flat for a decade now. However, liquidity growth on LJSE supports the strong realized returns this year, as well as expected developments in the Slovenian capital market. Taking a look at the total equity turnover on LJSE in the first 10 months this year, it amounted to almost EUR 400m, implying an average daily turnover of almost EUR 2m. Comparing it to the turnover realized in the comparable period last year, we can see an increase of as much as 57% when the average daily turnover amounted to EUR 1.2m.

Average daily turnover – LJSE

Source: Bloomberg, InterCapital Research

Where from now?

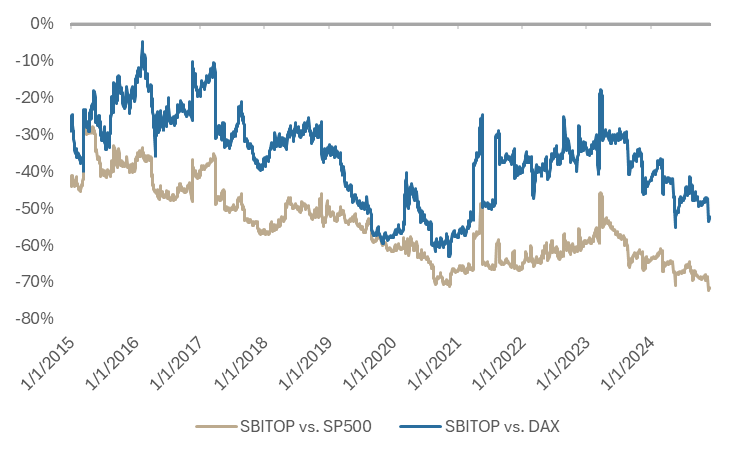

SBITOP is still traded at a deep discount compared to developed markets*

*P/E gap between SBITOP and developed markets (Jan 2015 – Nov 2024)

Source: Bloomberg, InterCapital Research

So far, we have talked about realized returns. At this point, where do we stand in terms of valuation & can we expect future returns? Slovenia, which can be considered a pure value play, is traded at a significant discount to developed markets, with SBITOP’s P/E standing at 7.6x, according to Bloomberg. As already noted, despite being one of the best performers globally so far in 2024, SBITOP’s discount to developed markets remains very large. To be specific, according to Bloomberg, SBITOP’s discount to S&P Value currently stands at 71%, which is significantly higher than the average of 55% for the taken period, since 2015. Taking into consideration that a certain discount is reasonable due to the specificity of the Slovenian equity market, we still deem that the market is very much fundamentally attractive.