In today’s blog, we bring you part II of our analysis of the challenges that the Zagreb Stock Exchange faces in terms of liquidity, and more specifically, the possible solutions.

To give a quick recap, the main challenges that are affecting the liquidity on the ZSE are: Firstly, a continual reduction in total and equity turnover throughout the years, stemming from the reduced number of listed companies (either delistings or takeovers), and the lower number of overall trades. Secondly, there is a lack of incentives for large in scale private companies to do an IPO on the ZSE as compared to doing IPOs on foreign exchange markets where they can attract a lot more capital, and get better valuations, especially in the tech sphere. At the same time, we have a lack of new listings of government-owned companies. Next up, we have issues related to the current legal, or rather, transparency/ investor relations framework, as well as the current capital gains structure. Finally, there is a lack of domestic retail investor participation in the exchange, as Croats are still mainly real estate investors. All of these issues are described in more detail in part I of our blog. If you would like to read more about this, click here.

Now we will try to provide some of the possible solutions to these issues. It should be noted that due to the fact that the stock exchange is an interconnected market in which changing one thing does not only have an impact on the thing that the change is aimed at, but rather a domino effect on multiple systems of the exchange. This, however, does not have to be negative, as improving one factor might help alleviate some of the problems related to other issues. Due to the complexity of the issues, we decided to present the solutions as both short-term and long-term. Due to their nature, some of the solutions will overlap in both of these categories. Let’s start with the short term.

Short term solutions

Out of all the possible short-term solutions, the one that comes to mind first is the capital gains tax, which is payable in case of gains made on stocks, within the 2-year holding period. Even though the tax itself is something that a lot of countries around the world have implemented, combined with ZSE’s low liquidity, it only reduces incentives to invest or divest, thus further reducing liquidity. There are several options on how to make this system work better. The first one which could be implemented, and this is something that has already been done in European countries is the so-called ISA (Individual Savings Account). This refers to accounts in which a resident can invest up to a certain amount of EUR (for example, 20,000) into stocks, shares, deposits, UCITS Funds, or several other forms of financial investments. The reason these accounts are special is that they do not have to pay any capital gains or dividend tax on investments. This can allow individual investors to use stocks as a form of saving, without having to worry about a tax that will reduce their earnings. At the same time, this can also incentivize more daily trading of stocks (even though there still are transaction fees), which by extension, would lead to higher liquidity. Another possible solution would be, of course, the abolition of the capital gains tax altogether.

The second thing that could be done in the short-term (or rather started in the short-term), is improving the overall investor relations and transparency framework. This is particularly important for foreign investors who have numerous possibilities and markets to invest in, and thus we need to further improve the standards and engage investor relation teams to have those investors invest in Croatia. Otherwise, money will flow to other larger, more liquid frontier and/or emerging markets. In terms of transparency, increasing the requirements for listing on the stock exchange could also be helpful, even though it would surely lead to some companies getting delisted. Is this a bad thing though? We could look at some other regional exchanges for an answer. For example, if we look at Ljubljana Stock Exchange, we can see that it is a solid example that a higher number of listed companies does not equate to higher liquidity or a more efficient market, as it only has a fraction of listed companies as the ZSE does, but still maintains higher overall liquidity and turnover.

The third thing that can be done in order to improve the liquidity on the exchange is promoting new IPOs. Considering the paradox we saw in part I of this blog, where ZSE needs new IPOs to increase liquidity and the overall attractiveness of the exchange, while issuers need wider reach to educated investors such as the NYSE or the London Stock Exchange. We find that in order to attract large-scale IPOs domestically, we firstly need an IPO/listing of Government-owned large caps, something that we can also see an example of in one of our regional peer exchanges – Romania, in which the government listed Fondul Proprietatea. A similar strategy can help bring in new international investors, slowly push Croatia towards Emerging market status, and then, in the years to come, ZSE might have a real chance at having some of the new “champions” choose ZSE over foreign markets.

The last thing that can be started in the short-term is promoting retail investor education, through various programs. Considering that Croatia has such low participation in equity investments (Croats only hold 0.16% of all assets as stocks), programs launched by the exchange, or/and by the government could start to have a positive impact on the liquidity of the exchange. One of these programs could be the aforementioned investor saving accounts.

Long Term solutions

In the long term, more improvements to the legal framework should be implemented, especially after Croatia joins the Eurozone. It should be noted that the Croatian National Bank already does a good job when it comes to keeping the EUR/HRK exchange rate stable, so investing right now in Croatia for a foreign investor isn’t difficult. However, with the approval of Croatia’s ascension into the Eurozone, some transactional costs will be mitigated, exchange rate risks will be removed, and Croatia’s credit rating will look even better (something that we can already see as Fitch, S&P Global, and Moody’s have upgraded Croatia’s credit rating last week) Combined with higher transparency and better adoption of the international financial reporting standards, as well as higher availability of financial reports in English, this should make investing in Croatian equity less “risky” and more attractive to foreign investors.

The next thing that could be done is in regards to both the retail and institutional investors. When it comes to retail investors, there should be more educational programs to show the various benefits of investing in the stock market. This should be done through as many avenues as possible, i.e. through the stock exchange itself, in universities and in high schools through curriculums that focus on financial knowledge, and through newsletters informing the older citizens on the benefits of investing. In general, and unfortunately, the level of financial investing knowledge in Croatia is pretty low, especially when it comes to investing in other forms of assets besides real estate, the most popular type of investment in the country.

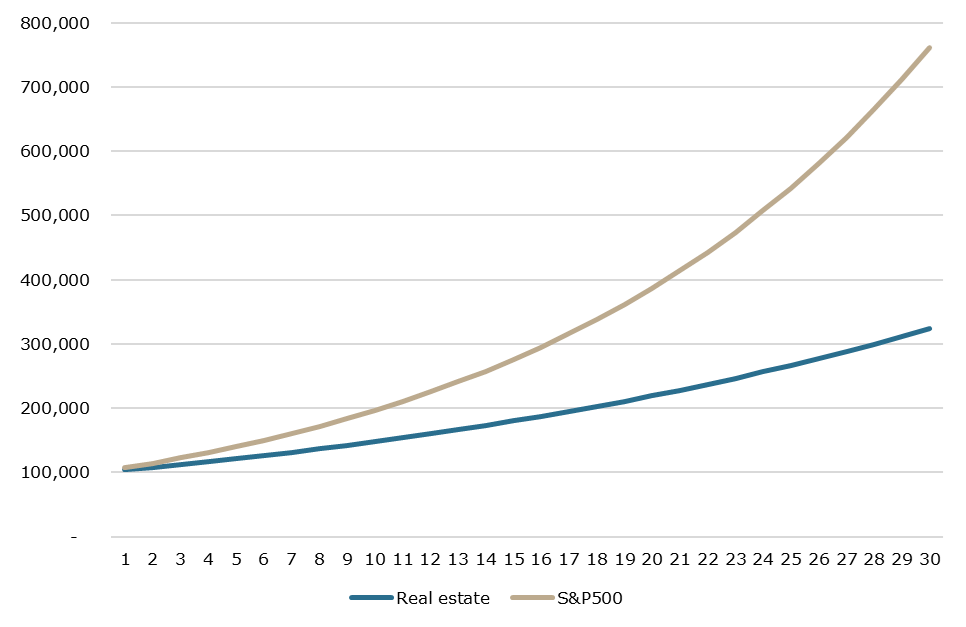

Considering the traditionally low investment volumes of Croatian retail investors into financial assets, and likewise, the tradition of investing in real estate as a form of investment, one has to ask themselves, why is this, and is this an investment that brings the best return? Let’s start with the why. The current real estate tax system in Croatia favors investments in this type of asset. Combined with the tradition of investing in these forms of assets, you get a lot of retail attraction towards them. But are they really the best form of investment? Let’s look at an example. On average, the overall return on a real estate asset is app. 4% yearly. If we compare that to investing in stocks, and in this case, let’s look at one of the most popular types of investment in the world, i.e. investing in the S&P500 index, of which the yearly return is on average, 7%, right away we can see the difference in returns. Let’s also estimate that this is an investment of EUR 100,000 (which is also one of the downsides of investing in real estate, as they require way higher amounts of capital to even get into). With all of that out of the way, let’s see how these compare over a longer time period, say 30 years.

Comparison of returns over a 30-year time period into real estate (4% yearly), S&P500 (7% yearly), (EUR)

Source: InterCapital Research

As can be seen from the graph, the difference is pretty profound. In particular, after 5 years, the investment into S&P500 yielded a 15% higher return than real estate. After 10 years, it yielded 33% higher returns. After 20 years, it yielded 77%, and after 30 years, it could lead to a 135% higher return. If we take into account the aforementioned fact that investing in real estate requires higher amounts of capital, while investing in stocks does not, the current hypothesis that investing in real estate makes more sense isn’t that viable.

There are also some things that institutional investors, and especially the pension funds (which play a crucial role in the Croatian equity market) could do. According to the latest report by the Croatian Financial Services Supervisory Agency, in May 2022, the 3 available categories of pension funds (A, B, and C), invest 55%, 34%, and 32% of their NAV into stocks, respectively. We find that pension funds could and should have an option to allocate more into equity positions. Furthermore, a larger push needs to be put in place for the general population, especially the younger ones, to choose or transfer their savings into the A category.

Finally, there are some solutions that are proposed at the EU level, such as the one for a capital markets union. Even though this is just in the planning phase, the core of the idea is providing a single market for capital across the EU, on which companies’ across the continent would be listed. This would by itself allow Croatian companies higher exposure to international investors, and as such would help with the liquidity issue. Unfortunately, no concrete details are currently available for this plan, and as the current macroeconomic situation is requiring a lot more focus on maintaining the growth of the EU and weathering the inflation shocks, ideas like this one are unlikely to be implemented at this time.

All in all, these are some of the possible solutions to the liquidity issues that ZSE faces. Most of these could be implemented individually, but implementing them together (and starting as soon as possible) could really get the ball rolling and improve the overall capital market situation in Croatia.