According to the first estimate, Croatian GDP expanded by 2.9% YoY (2.8% SA) in Q3 2019. Growth was underpinned by steady growth of domestic demand while biggest surprise came from sharp deceleration of imports of goods that resulted in bigger positive contribution from net exports. So, in the first three quarters of 2019, Croatian GDP rose by 3.0% which is in line with other CEE countries, and reflects acceleration compared to 2018.

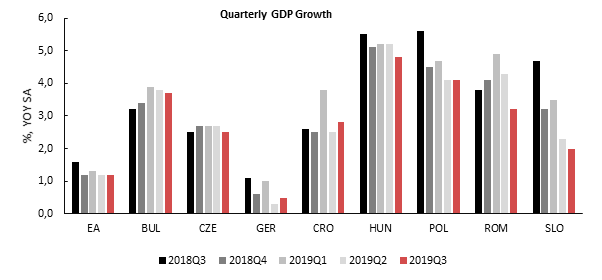

Two weeks ago, most of the CEE countries published their flash estimates of GDP for penultimate quarter of the year. The data showed that GDP growth slowed further to the lowest pace in the last three years although there were two countries which growth stood around 5.0% YoY. Czech Republic, Romania and Slovenia have seen solid deceleration this year as foreign demand kept weighing on their growth. However, Poland and Hungary are not witnessing any significant slowdown as domestic demand supported by loose monetary in Hungary and fiscal policy in Poland are not diminishing. Looking further, we expect slowdown to continue driven by slower exports of both goods and services but also due to slower investment as business sentiment is getting worse. Personal consumption growth could decelerate as labor markets are extremely tight meaning that rise of employment could be almost flat while rise of wages is not expected to accelerate. To put things into perspective, we depicted GDP growth for all the mentioned countries for the last several quarters.

Source: Eurostat, InterCapital

Looking at the chart above, one could see that Croatian GDP growth outpaced the one from Q2, which was the case only in Germany which economy is not to be compared with CEE. What was the reason for Croatian acceleration? Well, domestic demand kept the pace similar from the last several quarters, so biggest surprise came from contribution of net exports which increased by 11.86% YoY driven by sharp deceleration of imports of both goods and services which growth level was the lowest since last quarter of 2014. Exports driven by tourism sector were solid, rising by 4.7% YoY but imports increased by only 1.1% YoY compared to average of 7.9% YoY in the last 10 quarters. Looking into more details, imports of services decelerated already in Q2 when rose by 1.9% YoY (1.8% YoY in Q3) while growth of merchandise imports of only 0.9% was big surprise. Statistical office data (imports according to sections, data for July and August) reveals that major negative contribution came from import of mineral fuels driven by lower exports of the same goods in the second quarter so this could be reverted in the following quarters. On the other side, personal consumption kept the pace similar to Q2, as it increased by 3.1% YoY (3.0% YoY in Q2) with household’s expenditure rising by 3.3% compared to 2.7% YoY in Q2 while government expenditure decelerated by 1.0% compared to Q2, to 2.9% YoY. Furthermore, gross fixed capital formation decelerated towards last year’s levels as it skyrocketed in first two quarters, i.e. it increased by 11.5% YoY and 8.2% YoY in Q1 and Q2“, respectively.

To sum it all, Croatian GDP growth seems not to lag compared to other CEE countries this year and the drivers are similar to these countries with some minor differences. Overall growth is supported by domestic demand while Croatian net export decelerates at slower pace compared to Hungary, Czech Republic, Slovenia and Poland due to lower inclusion in euro area’s supply chains. However, Croatia is more and more included in these chains and its part of exports and imports stands around 50% of total GDP so in the following quarters we could see some effects of slowdown among trading partners, but we expect that negative contribution to be modest. On the other side, domestic demand should not decelerate significantly, securing above EU growth in the following period.